Kalkine Media -

Highlights

- In Q4’22, Brookfield Asset Management (TSX:BN) generated US$ 19 million in net income.

- Scotiabank improved its net income for fiscal 2022 to C$ 10,174 million compared to C$ 9,955 million in 2021.

- Manulife’s Asia Business grew by 12 per cent on a year-to-date term.

Due to the crucial role that financial institutions play in the global economy, financial companies have been able to pay consistent dividends to their shareholders.

However, financial stocks are cyclical and susceptible to economic downturns as people and businesses struggle and borrow less money, make fewer investments, and use their credit cards less frequently. This ultimately reduces the revenue generated by financial companies.

The performance of financial stocks in the past is not a guarantee of future success but can be helpful when assessing your investment options.

In light of this, let’s see the recent performances of these three TSX-listed financial companies:

Brookfield Asset Management (TSX: BAM) Brookfield Asset Management offers a range of alternative investment products to investors worldwide. Private health investors, insurance companies, and public and private pension plans are just a few of the types of investors that Brookfield serves.

The company has a total market share of C$ 19.2 billion alongside earnings per share (EPS) of C$ 4.85.

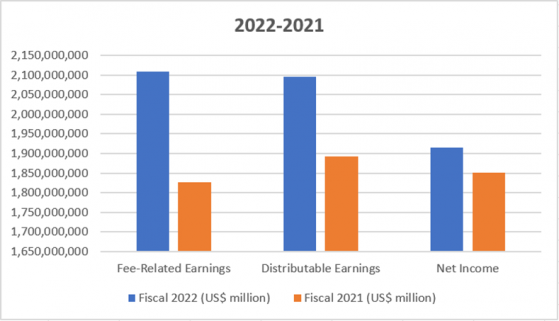

According to Brookfield Asset Management’s fourth quarter results for 2022, the company mentioned raising record capital of US$ 93 billion, resulting in US$ 2.1 of annualized distributable earnings. For the quarter that ended December 31, 2022, Brookfield’s net income was US$ 19 million, and for the entire year, it was also US$ 19 million.

The full year 2022 financials of Brookfield Asset Management and its subsidiaries are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Bank of Nova Scotia (TSX: TSX:BNS) The Bank of Nova Scotia, as a global financial services provider, operates different business segments, including Canadian banking, global wealth management, international banking, and others.

With a market capitalization of over C$ 87 billion, the Bank of Nova Scotia has paid its stockholders a quarterly cash dividend of C$ 1.03 per share alongside an annualized dividend yield of 5.627 per cent.

Scotiabank mentioned generating a reported net income of C$ 10,174 million for the full year of 2022, up from C$ 9,955 million in the prior comparable period. For the fourth quarter of 2022, the bank’s net income was C$ 2,093 million.

Apart from this, Scotiabank delivered a return on equity of 14.8 per cent for fiscal 2022, up from 14.7 per cent in 2021.

Manulife Financial Corporation (TSX: TSX:MFC) With operations in Canada, the United States, and Asia, Manulife provides its customers asset management, annuities, and life insurance products. The company generates about 30 per cent of profits from its US segment and approximately 20 per cent from its investment management segment.

Manulife has its shareholders a quarterly cash dividend of C$ 0.33 per share while holding a total market share of more than C$ 48 billion.

The company informed the market of growing its Asia business by 8 per cent in the third quarter of 2022 and 12 per cent on a year-to-date (YTD) basis. In addition, the net inflows for Q3’22 were C$ 3 billion alongside a core EBITDA margin of 32.7 per cent. Manulife’s net income for the third quarter of 2022 was C$ 1.3 billion.

Bottom Line Looking at the volatile nature of the stock market, investors are advised to conduct thorough market research before investing their money.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.