Investing.com -- Hedge funds (HFs) are rotating out of sectors like Information Technology, Energy, and Financials into Consumer Discretionary, Materials, and Consumer Staples, Goldman Sachs (NYSE:GS) revealed in a new report.

Energy, in particular, has faced sustained selling pressure. Hedge funds have now net sold U.S. Energy for five consecutive weeks, driven entirely by short sales.

“This week’s short selling in the sector was the largest in over 5 years," as short sales outpaced long buys by a striking 6.4 to 1 margin.

As a result, Energy's share of overall U.S. net exposure has dropped to 2.3%, down from a year-to-date high of 3.3% in mid-August.

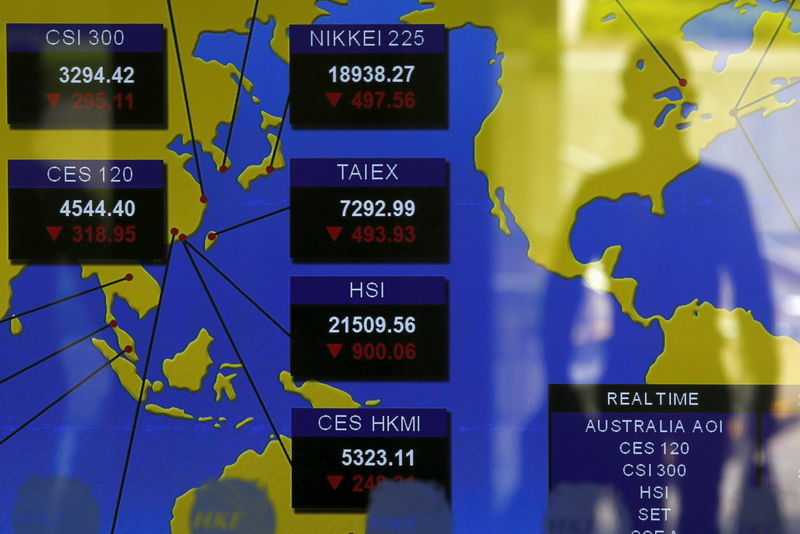

Meanwhile, the most significant regional development was in Asia, where both developed (DM) and emerging markets (EM) saw the largest net buying in over a decade, led by China and Hong Kong.

“Asia (both DM and EM combined) was the most net bought region on our Prime book this week and saw the largest net buying in over 10 years,” Goldman notes. “This week’s net buying was driven by long buys and to a much lesser extent short covers.”

Single stocks and macro products accounted for most of the activity, with Chinese equities recording their largest weekly net buying on Goldman Sachs' books. Hong Kong also saw substantial buying, though it was more focused on macro products than individual stocks.

The strong interest in Asian equities comes after China recently unveiled a set of measures aimed at combating the broader economic slowdown.

Chinese stocks continued their upward trajectory on Monday, with mainland equities on track for their strongest monthly performance in nearly a decade.

Specifically, mainland benchmark indices started the week positively, following their best weekly performance in almost 16 years. The Shanghai Shenzhen CSI 300 blue-chip index gained over 6.22%. Meanwhile, the Shanghai Composite Index jumped 5.7%, and Hong Kong’s Hang Seng Index climbed 3.34%.