On Wednesday, JMP Securities maintained a positive stance on PayPal Holdings Inc . (NASDAQ:PYPL) shares, reiterating its Market Outperform rating with an $82.00 price target. The firm's optimism is tied to PayPal's recent strategic moves, including the introduction of a new advertising platform.

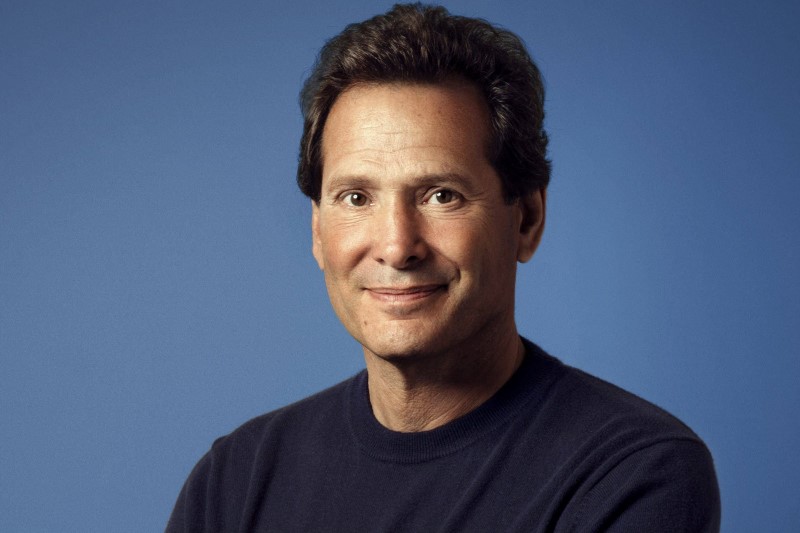

PayPal has announced the appointment of Mark Grether as SVP GM of PayPal Ads, signaling a foray into leveraging its substantial data from approximately 400 million consumer accounts, 35 million merchants, and around 25 billion annual transactions.

The new advertising platform is seen as tapping into a significant market opportunity, with advertising estimated to be a more than $900 billion opportunity in 2024.

PayPal's approach to data monetization is expected to initially focus on data sales, but the potential for expanding advertising-based merchant services is anticipated given the company's leadership, customer relationships, and unique data.

This development is part of a broader trend of accelerated product rollouts under PayPal's new management. Earlier in the year, the company launched Smart Receipts and PayPal CashPass, and it is preparing to introduce Fastlane, an expedited guest checkout experience, in the second half of 2024.

Despite the competitive nature of the checkout and payments sector, JMP Securities believes PayPal is significantly enhancing its offerings.

PayPal's financial health remains robust, with the company continuing to generate significant free cash flow. The stock is currently trading at approximately 13 times JMP Securities' projected earnings per share for 2025.

This valuation, along with the company's recent strategic initiatives, supports JMP Securities' view of a positive risk-reward balance and the decision to maintain the $82.00 price target.

InvestingPro Insights

Recent metrics from InvestingPro show that PayPal Holdings Inc. (NASDAQ:PYPL) continues to be a significant player in the financial services industry, with a strong market capitalization of $65.03 billion. The company's aggressive share buyback strategy and its low P/E ratio of 15.53, relative to near-term earnings growth, underscore management's confidence in PayPal's value proposition. Analysts have noted that despite some downward revisions in earnings expectations, PayPal is trading at an attractive valuation with a PEG ratio of just 0.22, indicating potential for growth relative to earnings.

InvestingPro Tips highlight that PayPal has been profitable over the last twelve months and is expected to maintain profitability this year. Moreover, the company's revenue growth remains solid, with an 8.39% increase in the last twelve months as of Q1 2024. These financial indicators complement JMP Securities' positive outlook and support the potential upside for PayPal's stock. For those looking to delve deeper into PayPal's financials and future prospects, InvestingPro offers additional analysis and tips. To discover more, use coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.