By Barani Krishnan

Investing.com - It’s hard to imagine oil having its worst week in five just before the start of an OPEC meeting. Yet, as the saying goes, “it is what it is.”

The lockdown of nearly 18 million people in China’s tech hub Shenzhen over a new Covid fright pulled crude futures down from Friday’s highs that initially drove both West Texas Intermediate and Brent crude up more than 3% on the day. That left both crude benchmarks down more than 6% for the week, their most dismal showing since the week ended July 29.

New York-traded West Texas Intermediate, the benchmark for U.S. crude, settled up 26 cents, or 0.3%, at $86.87 per barrel, after a session peak at $89.61.

WTI was down in three prior sessions, losing 3.3% on Thursday, 2.3% on Wednesday and 5.5% on Tuesday. That left the U.S. crude benchmark down 6.7% for the week.

Brent, the London-traded global benchmark for oil, settled Friday’s trade up 66 cents, or 0.7%, at $93.02 per barrel, after a session high at $95.28.

Like WTI, Brent was down in three prior sessions, losing 4.5% on Thursday, 2.8% on Wednesday and 5% on Tuesday. For the week, it fell 6.4%

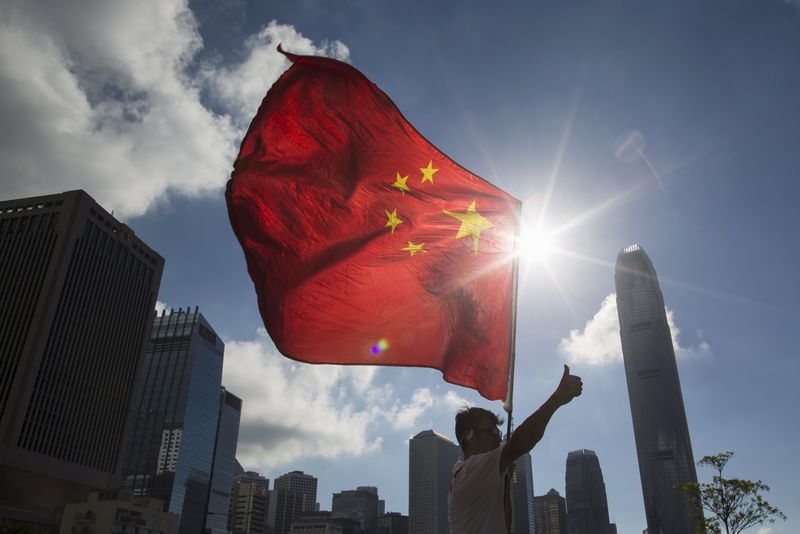

Key districts in Shenzhen shut down public transport and extended curbs on public activities on Friday as cities across China battled fresh coronavirus outbreaks that have dampened the outlook for economic recovery, Reuters said in a report.

China is the world's top importer and any curbs on the movement of its people can usually have detrimental effects on its crude consumption.

Six districts comprising the majority of the city's population of almost 18 million announced that all residents would be tested twice for Covid-19 over the weekend as subway and bus services were suspended, the report added.

Also pulling oil down from Friday’s highs was the Biden administration’s latest take on efforts to revive the Iran nuclear deal that could pave the way for the removal of U.S. sanctions that — if abolished — could add up to a million barrels per day of the Islamic Republic’s crude on the global export market.

The White House said there should be no link between the reimplementation of the Iran nuclear deal and Tehran's obligations under the Non-Proliferation Treaty.

That was the strongest signal yet that Washington really wanted a revival of the deal, agreed between Iran and six global powers in 2015 under the aegis of the Obama administration. The Trump administration that came on later canceled the deal in 2018 and placed sanctions on Tehran. President Joe Biden, on entering office in January last year, allowed negotiations to begin with the aim of reviving the deal.

The White House made clear on Friday that there was no deal.

“Iran’s response didn’t put us in a position to close a deal, as we won’t close a deal unless Iran meets the terms we have set forth. We are not there yet,” a White House National Security Council spokesperson was quoted saying in a tweet by Iran International, a London-based TV station that reports on Iranian affairs.

“It’s clear from Iran’s response that the gaps still remain,” the tweet added,

OIl market participants said while the language emerging from the discussions seemed confusing, the intent for a deal among the participants was clear.

“I think it’s going to happen,” said John Kilduff, partner at New York energy hedge fund Again Capital. “But there’s a lot of rhetoric that you’ll continue seeing between now and then. Still, it’s weighing on the market’s sentiment, along with the China news.”

Be that as it may, it was still surprising to see such weakness in oil in the week preceding an OPEC meeting.

The 13-member Saudi-led Organization of the Petroleum Exporting Countries and its 10 allies led by Russia — who are together known as OPEC+ — will meet on Monday, when U.S. markets will be closed for the Labor Day holiday.

Expectations were initially heavy that OPEC+ will push for a production cut at the meeting in order to get oil prices up, and make up for the recent losses in crude.

Yet, in recent days, most analysts had tamped down such expectations after OPEC+ put out an improved demand outlook for its oil. The 23-nation strong oil exporters’ alliance reduced its 2022 surplus estimate by half to 400,000 barrels per day, while forecasting a 300,000 bpd deficit for 2023.

The improved demand outlook suggests that OPEC+ is confident about sales for its oil and wants to maintain production as it is.