Kalkine Media -

Blue-chip stocks refer to stable and profitable companies with consistent performances over the years. They frequently have substantial market capitalizations and are widely regarded. In short, they are successful businesses that have stood the test of time and have a solid reputation in the market.Highlights

- For the third quarter of 2023, BCE’s revenue improved by 3.2 per cent.

- TD Bank has declared to pay a dividend of 96 cents for the quarter ending January 31, 2023.

- Canadian Pacific’s revenue for Q3’22 increased from C$ 1.94 billion in Q3’21 to C$ 2.31 billion.

BCE Inc. (TSX: TSX:BCE), Canadian Pacific Railway Limited (TSX: CP), Fortis Inc . (TSX: FTS), Toronto-Dominion Bank (TSX: TSX:TD), Enbridge Inc. (TSX: TSX:ENB), and Royal Bank of Canada (TSX: TSX:RY) are some of the well-known blue-chip stocks on the TSX market.

Canadian blue-chip companies like the ones mentioned above have placed themselves as steady income sources for investors alongside paying cash dividends to their shareholders regularly. However, it is important to know that past performances are not a guarantee for future gains and given the volatility factor, investors must note all the pros and cons of a particular stock before investing.

With all that said, here is a list of three TSX-listed blue-chip stocks and we'll see how they've performed in the previous quarters:

BCE Inc. (TSX: BCE) BCE Inc., aka Bell, was founded in 1880 in Montreal and is one of the largest telecommunications companies in Canada. It provides various communication services across Canada, including broadband, wireless, internet, media, business, and TV.

With a market capitalization of C$ 56.39 billion, Bell has paid its shareholders a quarterly cash dividend of C$ 0.92 per share, alongside an annualized dividend yield of 5.951 per cent.

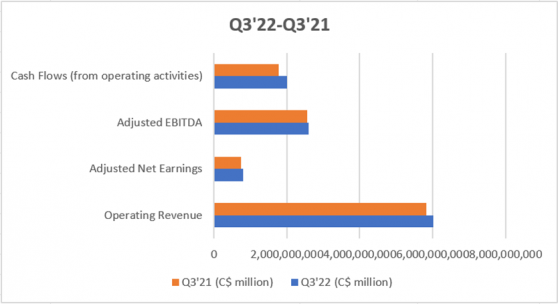

The company reported a 3.2 per cent increase in operating revenue for the third quarter of 2023. It surpassed the total operating revenue of C$ 5,836 million in Q3’21 to C$ 6,024 million in Q3’22. On the other hand, net earnings reduced to C$ 771 million in Q3’22 from C$ 813 million in the same period last year.

Bell’s other financials are listed below:

© 2023 Krish Capital Pty. Ltd.

Toronto-Dominion Bank (TSX: TD) The Toronto-Dominion Bank, collectively known as the TD Bank Group, serves more than 27 million customers across North America using its four primary businesses: Canadian Personal and Commercial Banking, US Retail, Wealth Management and Insurance, and Wholesale Banking.

TD Bank’s total market share is over C$ 163 billion, with C$ 1.9 trillion in assets as of October 31, 2022.

The bank recently provided an update on how the fourth quarter results of The Charles Schwab Corporation (NYSE:SCHW) may affect net income from its investment in Schwab for the first quarter of TD Bank's fiscal 2023. The Group anticipates that Schwab's Q4 earnings will amount to around C$ 285 million after deducting acquisition and after-tax costs.

Other than this, TD Bank declared its dividend for the quarter ending January 31, 2023, of 96 cents per fully paid common share.

Canadian Pacific Railway Limited (TSX: CP) Operating as a transcontinental railway in Canada and the US, Canadian Pacific Railway Limited provides connections to important ports on the west and east coasts. Canadian Pacific has been advancing its climate strategy over the last few years, resulting in the railway being named A List for the second consecutive year per Carbon Disclosure Project (CDP) scoring measures.

With a market capitalization of C$ 99.22 billion, this Canadian railway business has paid its stockholders a quarterly cash dividend of $0.19 per share.

Canadian Pacific stated that its revenue increased by 19 per cent to C$ 2.31 billion for the third quarter of fiscal 2022 from C$ 1.94 billion in Q3'21. Additionally, reported diluted earnings per share (EPS) were C$ 0.96, up 37 per cent from Q3’21 and core adjusted diluted EPS, excluding KCS, was C$ 1.01, up 15 per cent from Q3’21.

Bottom Line Even though blue-chip stocks are companies that are stable and profitable, the stock market isn’t predictable, and anything can happen at any time. Therefore, thoroughly analyse the market before choosing to invest in blue-chip or any other stocks.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.