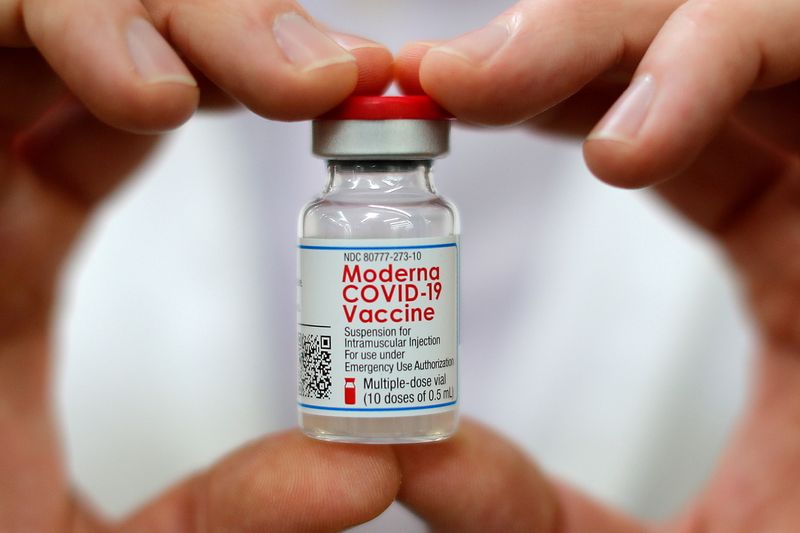

CAMBRIDGE, MA - Moderna , Inc. (NASDAQ:MRNA) is on the brink of securing European Union approval for the latest version of its COVID-19 vaccine, Spikevax, which targets the SARS-CoV-2 variant JN.1. The European Medicines Agency's (EMA) Committee for Medicinal Products for Human Use (CHMP) has recently recommended the vaccine for authorization, setting the stage for a potential European Commission decision to allow its use for the upcoming 2024-2025 autumn/winter vaccination season.

This recommendation follows the EMA's guidance from April and confirmation in July 2024 to update COVID-19 vaccines to combat the JN.1 family of Omicron subvariants. The decision by the CHMP is underpinned by a combination of manufacturing data, preclinical studies, and existing clinical and real-world evidence attesting to the efficacy and safety of Moderna's mRNA COVID-19 vaccines.

The updated vaccine is intended for individuals aged six months and older and aims to provide enhanced neutralizing antibody responses against JN.1 and related lineages. Stéphane Bancel, CEO of Moderna, expressed that the CHMP's positive opinion marks a significant step in the company's effort to protect EU citizens, especially as respiratory illnesses tend to surge during the winter months.

Moderna has already achieved approvals for its JN.1-targeting vaccine in Japan, Taiwan, and the UK, while in the U.S., a vaccine targeting the KP.2 variant has been approved. Additional regulatory reviews for updated vaccines are ongoing in other regions.

In the EU, Moderna is a participant in the Health Emergency Preparedness and Response Authority's (HERA) tendering process for mRNA COVID-19 vaccines. This move could potentially expand the reach of Moderna's vaccines across member states.

This development is part of Moderna's broader mission in mRNA medicine, aiming to revolutionize the treatment and prevention of diseases. The company's platform has facilitated the rapid development of vaccines and therapeutics for various health conditions.

The information provided is based on a press release statement from Moderna, Inc. and does not include any promotional content or subjective claims. The European Commission's authorization decision is pending and will determine the availability of Moderna's updated COVID-19 vaccine for the forthcoming vaccination season.

In other recent news, Moderna's updated COVID-19 vaccine, Spikevax, targeting the JN.1 variant, has received authorization from the UK's Medicines and Healthcare products Regulatory Agency. The vaccine will be distributed through the National Health Service and available for private purchase in the UK. In addition, Moderna's mRNA-based vaccine, mRESVIA, received FDA approval, but may not perform as well compared to competing products. Furthermore, Brookline Capital Markets maintained a Buy rating on Moderna with a price target of $310.00, projecting the COVID-19 vaccines to generate $2.7 billion in sales for Moderna in 2024. HSBC upgraded Moderna's stock from Reduce to Hold due to an unexpected dip in COVID-19 vaccine revenue. Finally, Piper Sandler maintained its Overweight rating for Moderna, projecting sales for SpikeVax to reach $2.85 billion. These are recent developments for Moderna.

InvestingPro Insights

As Moderna, Inc. (NASDAQ:MRNA) anticipates European Union approval for its updated COVID-19 vaccine, Spikevax, the company's financial health and market performance provide a broader context for investors. According to InvestingPro data, Moderna holds a market capitalization of $27.86 billion, reflecting its significant presence in the biotechnology industry. Despite facing challenges such as anticipated sales decline and revised earnings expectations, the company's resilience is evident in its balance sheet, which boasts more cash than debt, as highlighted by one of the InvestingPro Tips.

InvestingPro data also reveals that Moderna's stock is currently in oversold territory based on the Relative Strength Index (RSI), suggesting potential interest from value investors seeking entry points. Additionally, the company's liquid assets surpass its short-term obligations, indicating a strong liquidity position that could support its ongoing operations and research initiatives.

While Moderna has not been profitable over the last twelve months, with a negative P/E ratio of -4.71, the company has demonstrated significant returns over the last five and ten years. This performance underscores Moderna's long-term growth trajectory and its ability to deliver value to shareholders, despite the absence of dividend payouts. For investors seeking more in-depth analysis, there are over 10 additional InvestingPro Tips available, offering insights into Moderna's financial metrics and market performance.

With the next earnings date set for October 31, 2024, and the fair value of Moderna's stock estimated at $89.0 by InvestingPro, stakeholders and potential investors will be closely monitoring the company's progress, especially as it navigates the regulatory landscape and expands its vaccine offerings globally.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.