By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Investors were net sellers of U.S. dollars ahead of Wednesday’s Federal Reserve meeting, which is surprising because the odds of a dollar-positive and negative outcome is roughly balanced. So even though no changes in monetary policy is expected at this month’s meeting, the greenback could still have a meaningful reaction to FOMC. The statement is the only component of the announcement that could trigger a move in the dollar because there’s no press conference or updated economic forecasts scheduled for release. Without a meeting in May, this is also the last opportunity for the Fed to officially change its guidance because every other view from Wednesday through June could be interpreted as an individual bias, even if it's made by Janet Yellen.

Now lets run through the possible scenarios – if the FOMC statement remains virtually unchanged, it would be mildly negative for the dollar because it would imply an ongoing split within the Fed and reluctance to raise interest rates. The balance of risks statement was removed from the last 2 monetary policy statements because policymakers could not agree on the outlook for the economy. Unfortunately things haven’t become much clearer this month because improvements in global markets were met with deterioration at home. So if the risk statement is absent again, it will hurt the dollar. But if it reappears and the Fed says the risks are balanced, the dollar will soar as the chance of a June hike increases significantly. Aside from the risk statement, the central bank’s comments about recent data disappointments will also be important. If they say the deterioration is transitory, it will help the dollar.

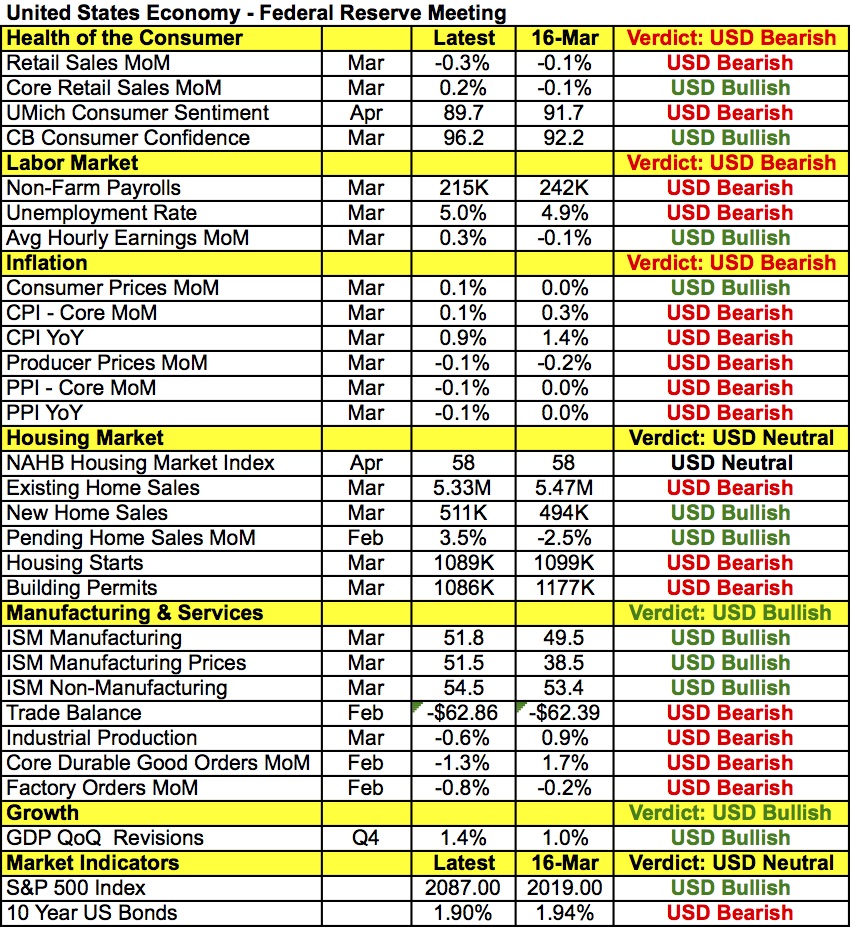

The following table shows how the U.S. economy performed between March and April. An initial glance shows more deterioration than improvement with consumer spending, labor-market activity, inflation, production and trade weakening. However there are glimmers of hope. The rally in U.S. stocks helped to boost consumer confidence as measured by the Conference Board’s report, consumer prices are still moving upward as gas prices increased. New and pending home sales rebounded and most importantly, manufacturing- and service-sector activity accelerated. With average hourly earnings on the rise, the Fed could argue that the economy will regain momentum in the near future and with prices rising, they need to get ahead of inflation expectations. In other words, while the data suggests that the Fed should be less hawkish, they could also find reasons to stick to their plan of raising rates twice this year.

Meanwhile sterling continued to march higher, coming within 20 pips of 1.4600. Investors were completely unfazed by the drop in loans approved for house purchases. It was the second month in a row that mortgage approvals declined and is a sign of trouble ahead for the housing market. Yet sterling continued to ignore economic fundamentals, a trend that could persist with Wednesday’s first-quarter GDP report. Although growth is expected to slow, traders are far more focused on covering Brexit bets. The latest polls still show a tight vote with 53% favoring 'Stay', 46% favoring 'Leave', 3% 'Undecided' and 20% 'non-committed'. But investors are interpreting every negative headline as a reason for the U.K. to remain in the European Union. According to our colleague Boris Schlossberg, “Bookies are now projecting chances of Brexit at only 20% or less and there was speculation today that many hedge funds have started to close out their cable shorts capitulating on their earlier bets on Brexit….the risks of Brexit may have diminished, but they have not fully disappeared and the recent rally in the pound could quickly change course if market senses any shift towards the Leave camp.” We see GBP/USD aiming for its February high near 1.4670.

No news has been good news for the euro, which traded slightly higher versus the greenback. Technically, we see a head-and-shoulders pattern forming in the pair but whether EUR/USD breaks above 1.1350 or below 1.1190 hinges in large part on Wednesday’s FOMC rate decision. The ECB is in no rush to cut interest rates again and a dovish Fed could renew the rally in EUR/USD. However if the Fed reaffirms its commitment to tightening the wide gap between Eurozone and U.S. policy, it could come back to haunt the currency.

All 3 of Tuesday's commodity currencies traded higher. With oil prices holding onto recent gains, USD/CAD looks poised to retest its 9-month low. The Australian and New Zealand dollars, on the other hand, are waiting for this week’s key releases. Australian consumer prices were due Tuesday night and from New Zealand we have trade numbers followed by the Reserve Bank’s monetary policy announcement. CPI growth in Australia is expected to slow and if economists are right, lower price pressures could take some steam out of Aussie’s rally. NZD on the other hand is at the whim of the RBNZ. Having just lowered rates last month, no additional easing is expected, but when the Reserve Bank eased, it warned that further stimulus may be required. If that view is emphasized again in April, it could tip the currency lower.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI