A bright start to the week has given bulls a vital advantage, although trading volume remained light overall. Since the breakouts happened in early July, I would now be looking for a more substantial breakout support retest than last week. However, there is no guarantee we will see such a move.

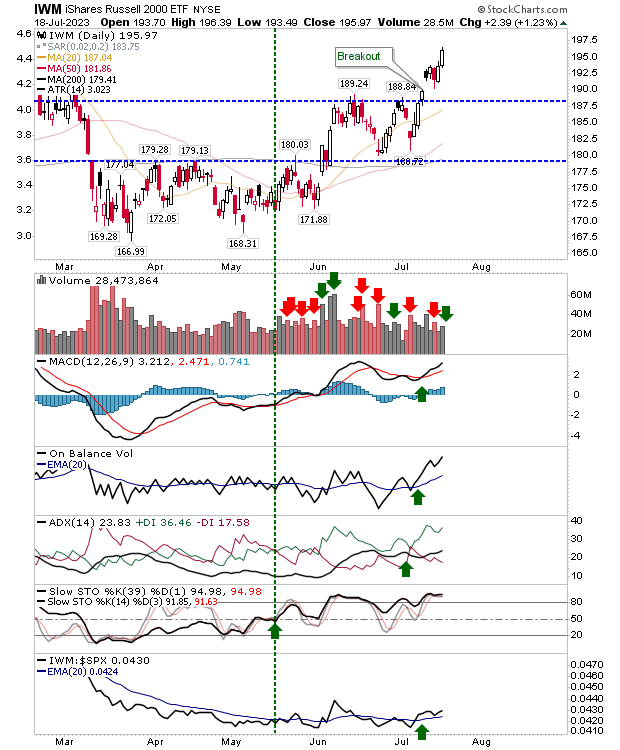

In the case of the Russell 2000 (IWM), Tuesday's gain pushed beyond the tight trading of the last four days. Volume rose to register as accumulation, but the volume was light overall. Technicals are net bullish. I would like to see tight trading near the day's highs to consolidate the jump.

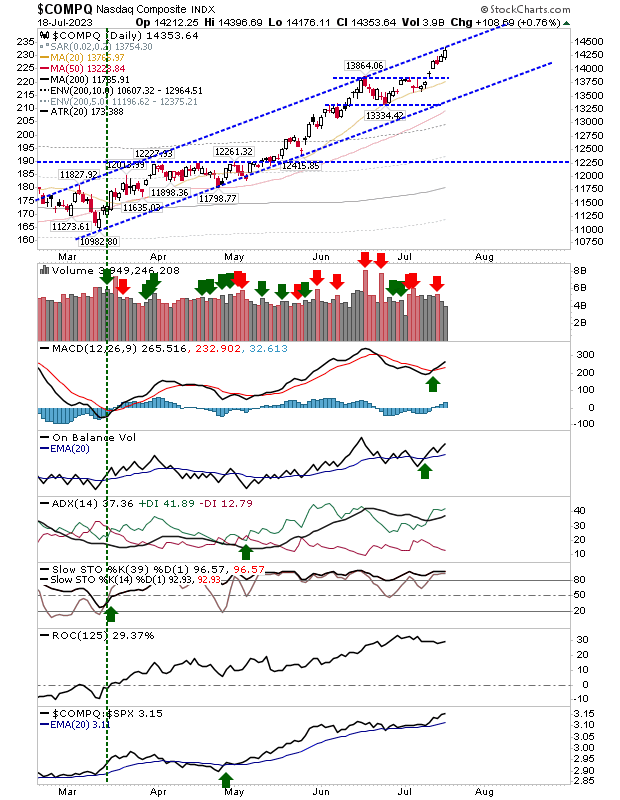

Today's gain in the Nasdaq has pinged channel resistance. Given the pace of advance, the angle of the current channel is one earmarked for sustainability, so if there were a break in the channel, I would look for a rapid acceleration into a late summer blowout top, or at least, a rally that will lead to an extend sideways trading range. This index has been steady-as-she-gos for a good time now, which will likely change.

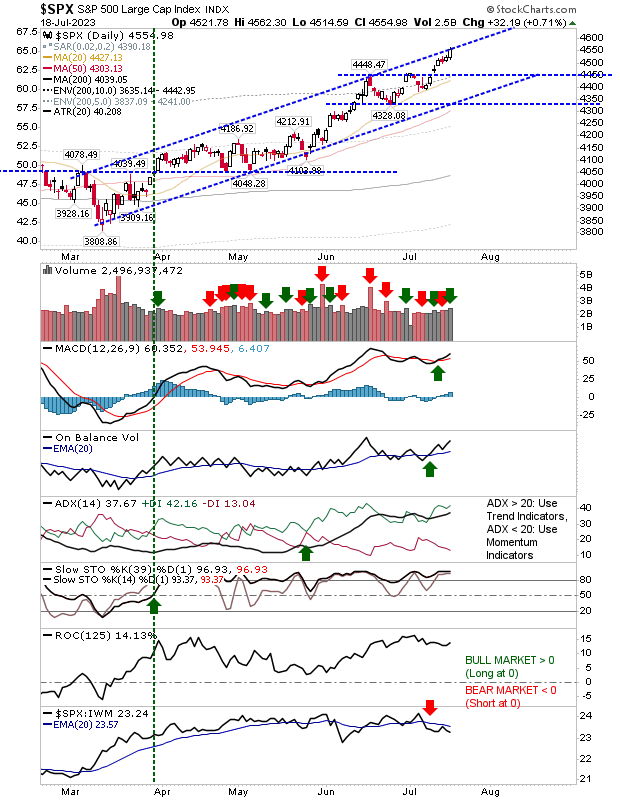

The S&P 500 is also up at channel resistance similar to the Nasdaq. Trading volume was more in line with traditional accumulation, which the Nasdaq did not enjoy. If one were to pick which index would break channel resistance, the S&P would get the nod.

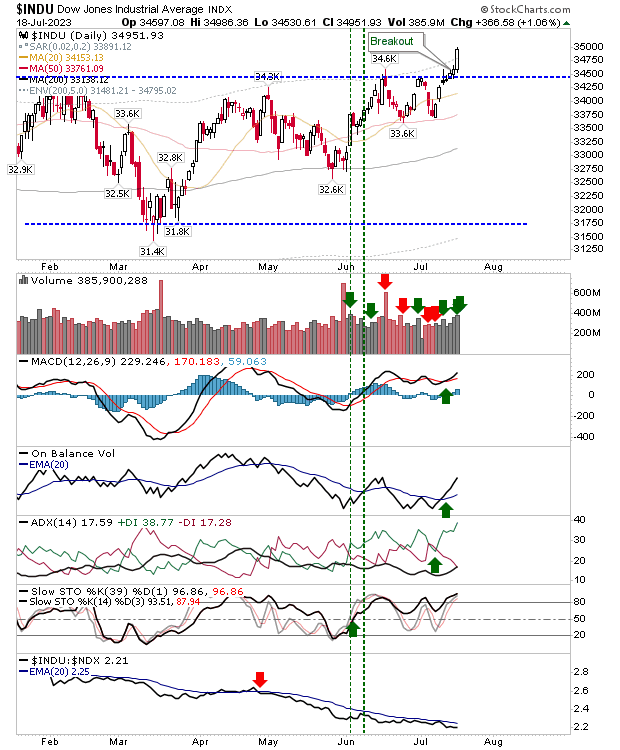

What might drive gains in the S&P more is the breakout in the Dow Jones Industrial Average. Recent buying has skewed in favor of accumulation, with a solid trend shift in On-Balance-Volume after a couple of months of selling. What's needed now to confirm the change is a new 'buy' trigger in relative performance against the Nasdaq 100.

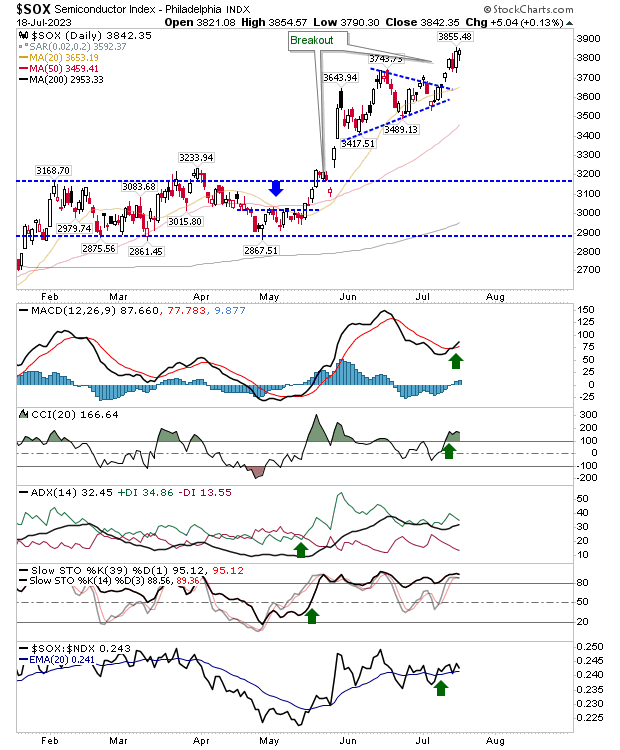

The Semiconductor Index has accelerated beyond its triangle consolidation, backed by a new MACD trigger 'buy' above its bullish zero line. Other technicals are net bullish.

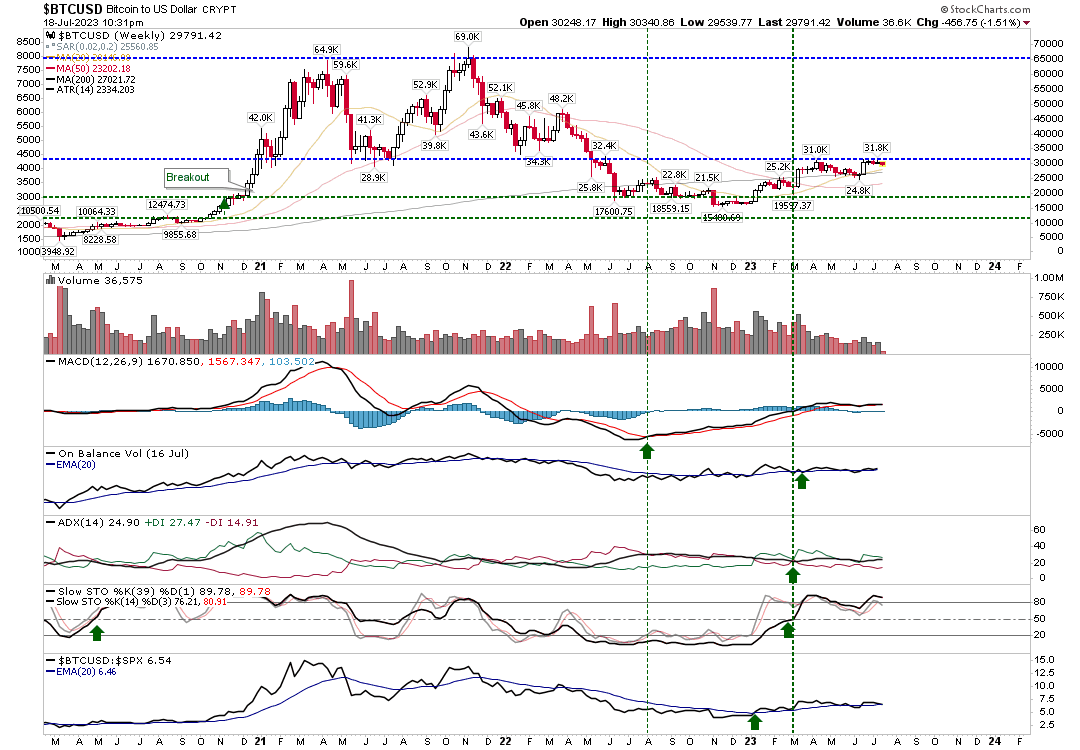

Finally, the other asset looking ready to break out is Bitcoin. It has been caught in an extended range for a while but is now ready to build a right-hand-side base.