By Ketki Saxena

Investing.com – Air Canada (TSX:AC) reports its fourth-quarter 2021 earnings tomorrow before the opening bell.

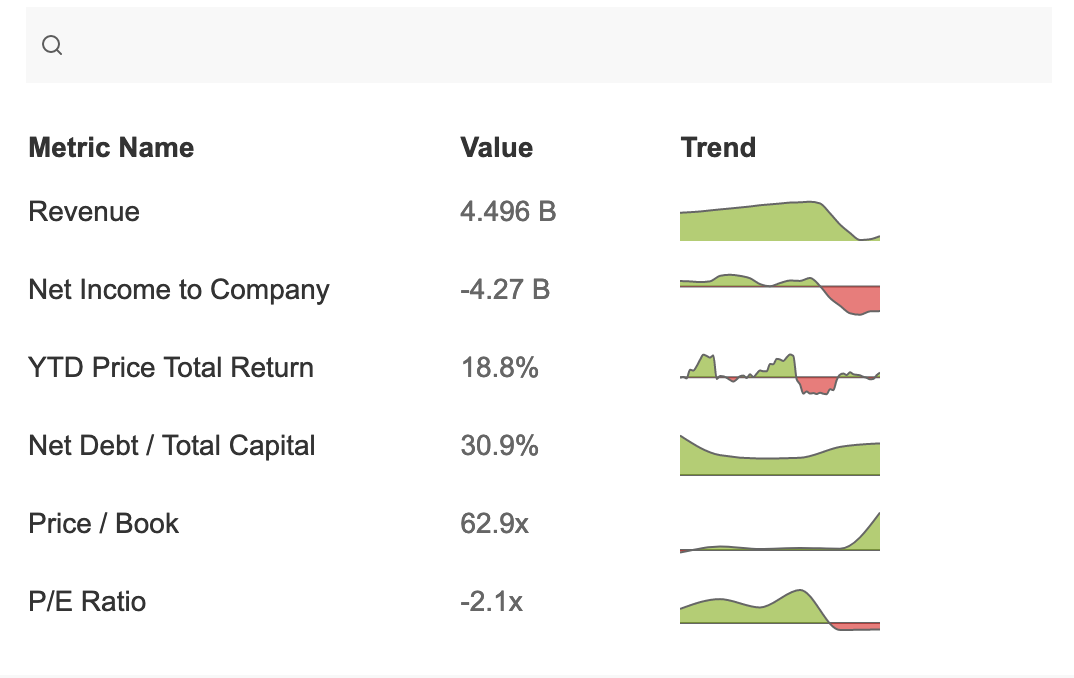

Year to date, Air Canada has delivered 18.8% total returns to shareholders and currently trades at a P/E multiple of -2.1x. As of 2:50 ET today, Air Canada stock was trading a C$ 24.55, with a 52-week range of C$ 19.31 - 31.00.

Analyst data from 17 brokerages aggregated by Investing.com suggests a fair share price of C$ 29.2, representing an upside potential of 17.8%.

Air Canada Earnings: What to expect tomorrow

Analysts are forecasting fourth-quarter revenue of C$ 2.427 Billion, up 15.4% from C$ 2.103 B billion in the last quarter, and a whopping 193.5 % higher than C$827 million in Q4 2020. EPS are forecast at -1.47, little changed from -1.46 in the last quarter, but a significant 63.8% increase from -4.07 this time last year.

In the last quarter, Air Canada beat analyst estimates, posting a +11.6% or +0.19 surprise on forecasted EPS and beating revenue forecasts by +14.8%, or 271.2 M.

For the full fiscal 2021, analysts expect Air Canada to report EPS of -9.93 on revenue of C$ 6.076 billion; a significant improvement from EPS -16.47 on revenue of C$ $5.833 billion for the full year 2020.

Air Canada Stock Outlook

Tomorrow’s earnings are likely to be less than spectacular for Air Canada. The airline is unlikely to beat analysts’ forecasts, which have been downgraded in recent days by key firms, including Scotiabank (TSX:BNS).

Air Canada’s Q4 results will likely have been significantly impacted by the onset of the Omicron variant, while the rising cost of jet fuel relative to both the previous quarter and the year further cut into the carrier’s bottom line.

However, the long term outlook for Air Canada remains positive. Analysts continue to rate Air Canada as a sector outperform, and remain confident that shares will rebound now that Omicron has peaked, travel restrictions have been lifted, and demand looks set to recover as early as this summer.

Other Undervalued Stocks in The Sector

Investors in airlines seeking significantly undervalued stocks may also want to explore:

JetBlue Airways Corp (NASDAQ:JBLU), currently trading at C$20.17 with a fair price target of C$24.01, representing a 19.1% Upside

Delta Air Lines Inc (NYSE:DAL) currently trading at C$55.39, with a fair price target of C$66.06, representing a 19.3% Upside.

All data and visuals are from Investing Pro

All Data is as of 2:50 PM ET