Kalkine Media -

Highlights

- In 2020, C$ 12.2 billion of Canada’s GDP was contributed by the Canadian film and TV industry.

- Stingray generated C$ 77.6 million in revenue in Q2’23, representing a 9.8 per cent increase YoY.

- For the third quarter of 2022, Cineplex increased its revenue by 35.7 per cent compared to Q3’21.

In 2020, the Canadian film and television industry generated over 244,000 jobs across the country alongside contributing C$12.2 billion to Canada’s GDP, as per a report by Canadian Media Producers Association.

There are a wide variety of entertainment stocks available in Canada, but investors must analyze them carefully as the stock market is unpredictable, and anything can happen at any time.

Having said that, let's look at the financial performances of these two Toronto Stock Exchange (TSX)-listed entertainment companies:

Stingray Group Inc. (TSX: RAY.A) With a portfolio of over 540 million customers across 160 different countries, Stingray Group Inc. provides TV broadcasting, radio, streaming, advertising, and business services. Stingray Advertising in North America and Stingray Business are two other group segments.

With an annualized dividend yield of 5.435 per cent and a 5-year dividend growth rate of 13.76 per cent, Stingray paid its stockholders a quarterly cash dividend of C$ 0.075 per share.

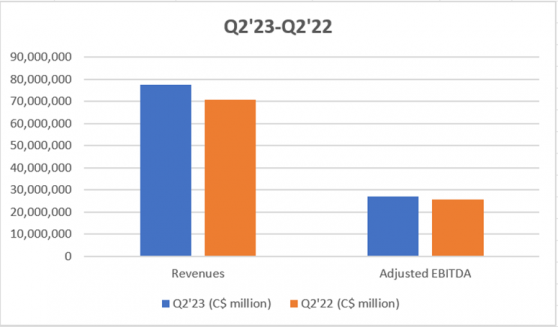

In the second quarter of 2023, Stingray increased its revenue by 9.8 per cent year-over-year (YoY) to C$ 77.6 million, with adjusted EBITDA coming in at C$ 27 million, or 34.8 per cent of revenues. Following this, the company asserted that it could maintain a 35 per cent adjusted EBITDA by year's end.

Revenue from broadcasting and commercial music and radio reached C$ 44.9 million and C$ 32.7 million, respectively, in the second quarter of 2023. Additionally, at the end of the second quarter, Stingray grew its total number of subscribers by 24.4 per cent YoY.

Stingray’s financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Cineplex Inc. (TSX: CGX) Canada’s leading entertainment and media company, Cineplex Inc., caters to millions of customers globally using its wide network of 170 movie theatres and entertainment venues alongside several digital businesses like CinplexStore.com, Cineplex Pictures, Cineplex digital media, and more. Cineplex’s market capitalization totals about C$ 535.5 million.

Cineplex grew its revenue to C$ 339.8 million in Q3’22 compared to the same period last quarter, a 35.7 per cent increase over Q3’21 revenue. Net income and adjusted EBITDA also improved to C$ 30.9 million and C$ 20.4 million (an 89 per cent increase from Q3’21), respectively.

Bottom Line No matter which stocks you decide to invest in, perform extensive market research before doing so. The stock market is yet to fully recover from volatility tendencies that have persisted since last year.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.