Kalkine Media -

Utility stocks are companies that engage in the infrastructure, transmission, and generation of electricity. Canadian utility stocks are generally regarded as great investment options by investors because of their dependability and the fact that they come in second to basic consumer necessities.Highlights

- Brookfield Infrastructure achieved funds from operations for fiscal 2022 of US$ 2.1 billion, a 20 per cent increase from 2021.

- Emera (TSX:EMA) witnessed improved its adjusted net income to C$ 203 million in Q3’22.

- Canadian Utilities (TSX:CU) improved its adjusted earnings by C$ 32 million in the third quarter of 2022.

At the same time, most utility companies are well-established and firmly rooted in the market and have been paying cash dividends to shareholders.

However, this is not to say that utility companies are not risky to invest in. The general phenomenon has shown that utility companies have high debts on their balance sheets, and an increase in interest rates could harm their financial performance.

In light of this, let's get to three utility companies on the Toronto Stock Exchange (TSX) and track their financial performances:

Brookfield Infrastructure Partners LP (TSX: BIP.UN) Brookfield Infrastructure Partners LP (BIP) operates in Asia Pacific, Europe, and North and South America with high-quality infrastructure assets in utilities, transport, data, and midstream sectors. The company is listed on both TSX and NYSE.

BIP has earnings per share (EPS) of US$ 0.18 and an annualized dividend yield of 4.388 per cent.

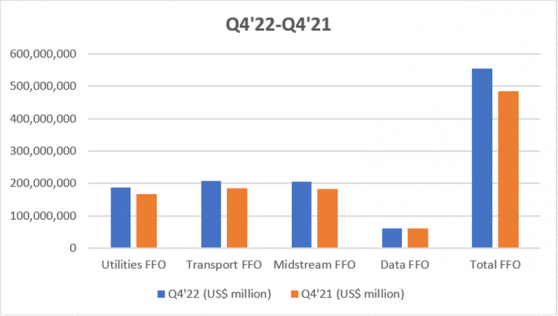

The company mentioned generating US$ 2.1 billion in funds from operations (FFO) for the full year 2022, representing a 20 per cent increase from fiscal 2021. The biggest contributions were made by the utilities, transport, and midstream segments, US$ 739 million (US$ 705 million in 2021), US$ 794 million (US$ 701 million in 2021), and US$ 743 million (US$ 492 million in 2021), respectively.

BIP’s financials for the third quarter of 2022 are showcased below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Emera Inc. (TSX: EMA) Based out of Halifax, Nova Scotia, Emera Inc. is diverse energy and services company, with electricity transmission and generation investments in the US, Canada, and three Caribbean countries. The company had about US$ 36 billion in assets as of 2022.

In the third quarter of 2022, Emera paid its shareholders a cash dividend of C$ 0.69 per share. Also, it increased its adjusted earnings per share (EPS) to C$ 0.76 from C$ 0.68 in the same period last year. On the other hand, the year-to-date (YTD) adjusted EPS increased by 5 per cent to C$ 2.27, up from C$ 2.17 in Q3’21.

Emera mentioned increasing its Q3’22 adjusted net income from C$ 175 million in Q3’21 to C$ 203 million. Besides, the YTD adjusted net income also increased to C$ 601 million in the third quarter of 2022 from C$ 555 million in the prior comparable period.

Canadian Utilities Limited (TSX: CU) Canadian Utilities Limited is a diversified global energy infrastructure company headquartered in Calgary, Alberta. The company is an ATCO subsidiary primarily operating in utilities, infrastructure, and retail energy in Canada and Australia.

Canadian Utilities' 5-year dividend growth rate is 4.45 per cent and it paid its stockholders a quarterly dividend of C$ 0.449 per share.

In the third quarter of 2022, Canadian Utilities generated C$ 120 million in adjusted earnings, up from C$ 88 million in the same period last year. Meanwhile, for the nine months that ended September 30, 2022, the adjusted earnings for the company were C$ 475 million, an increase from C$ 394 million in Q3’21.

Bottom Line Even though the utility sector is more resilient to inflation and recession than many other sectors, investors should always exercise caution before investing because the stock market is prone to volatility, and anything can happen at any time.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.