Halloween is coming up next week. It may have spooked the market and triggered a sell-off, but investors shouldn’t panic. Instead, view the market decline as a treat — quality stocks are now trading at cheaper valuations.

Buy these three dividend stocks for your peace of mind.

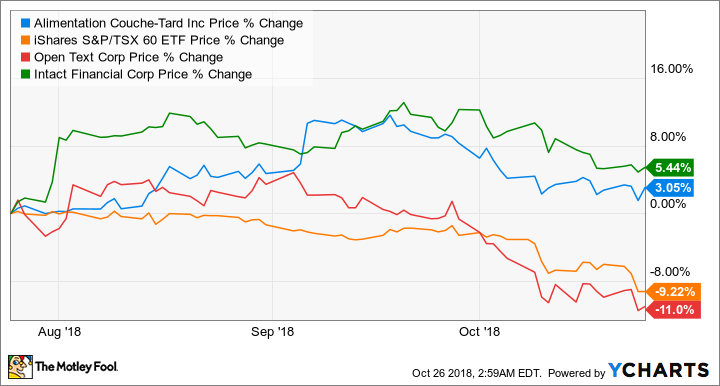

ATD.B data by YCharts. three-month price actions of Couche-Tard, Intact Financial, Open Text, and the Canadian market.

Alimentation Couche-Tard (TSX:ATD.B) stock has held up fairly well in the market sell-off. In fact, while the Canadian market has retreated about 9% in the last three months, Couche-Tard stock has actually appreciated about 3%.

A part of Couche-Tard stock’s stability comes from its defensive business. It has a network of about 14,700 convenience stores around the world. Most of these stores that are in North America and Europe also offer road transportation fuel, which helps drive traffic for its higher-margin products, such as dispensed beverages and food.

The stock is also relatively stable from having been trading in a sideways range for multiple years. Several years ago, the stock was overpriced, but earnings have caught up. So, it’ll become better and better valued if it continues trading in the range of about $52-68 per share, as its earnings and cash flow routinely grows.

In the low $50s, it would be a safer entry point for Couche-Tard, but long-term accounts would be fine buying at the current levels of about $61 per share.

Intact Financial (TSX:IFC) stock has shown even greater strength than Couche-Tard, as it has appreciated +5% in the last three months. Intact Financial benefits from increasing interest rates. The Bank of Canada just increased the overnight rate again a few days ago, boosting it to 1.75%.

Intact Financial is a market leader (with about 17% of the market share) in a fragmented industry. It’s focused on profitability, and it consistently beats its peers by about 5% for the return on equity. It aims for net operating income growth of 10% but has achieved an eight-year compound annual growth rate of 11.5%.

It would be safer to buy Intact Financial in the low $90s, but long-term accounts would be all right buying at the current levels of about $100 per share.

Open Text (TSX:OTEX)(NASDAQ:OTEX) stock has declined with the market. However, it’s poised to grow at a double-digit rate in the foreseeable future. Open Text operates globally in the growing industry of enterprise information management. Data will continue to grow at a rapid pace with the eventual ubiquitous use of the Internet of Things, artificial intelligence, the cloud, and 5G.

Open Text is undervalued at about $44 per share. However, with the broad market sell-off, it could very well trade low. Long-term accounts can consider the strategy of averaging in and start buying at current levels.

Investor takeaway

By holding quality businesses, such as Couche-Tard, Intact Financial, and Open Text, investors should feel at ease that their capital is well invested and that in the long run these investments will trade much higher and outperform as a whole.

Fool contributor Kay Ng owns shares of ALIMENTATION COUCHE-TARD INC and Open Text. The Motley Fool owns shares of Open Text. Alimentation Couche-Tard, Intact Financial , and Open Text are recommendations of Stock Advisor Canada.