Investing.com -- While the market is giving back some of its gains from last week as traders take profits on the market's frothy highs, Autodesk (NASDAQ:ADSK) stock is gaining a hefty 5% in early market trading.

With these gains, our readers who received the tip to buy the stock at the beginning of June for less than $9 a month are now collecting a fat 17% on the stock in June alone. Yet, despite the solid month-to-date gains, our fair value tool indicates that the stock still has room to grow another 12% upside potential.

And if that's not enough, they also received several other fantastic tips that are leading to market-beating results this month, such as Adobe (NASDAQ:ADBE): +18.11% this month. They were also advised to hold on to Nvidia, which is up yet another 20.7% in June.

See the full list of picks for the month here!

The impressive performance follows an even better May run in which our users collected life-changing profits on stocks such as:

- Perficient Inc (NASDAQ:PRFT): +56.39% in May.

- Vistra Energy Corp (NYSE:VST): +37.08% in May.

- Marathon Digital Holdings Inc (NASDAQ:MARA): +24.70% in May.

- Applovin Corp (NASDAQ:APP): +18.30% in May.

- NVIDIA Corporation (NASDAQ:NVDA): +33.07% in May.

- NAPCO Security Technologies Inc (NASDAQ:NSSC): +28.88% in May.

- Louisiana-Pacific Corporation (NYSE:LPX): +24.88% in May.

- Wayfair Inc (NYSE:W): +17% in May.

These results pushed our long-term real-world performance to a solid beat over the S&P 500 since our official launch in October:

- Tech Titans: +68.99%

- Beat the S&P 500: +32.88%

- Dominate the Dow: +18.03%

- Top Value Stocks: + 30.39%

- Mid-Cap Movers: + 17.11%

This is no backtest. This is the real-world performance unfolded right in front of our eyes.

The real secret behind our AI's top performance is that, unlike everything else out there, our strategies are forward-looking and not a momentum indicator.

Powered by the history of the stock market in data, our AI is designed to pick stocks before they rally - thus not trying to chase the market. No bag-holding, just best-in-breed fresh stock picking.

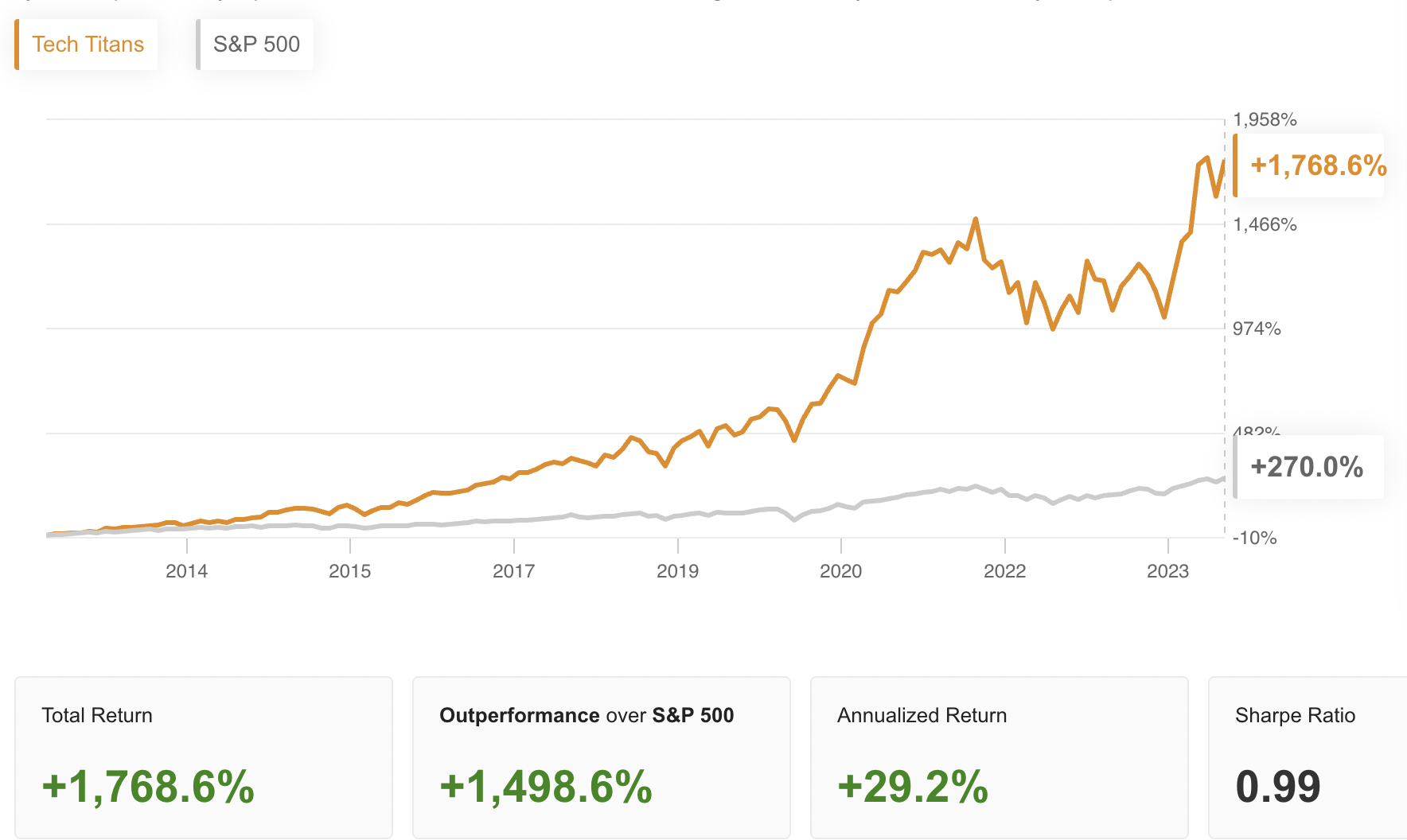

This is the methodology that led our flagship Tech Titans strategy to garnish an eye-popping 1,768% return in our backtest over the last decade.

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,868,000 by now.

Subscribe now for less than $9 a month and get ready for a market-beating June performance!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS20242!