Kalkine Media -

E-commerce stocks are companies that generate the majority of revenue via online sales of goods and services. Since the COVID-19 pandemic broke out, the global e-commerce market has experienced a remarkable rise as consumers were forced to stay at home and purchase items online.Highlights

- Companies selling goods and services via online platforms are called e-commerce stocks.

- The number of Canadian e-commerce users in 2022 was 27 million, accounting for 75 per cent of the nation’s population.

- During Black Friday Cyber Monday weekend, Shopify (TSX:SHOP) generated record sales of US$ 7.5 billion, up 19 per cent from 2021.

According to Statistics Canada, during the peak pandemic period, the Canadian e-commerce industry generated US$ 3.2 billion in retail trade sales for May 2020, which even boosted to an all-time high of US$ 3.82 billion in December 2020.

Additionally, as of 2022, there were over 27 million e-commerce users in Canada or 75 per cent of the country's population. By 2025, this percentage is expected to increase to 77.6 per cent.

In light of this, let’s flick through the financial performances of these two TSX-listed e-commerce companies:

Shopify Inc. (TSX: SHOP) With its network in more than 175 nations, Shopify Inc. is an essential internet infrastructure provider, helping companies conceptualize, grow, and market their retail businesses.

Shopify was founded in Ottawa, Canada, in 2006. During the Black Friday 2022 sale, Shopify generated record sales of US$ 3.36 billion; this was a 17 per cent increase or 19 per cent on constant currency, compared to the same period last year.

On the other hand, sales for its Black Friday Cyber Monday weekend also hit a record of US$ 7.5 billion from the company’s independent businesses worldwide, a 19 per cent (21 per cent on constant currency) increase from US$ 6.3 billion in 2021.

Meanwhile, during the third quarter of 2022, Shopify grew its revenue by 22 per cent to US$ 1.4 billion.

Nuvei Corporation (TSX: TSX:NVEI) As a payment technology solutions provider, Nuvei Corporation enables merchants and partners to carry out mobile payments, in-store payments, and online payments. The company generates a large chunk of its revenue from North America alongside its operations in Europe, the Middle East, and Africa.

Nuvei's earnings per share (EPS) of C$ 0.53 and a P/E ratio of 88.40.

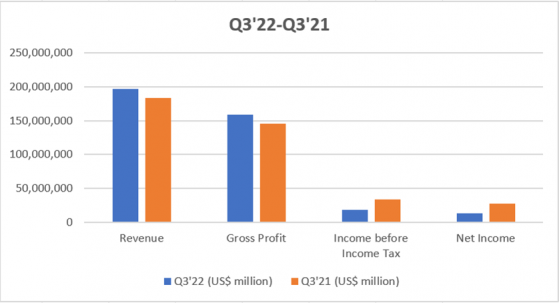

The corporation mentioned growing its revenue by 7 per cent in the third quarter of 2022, up from US$ 183.9 million to US$ 197.1 million. Adjusted net income and adjusted EBITDA also increased in Q3’22, up from US$ 62.3 million to US$ 62.4 million and US$ 80.9 million to US$ 81.2 million, respectively.

Moreover, Nuvei increased its total volume from US$ 21.6 billion to US$ 28 billion, representing a 30 per cent increase from the prior comparable period.

The company’s financials are showcased in the chart below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Bottom Line The volatility triggered by several recessionary and inflationary headwinds in the second half of 2022 still impacts the stock market. Therefore, investors should thoroughly analyze the market before investing in protecting their portfolios.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.