By Lawrence White and Chibuike Oguh

LONDON/NEW YORK (Reuters) - Stocks sagged worldwide on Wednesday as earnings from Tesla (NASDAQ:TSLA) and European luxury brands disappointed, while oil prices edged higher after trading near-six week lows due to concerns over weak global demand.

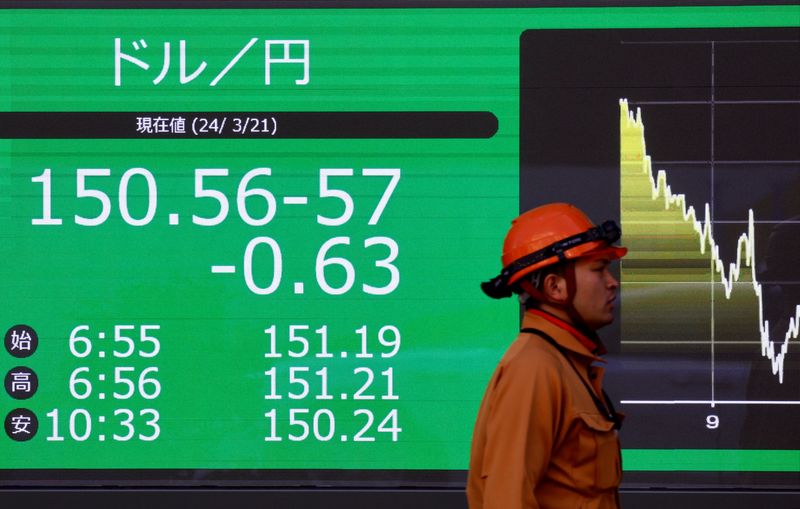

The U.S. dollar edged lower, with traders watching out for an inflation reading on Friday and a Federal Reserve meeting next week, while the yen climbed to a seven-week high ahead of a central bank meeting next week.

"I think the big story is clearly the earnings front and you've kind of seen reports all over the map, with Tesla probably the disappointing one," said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions in Boston.

MSCI's broadest index of Asia-Pacific shares outside Japan lost 1.7%, while Japan's Nikkei fell 1%.

On Wall Street, all three main indexes finished lower, led by losses in technology, consumer discretionary and communication services stocks.

Tesla's shares slumped 12.3% after it reported its lowest profit margin in five years amid waning demand for electric vehicles. Other so-called "Magnificent Seven" stocks including, Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT), closed down between 2.8% and 6.8%.

The Dow Jones Industrial Average fell 1.25% to 39,853.87, the S&P 500 lost 2.31% to 5,427.13 and the Nasdaq Composite lost 3.64% to 17,342.41.

The pan-European STOXX 600 index fell 0.61% to 512.30 points. The world's biggest luxury group LVMH had reported slower sales growth as Chinese shoppers rein in their spending.

"It's the curse of high expectations, that's what the market was coming into earnings season with, especially for the tech companies that have been the darlings of the market", said James St. Aubin, chief investment officer at Sierra Mutual Funds in Santa Monica, California.

RATE CUT EXPECTATIONS

Subdued stock trading globally was symptomatic of markets looking for direction, with traders digesting a range of themes including the U.S. election, expectations of rate cuts and weak corporate earnings reports.

Oil prices settled higher thanks to falling U.S. crude inventories and growing supply risks from wildfires in Canada, but still sat near month-and-a-half lows amid lacklustre demand.

Brent crude futures closed 0.9% higher at $81.71 a barrel. U.S. West Texas Intermediate crude rose 0.8% to $77.59 per barrel.

U.S. GDP data on Thursday and personal consumption expenditure data - the Fed's favoured measure of inflation - on Friday could help investors calibrate their expectations of when interest rates might be cut.

Markets are pricing in 62 basis points of easing this year, with a cut in September priced in at 95%, the CME FedWatch tool showed. The benchmark U.S. 10-year Treasury yield was lower for a second straight session. The yield rose 4.9 basis points to 4.288%.

"The rotation is in full force. Magnificent 7 earnings growth are decelerating, while un-magnificent 493 growth are accelerating," said Thomas Hayes, chairman at Great Hill Capital in New York, in a statement. "Fed cut will add fuel to this new trend for cyclicals, small caps and dividend stocks picking up the mantle," he said.

Gold prices slipped after paring early gains. Spot gold lost 0.45% to $2,398.45 an ounce, while U.S. gold futures settled 0.3% higher at $2,415.70.

The Japanese yen strengthened 1.06% against the greenback at 153.97 per dollar. In cryptocurrencies, bitcoin gained 0.01% at $65,848.00. Ethereum declined 3.18% at $3,372.50.

($1 = 155.3600 yen)