The financial sector in Canada takes up a lion’s share of the stock market and constitutes about 30.54 per cent. As on October 27, 2022, the sector showed a quarter-to-date (QTD) increase of 1.398 per cent.Highlights

Lately, the financial markets have been caught up due to increasing inflation along with the rise in interest rates. Amid this scenario, the Bank of Canada has announced an increase in the key interest rate by 50 basis points to 3.75 per cent.

The bank is currently hawk-eyed in its efforts to combat inflation. This can eventually lead to reduced demand and more savings. Higher interest rates and a decrease in earnings and profits may impact the stock market. Investors should be able to tap into the opportunity for effective portfolio management.

However, not all sectors of the stock market are impacted by this. Considering the past trends, financial and banking stocks have shown a considerable improvement in this environment.

But for new investors, it can be daunting to make an entry and operate amid this situation. But they can still take a balanced decision and stabilize their portfolio with thorough market research.

Some analysts opine on exploring financial stocks in case of a rise in interest rates. Hence, Kalkine Media explores five financial stocks and assesses their recent financial performances:

For Q3 2022, Bank of Montreal's net income witnessed a decline to C$ 1,365 million as compared to C$ 2,275 million in Q3 2021.

The revenue was reported at C$ 6,099 million as compared to C$ 7,562 million for the same comparative period.

The bank’s quarterly dividend was noted at C$ 1.39 per share. The five-year dividend growth for the bank was reported at 6.77 per cent along with a dividend yield of 4.41 per cent. The bank has an EPS (earnings per share) of C$ 16.79.

On July 20, 2022, the Bank of Montreal made an announcement of its definitive agreement to acquire Radicle Group Inc.

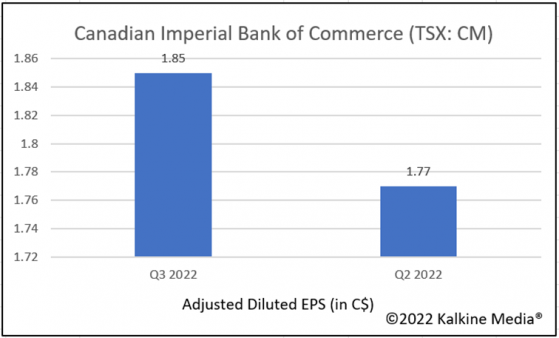

For Q3 2022, the net income of Canadian Imperial Bank was reported at C$ 1,666 million versus C$ 1,523 million in Q2 2022.

There was an increase in the revenue too and was noted at C$ 5,571 million in Q3 2022.

The total assets for the bank also rose to C$ 896,790 million as against C$ 894,148 million. The dividend paid by Canadian Imperial Bank of Commerce is C$ 0.83 per share.

The below graph depicts the increase in the adjusted diluted EPS of Canadian Imperial Bank within a time of 12 months.

In Q3 3033, net income of Royal Bank of Canada was reported at C$ 3,577 million as compared to C$ 4,296 million in Q3 2021.

The Q3 2022 revenue too witnessed a decline and was reported at C$ 12,132 million versus C$ 12,756 million in Q3 2021.

Royal Bank of Canada pays a quarterly dividend of C$ 1.28 per share to its shareholders. The dividend yield was reported at 4.117 per cent. Further, the EPS is noted at C$ 11.01.

For the quarter ended June 30, 2022, the total assets saw an increase to US$ 411,866 million versus US$ 391,003 million on December 31, 2021.

In the June 2022 quarter, the revenue for Brookfield Asset Management Inc. also grew to US$ 23,256 million as compared to US$ 18,286 million in the year-ago quarter.

In Q2 2022, the total core earnings of Manulife were reported with an increase to C$ 1,562 million versus C$ 1,552 million in Q1 2022.

The company’s net income was C$ 1.1 billion in Q2 2022. The quarterly dividend paid by the company was noted at C$ 0.33 with a five-year dividend growth of 4.46 per cent.

On October 26, 2022, Manulife Financial Corporation announced its acquisition of Alliance Gateway 11 of Fort Worth, TX.

Bottom Line: With an increase in banks’ interest rates, there can be an impact on the profits of the financial firms. Hence, investors must be fully aware of the market changes regarding their stocks.

However, investors can still stabilize their portfolios by investing in stocks that may perform well in a rising interest rate environment. Along with this, look at the diversification aspect too as it can help you to have different perspectives for your stocks.

Assess the financial performances of the companies along with their company valuations before deciding. This can provide a clear understanding of the stocks and the current market trends. Moreover, investment becomes easier when you move along with the market.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.