(Bloomberg Gadfly) -- In attempting to head off a Bernie Madoff moment, China has set the stage for an even deeper bond market rout.

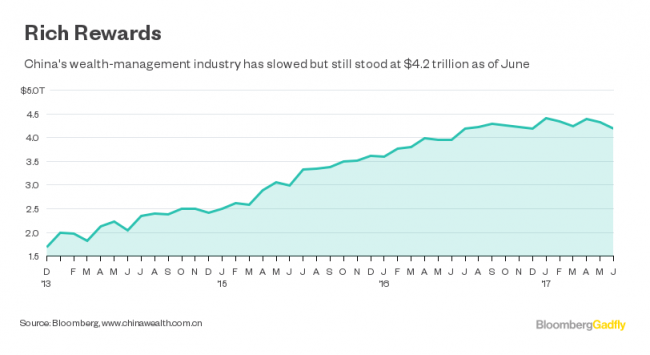

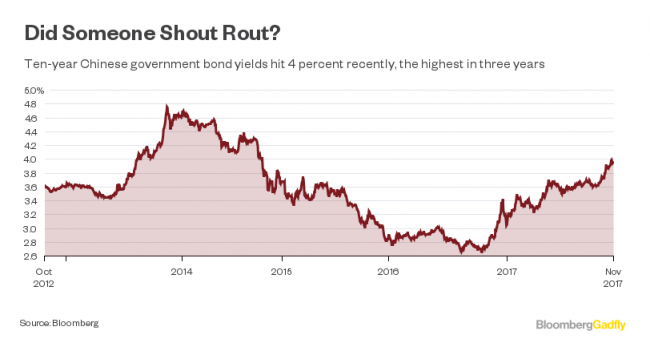

Ten-year government note yields last week hit the psychologically important 4 percent level as investors braced for sweeping rules to curb risks in the country's $15 trillion asset-management industry.

Caving into social pressure, banks in China have been bailing out wealth-management products that have gone bad. That's not going to be allowed come June 2019. If an offering defaults, issuers or manager can't use their own funds to prop it up or roll the product over into a new one. Those found violating the new conditions will be fined.

There will also be big changes to the types of debt offerings WMPs themselves can invest in.

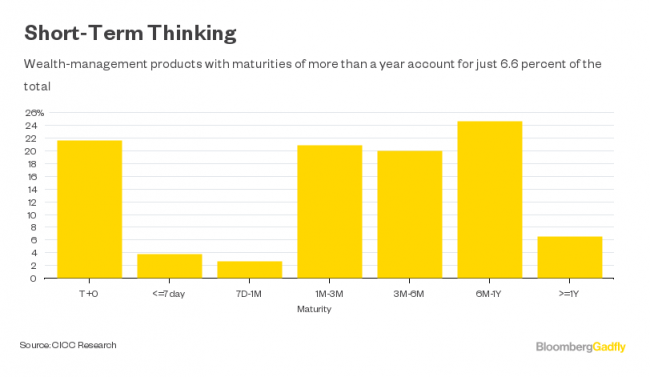

Beijing has deemed that interest rates paid by WMPs are too high. Many are short term -- only 7 percent have a maturity longer than one year, according to CICC Research -- and most yield around 4 percent to 5 percent.

To ensure those juicy returns on the front end, asset managers have had to move ever further up the yield curve on the back end, buying higher-risk, longer-term securities. As a result, more than 15 percent of banks' WMP funds are in so-called "non-standard debt products," which have tenors of up to three years.

Under the new rules, any WMPs that invest in non-standard debt, like debt-for-equity swaps that are less liquid than stocks or bonds, must have at least the same maturity as the underlying obligation. In addition, only funds raised via private placements can invest in non-standard debt; funds sold to the general public are restricted to buying liquid instruments, such as shares or debentures.

These broad changes come at a sensitive time, and raise the question of whether companies in China can cope with the dual challenge of rising interest rates and tighter liquidity.

China's wealth-management industry may be fraught with moral hazard but it is a key source of funding for the private sector, especially when firms find themselves cut off from regular financing channels such as bank loans. WMP proceeds have funded many a property project, which helps explain why shares of China Vanke Co. tumbled as much as 4 percent in Hong Kong on Monday.

Sudden liquidity tightening can also result in nasty surprises.

Dandong Port Group Co., which manages China's largest trading harbor with North Korea, defaulted on a 1 billion yuan ($151 million) bond that matured last month even though it's a profitable company with 15 percent operating margins. It just couldn't refinance fast enough.

China 10-year bond yield

3.96%

The yield on government debt due in a decade stabilized at 3.96 percent Monday, but that's probably the calm before the storm. China's debt market lacks proper credit ratings and is best described as a large sausage stuffed with good and bad meat. Of the some 1,500 notes of publicly traded companies covered by the nation's four main credit-rating firms, 70 percent are scored AA or above, and 60 percent are AAA. As recently as June, Dandong Port was at a respectable AA.

As Gadfly has noted, China is unlikely to want benchmark yields to spike much higher. But here's the problem with bonds: often bought with leverage, they can sell off quickly when risk aversion grips. What's more, asset managers will have to list their WMPs at market value rather than at cost, meaning any bond-market correction could snowball into worse much faster.

With these new rules, Beijing risks opening a Pandora's box of new problems.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Gadfly columnist covering Asian markets. She previously wrote on markets for Barron's, following a career as an investment banker, and is a CFA charterholder.

-

Last seen in October 2014.