GuruFocus - On June 7, 2024, Adam Peterson, CEO and 10% Owner of Boston Omaha Corp (NYSE:BOC), purchased 7,500 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 6,743,318 shares of Boston Omaha Corp.

Boston Omaha Corp is a holding company with interests in real estate, insurance, and other sectors. The company's strategy involves acquiring businesses with strong management teams and providing them with capital and strategic support to realize their potential.

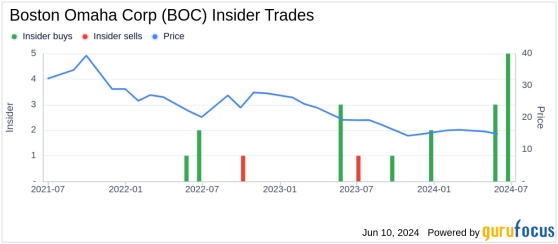

Over the past year, Adam Peterson has been actively increasing his stake in the company, purchasing a total of 51,276 shares. There have been no sales reported by the insider during this period. Overall, Boston Omaha Corp has experienced 11 insider buys and no insider sells over the last year, indicating a positive sentiment among the company's insiders.

Shares of Boston Omaha Corp were trading at $13.97 on the day of the transaction. The company currently has a market cap of approximately $444.205 million.

According to the GF Value, the intrinsic value of Boston Omaha Corp is estimated at $34.22 per share, suggesting that the stock is significantly undervalued with a price-to-GF-Value ratio of 0.41. The GF Value is calculated based on historical trading multiples, an adjustment factor from GuruFocus, and future business performance estimates.

This recent purchase by CEO Adam Peterson could be seen as a strong signal of confidence in the future prospects of Boston Omaha Corp, considering the significant undervaluation indicated by the GF Value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com