By Julie Zhu and Kane Wu

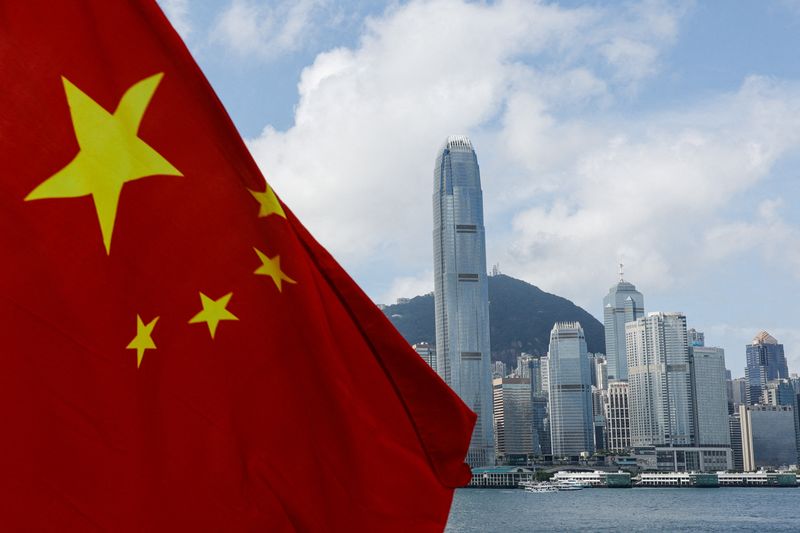

HONG KONG (Reuters) - CPP Investments, Canada's biggest pension fund, has laid off at least five investment professionals at its Hong Kong office as it steps back from deals in China, three people with knowledge of the matter said.

Most were on the fund's private equity team and were informed early last month, according to two of the people. The departures have not been previously reported.

They added that a managing director who was in charge of the firm's Greater China real estate portfolio had been told he was losing his position weeks earlier.

The fund has paused new investments in China, including direct investments as well as those in China-focused fund managers, discouraged by the country's faltering economic recovery and tensions with the West, said the people.

They were not authorised to speak to media and declined to be identified.

CPP, which employs more than 150 people in Hong Kong, its Asia hub, declined to comment.

It had flagged in its latest annual report that evolving relationships between Canada, the U.S. and China would be a factor as it reviewed its approach to emerging markets.

Political tension between Canada and China has been quite fraught over the past few years. More generally, the business climate for foreign firms in the world's second-largest economy has also chilled amid intensifying trade and political tension with the U.S. that has led to Washington imposing export controls on key tech such as some semiconductors.

U.S. Commerce Secretary Gina Raimondo noted during her China visit this week that U.S. companies have complained that China has become uninvestable, pointing to fines, raids and other actions that have made doing business in China risky.

Other Canadian pension funds are also pulling back from China.

The Ontario Teachers' Pension Plan (OTPP) closed down its China equity investment team based in Hong Kong in April, Reuters has reported. Canada's second-largest pension fund, Caisse de dépôt et placement du Québec (CDPQ), has also stopped making private deals in China and will close its Shanghai office this year, the Financial Times reported in June.

China accounts for 9.8% of CPP's total investments, according to Michel Leduc, a senior CPP managing director, who was speaking before a parliamentary committee studying Canada-China relations in May.

At the time, he said China was an "important source" for CPP's portfolio. CPP managed $575 billion in assets globally as of end-June.

China-focused private equity funds have raised just $11.6 billion this year. That compares with $74 billion raised for all of 2022, according to data from research firm Preqin.

The numbers are a far cry from a peak in 2016 when more than 1,500 China-focused funds raised around $300 billion.

There have been $3.2 billion worth of acquisitions of firms in China by private equity so far this year. That's up from $2.7 billion last year but still far below the $49 billion for 2021, data from Dealogic shows.