Kalkine Media -

Investors are anticipating a significantly better 2023 as 2022 is now in the rearview mirror and several equities are trading cheaper than they did at the start of 2022. However, many are preparing for another risky year in the markets given the amount of uncertainty that the future holds.Highlights:

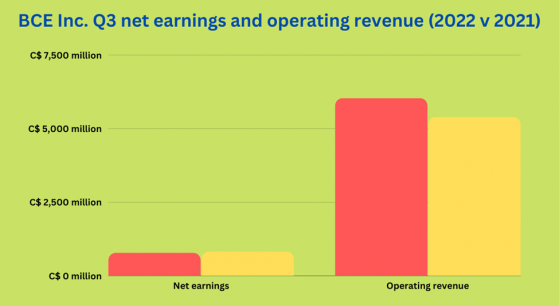

- BCE (TSX:BCE) Inc. Q3 2022 net earnings of C$ 771 million.

- TELUS Corporation’s net income in Q3 2022 was C$ 551 million.

- BCE paid a quarterly dividend of C$ 0.92 per share.

Amid uncertainty over the stock market conditions, we look at two TSX-listed communication stocks and see how have they performed:

BCE Inc. (TSX: BCE) BCE Inc., earlier known as Bell Canada Enterprises Inc., provides telecom services and owns several mass media assets. It holds a quarterly dividend of 6.054 per cent and paid a quarterly dividend of C$ 0.92 apiece. The three-year dividend growth of BCE is 4.38.

The company posted Q3 2022 adjusted net earnings of C$ 801 million. Meanwhile, the operating revenues of the company in the third quarter of 2022 were C$ 6,024 million compared to C$ 5,386 million in the corresponding quarter in 2021. It reported net earnings of C$ 771 million in Q3 2022 versus C$ 813 million in Q3 2021.

It generated a free cash flow of C$ 642 million in Q3 2022 against C$ 566 million in Q3 2021. The BCE stock returned 2.2 per cent in a week.

Source: ©Kalkine Media®; © Canva via Canva.com

TELUS Corporation (TSX: T) Among the big three wireless service companies in Canada, Telus (TSX:T) Corporation has nine million mobile phone subscribers across the country. Telus captures 30 per cent of the total market.

In the third quarter of 2022, Telus announced an increase of its quarterly dividend to C$ 0.3511, an increase of 7.2 per cent YoY.

The net income of the telecom company in Q3 2022 was C$ 551 million compared to C$ 358 million. The company’s operating revenues and other income came to C$ 4,671 million versus C$ 4,251 million in the year-ago quarter.

The adjusted EBITDA of Telus was reported at C$ 1,724 million in the three months that ended September 30, 2022, compared to C$ 1,559 million in the same period in 2021. The T stock gained 4.3 per cent in the last five days.

Bottom line In a market characterized by volatility and a bearish phase, investors should tread carefully by taking a decision after enough analysis of a stock. Take a long-term plan and stay invested while the market turmoil lasts.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.