Kalkine Media -

The stock market volatility that began last year has persisted in the first month of 2023 due to inflationary pressures and fears of a recession. The Canadian consumer stocks market has, nevertheless, been performing positively. Even if consumer stocks are not immune to economic downturns, there will always be a consistent demand for their products and services.Highlights

- Companies that create, manufacture, and market products and services used daily are known as ‘consumer stocks.’

- Canada Goose reported growing its revenue by 19 per cent in Q2’23.

- Aritzia mentioned generating a record quarterly revenue of C$ 624.6 million in Q3’23.

The S&P Capped Consumer Discretionary Index has grown by 7.01 per cent month-to-date.

In light of this, let’s glance at how these two TSX-listed consumer stocks have been performing lately:

Canada Goose Holdings Inc. (TSX: TSX:GOOS) Canada Goose Holdings Inc. represents itself as a lifestyle brand that deals in the production of performance luxury apparel. The company was founded in 1957 in Toronto, Canada.

The company holds a market share of C$ 3.072 billion, with earnings per share (EPS) of C$ 0.77.

The retailer is currently involved in the buyback process of up to 5,421,685 subordinate voting shares under a normal course issuer bid (NCIB), which started on November 22, 2022, and will end on November 21, 2023. This number equals about 10 per cent of Canada Goose's total subordinate voting shares.

With this repurchase program, this Canadian consumer stocks company plans to utilize extra cash and support its broader capital allocation strategy.

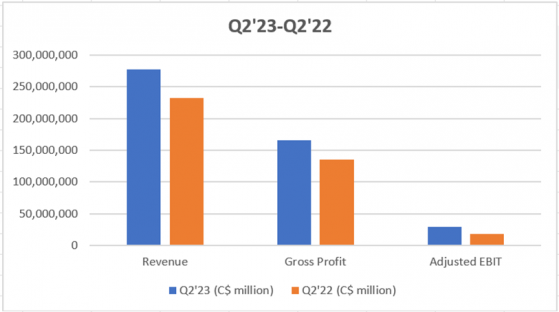

Canada Goose mentioned growing revenue for the second quarter of 2023 by 19 per cent on a reported basis to C$ 277.2 million. While DTC revenue improved by 15.6 per cent, wholesale revenue witnessed a growth of 21.2 per cent in Q2’23.

The company’s other financials are summarized below:

© 2023 Krish Capital Pty. Ltd.

Aritzia Inc . (TSX: TSX:ATZ) Vancouver, Canada headquartered Aritzia Inc. is a vertically integrated design house with operations across North America. The company has a vast online presence thanks to its global personal shopping platform, aritzia.com.

With a market capitalization of over C$ 5.3 billion, Aritzia has generated an EPS of C$ 1.67 alongside a P/E ratio of 27.80 for its stockholders.

This Canadian integrated design house informed the market of generating the highest-ever revenue for any quarter in Q3’23. Aritzia’s revenue for the third quarter of fiscal 2023 was C$ 624.6 million, a 37.8 per cent increase from the prior comparable period.

Revenue in the US retail and e-commerce segments also increased in Q3’23, up 57.8 per cent to C$ 313.5 million and 36.1 per cent higher to C$ 423.2 million, respectively.

Besides this, Aritzia’s net income grew by 8.9 per cent to C$ 70.7 million, and adjusted EBITDA reached the C$ 119.6 million mark with an increase of 9.5 per cent YoY.

Bottom Line Before investing in the stock market, always conduct thorough research. One should understand all the pros and cons to ensure that they don't make common mistakes.

Please note, the above content constitnutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.