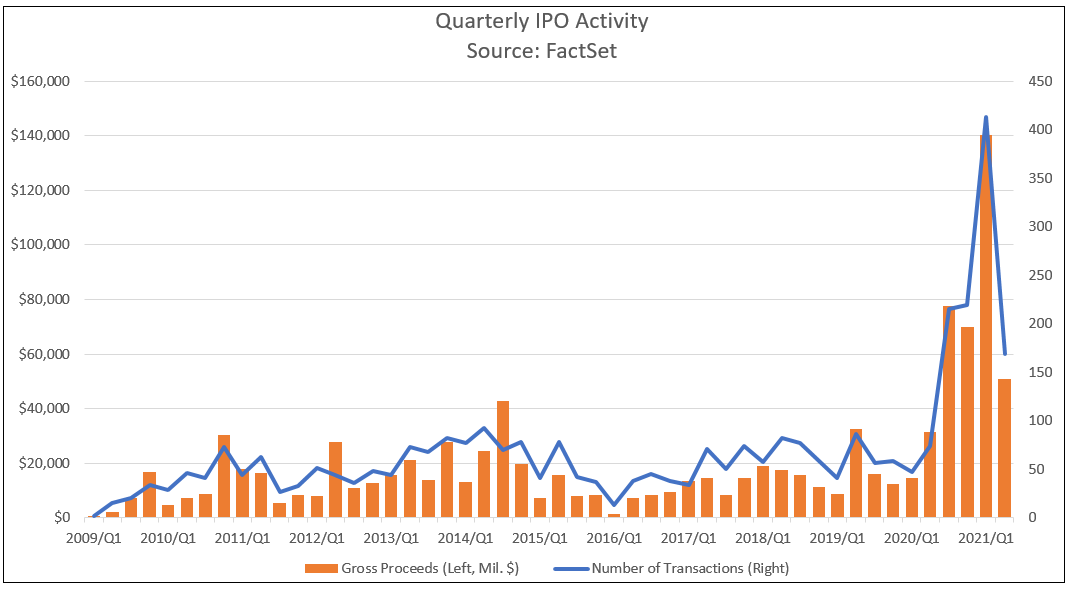

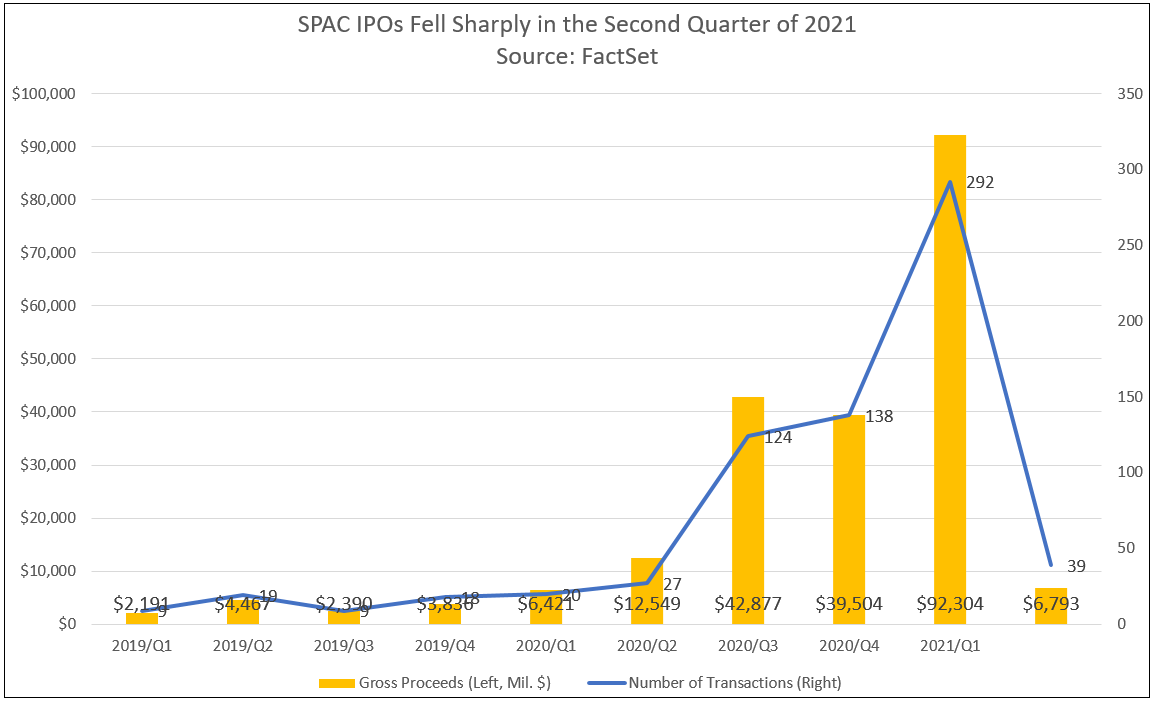

After surging in the first quarter of the year, initial public offerings (IPOs) on U.S. exchanges fell significantly in the second quarter, to their lowest level in a year. The second-quarter drop was driven by a sharp decline in offerings from Special Purpose Acquisition Companies (SPACs). There were just 39 SPAC IPOs in the second quarter compared to 292 in the first quarter. In the first quarter, SPACs represented 70.7% of all IPOs by volume; in the second quarter the share dipped to 23.1%.

IPO Activity Slows in the Second Quarter

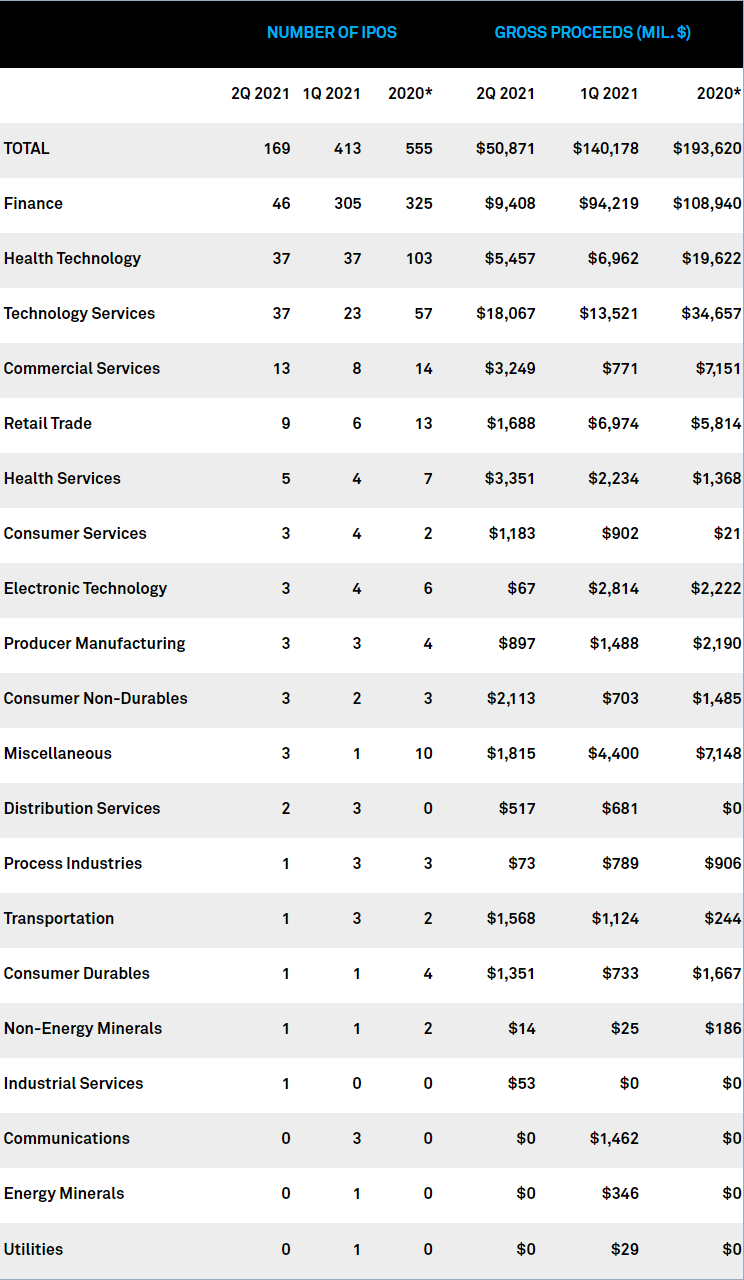

According to FactSet data, U.S. exchanges saw 169 IPOs in the second quarter, a 59.1% decrease from the first quarter yet 128.4% higher than a year ago. In aggregate, IPOs raised $50.9 billion in the second quarter, down 63.7% compared to the first quarter and up 60.9% compared to the second quarter of 2020. SPAC IPOs raised just $6.8 billion in the second quarter compared to gross proceeds of $92.3 billion in the first quarter. Note that all 39 SPAC IPOs were priced at $10 per share.

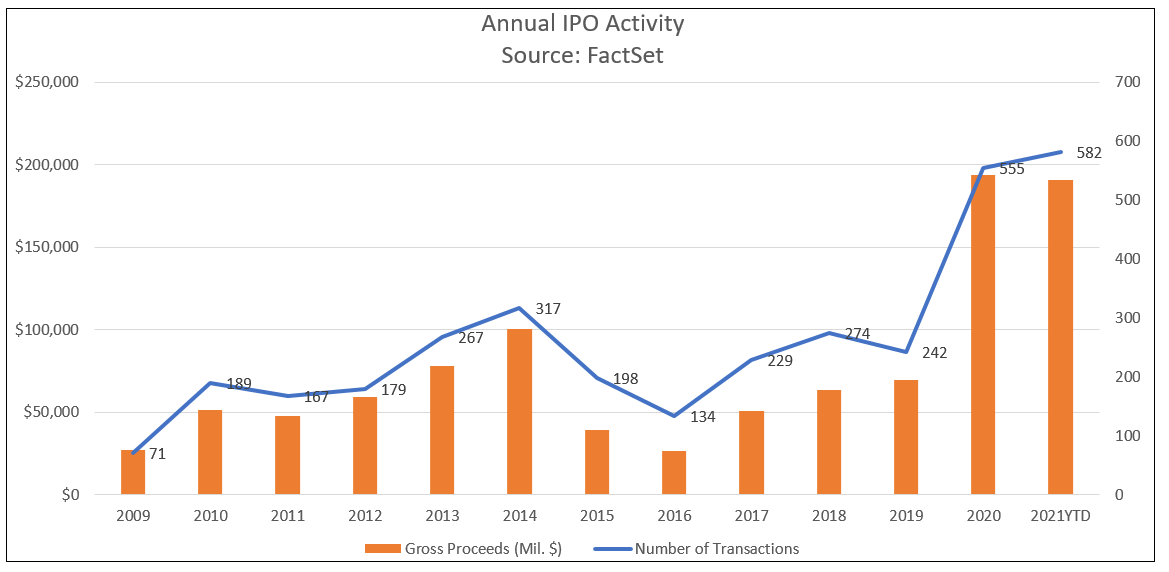

Even though IPO volume fell sharply in the second quarter, the record number in the first quarter guarantees that 2021 will surpass 2020’s high mark. We saw 555 IPOs in 2020 but there were 582 in just the first six months of 2021.

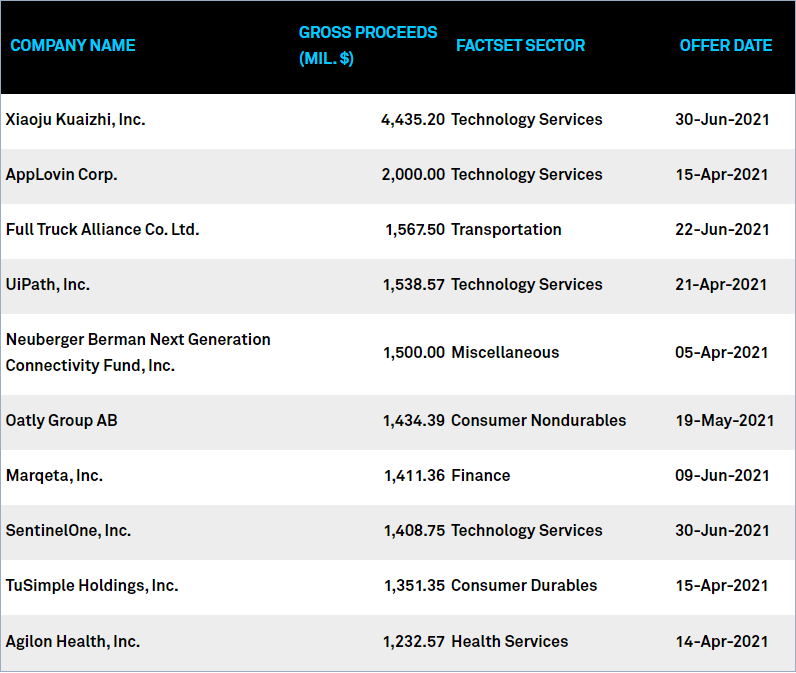

IPOs in the $100-500 million range made up just over half of the quarter’s IPOs (53.8%), down significantly from the 74.6% share seen in the first quarter as SPAC IPOs became less dominant. There were 10 mega-IPOs (IPOs with gross proceeds above $1 billion) in the second quarter raising a total of $17.9 billion; this represented 5.9% of all IPOs. The top ten IPOs for the quarter raised $23.3 billion. Note that three direct listings are excluded from these figures: Coinbase (NASDAQ:COIN) (priced April 14, raised $28.7 billion), SquareSpace (priced May 19, raised $3.6 billion), and ZipRecruiter (priced May 26, raised $1.6 billion).

Ten Largest IPOs in 2Q 2021 (ranked by gross proceeds)

Source: FactSet

Finance Sector Continues to Lead but Margin Narrows

Of the 169 initial public offerings in the first quarter, 46 were in the Finance sector, dominated by the 39 SPAC IPOs. Tied for second were the Health Technology and Technology Services sectors, each with 37 IPOs. The Technology Services sector raised the most money, with gross proceeds of $18.1 billion. The Finance sector followed with gross proceeds of $9.4 billion, the lowest total for this sector since the first quarter of 2020.

*2020 excludes Palantir

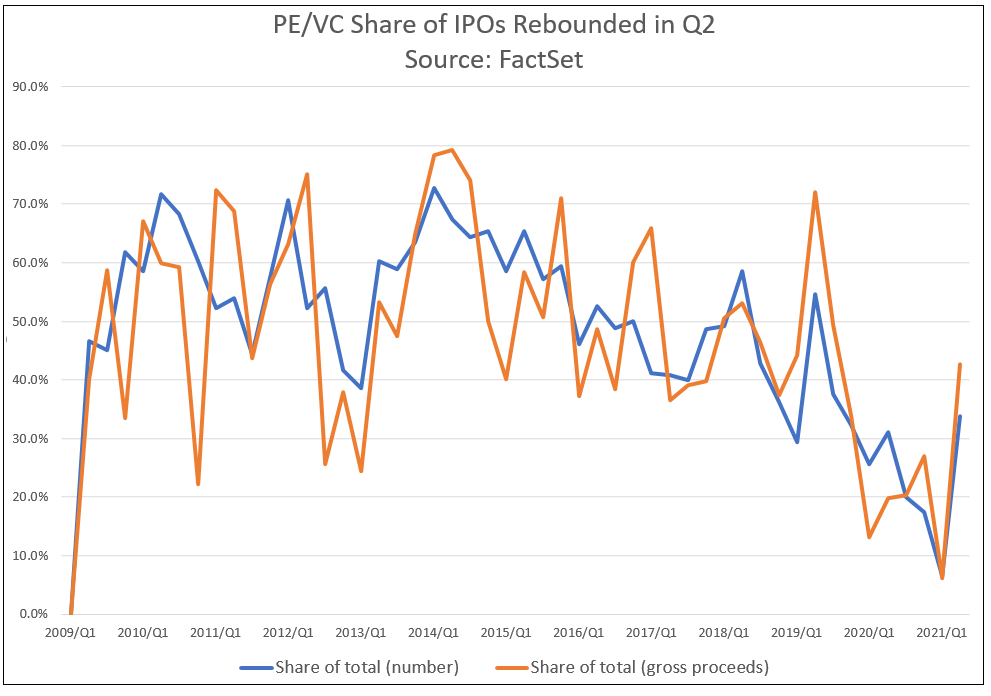

Activity by Financial Sponsors Rebounds

There were 45 venture-capital-backed (VC) IPOs in the second quarter, the largest quarterly number we’ve seen since the global financial crisis (GFC). There were 12 private equity-backed (PE) IPOs in Q2 2021, a two-year high. Gross proceeds for VC-backed offerings totaled $18.1 billion, also a post-GFC high; PE-backed IPOs raised $3.6 billion. It’s interesting to see a resurgence of PE/VC financing as the dominance of SPAC IPOs waned in the second quarter. PE- and VC-backed IPOs together accounted for 33.7% of IPO volume in the second quarter and 42.7% of total gross proceeds. While these shares are below the 10-year average of 47%, they represent a dramatic turnaround from the 6.5% of volume and 6.2% of gross proceeds seen last quarter.

Legal Challenges for SPACs

Previously, I highlighted the potential negative impact of increasing regulatory scrutiny of SPACS by the Securities and Exchange Commission (SEC). Now we’re seeing a growing number of lawsuits being filed against SPACs by shareholders. All of this has had an obvious dampening effect on the number of SPAC IPOs.

Looking Ahead

So far in 2021, 298 companies have released their initial preliminary filings and are still in registration (this excludes offerings that have been postponed or withdrawn). All but five of these are SPACs. Given the growing regulatory and legal challenges facing SPACs, it will be interesting to see what happens to these companies hoping to go public.

Aside from what is happening with SPACs, we have seen an uptick this year in consumer and retail IPOs. We have already had 29 IPOs this year in these categories, compared to just 22 in 2020. Will this trend continue? Concern is growing among market participants regarding the economic impact of the COVID-19 Delta variant. It remains to be seen what impact this has on financial markets broadly and on companies looking to go public that cater to consumers.