Kalkine Media -

Small-cap stocks are companies with a market capitalization of $300 million to $2 billion. It is often considered that small-cap stocks offer high rewards but carry higher risks, whereas larger-cap companies offer long-term, safer, and less volatile investment opportunities for investors.Highlights

- For the third quarter of 2022, WELL Health (TSX:WELL) reported record revenue, adjusted gross profit, and adjusted EBITDA.

- Payfare improved its Q3’22 revenue by a staggering 183 per cent from the prior comparable period.

- Absolute Software generated US$ 53.6 million for Q1’23, a 23 per cent increase from Q1’22.

In a stock market, many kinds of stocks are available, but research and analysis are of utmost importance. We are saying this because there’s no guarantee in an equity market and anything can happen. In light of this, let’s glance at how these three Toronto Stock Exchange (TSX)-listed small-cap companies have been doing lately:

WELL Health Technologies Corp. (TSX: WELL) WELL Health Technologies Corp. is a publicly-traded digital healthcare company provides end-to-end practice management systems to assist and empower healthcare professionals and their patients. Along with owning its innovative digital enablement platform, WELL also has Canada’s biggest network of outpatient medical clinics. The company holds a total market share of C$ 768.8 million.

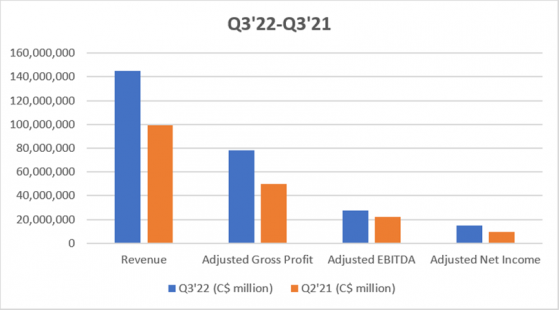

The company witnessed a strong third quarter in 2022. The record quarterly revenue of C$ 145.8 million was 47 per cent higher in Q3’22, up from C$ 99.3 million in Q3’21. Not only this, adjusted gross profit and adjusted EBITDA for the third quarter of fiscal 2022 also reached record highs of C$ 78.2 million (up from C$ 50 million in Q3’21) and C$ 27.5 million (up from C$ 22.3 million in Q3’21), respectively. The WELL stock gained 32.6 per cent year-to-date (YTD) at the time of writing.

WELL’s financials are in the table below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Payfare Inc. (TSX: PAY) Payfare Inc. is a financial technology company and provides mobile banking, instant payments, and loyalty-reward systems to consumers worldwide. Several well-known companies, like Uber, Lyft, and DoorDash (NYSE:DASH), use Payfare’s financial solutions to empower their workforces.

The fintech company recently informed the shareholders of increasing its Q4’22 revenue guidance. Payfare intends to exceed its previously provided revenue projection of C$125–C$135 million for 2022, with expected revenues of around C$ 133 million (up 205% year-over-year).

Also, in the third quarter of 2022, Payfare’s revenue was 183 per cent higher (C$ 35.9 million) from the same period last year. Gross profit and adjusted EBITDA were also 246 per cent and 357 per cent higher in Q3’22, respectively, from Q3’21. The PAY stock was up 52.05 per cent YTD as of writing.

Absolute Software Corporation (TSX: ABST) Absolute Software Corporation poses itself as the only provider of self-healing, intelligent security solutions. The company aims to deliver cyber resilience to its customers by establishing a constant digital link that includes control and self-healing capabilities for endpoints, applications, and network connections.

The company has paid its shareholders a quarterly dividend of C$ 0.08 per share, with a total market capitalization of about C$ 826 million.

Absolute Software grew its revenue by 23 per cent to US$ 53.6 million in the first quarter of fiscal 2023 compared to the same period last year. Adjusted revenue also increased by 11 per cent to US$ 54.2 million in Q1’23 from Q1’22. The ABST stock had surged 12.3 per cent YTD at the time of writing.

The company’s other financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Bottom Line According to market trends, it is clear that small-cap stocks are riskier to invest in than blue-chip or larger-cap companies. However, since there are so many volatile aspects in the stock market, nothing can be foreseen. Therefore, investors should do extensive market research before investing in stocks.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.