Kalkine Media -

Publicly traded companies are known as healthcare stocks within the broader healthcare sector. Healthcare facilities, digital healthcare platforms, manufacturers, healthcare REITs, pharmacies, health insurance companies, etc., are all included in this sector.Highlights

- The COVID-19 pandemic has accelerated the growth of Canadian healthcare companies.

- WELL Health (TSX:WELL) reported a record third-quarter revenue of C$ 145.8 million in 2022.

- For the second quarter of 2023, Neighbourly's revenue has increased by 97.3 per cent.

Canada's healthcare industry has expanded due to higher medical spending during the global COVID-19 pandemic.

Additionally, despite the possibility of a recession and rising inflation, the healthcare industry is believed to be defensive as it is vital to our daily lives. However, as the equities markets are full of uncertainties, anything can happen.

In light of this, let's sneak peek at three TSX-listed healthcare stocks and how they have been doing lately:

WELL Health Technologies Corp. (TSX: WELL) WELL Health Technologies is a digital provider of electronic medical records (EMR), revenue cycle management (RCM), and data protection services. It also offers comprehensive end-to-end practice management tools, including virtual care and digital patient engagement capabilities.

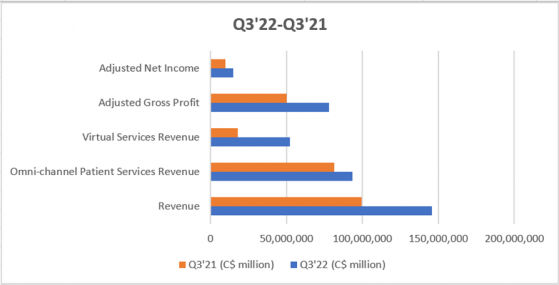

The owner and operator of Canada's largest outpatient clinics network, WELL, mentioned generating a record C$ 145.8 million in the third quarter of 2022; this was a 47 per cent year-over-year (YoY) increase from Q3'21. WELL's adjusted EBITDA for Q3'22 improved by 23 per cent YoY from the prior comparable period.

The company said its virtual services segment showed an organic 75% increase YoY, the third largest contributor to WELL's total revenue.

WELL's other financials are listed below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Andlauer Healthcare Group Inc. (TSX: AND) Andlauer Healthcare Group (AHG) is a rapidly expanding supply chain management company that provides specialized transportation and third-party logistics solutions for the healthcare industry in the US and Canada. With its services, the company hopes to effectively and comprehensively meet the needs of its clients’ specialised supply chains.

AGH's annual dividend yield was 0.569 per cent, with earnings per share (EPS) of C$ 2.68. The company announced to pay a fourth-quarter dividend of C$ 0.07 per subordinate share and multiple voting share to its stockholders, due last week (January 16, 2023).

The company's revenue improved from C$ 104.2 million in the third quarter of 2021 to C$ 164.9 million in Q3'22 alongside 65.9 per cent higher operating income. AGH's net income and comprehensive income also increased from the previous corresponding period to C$ 19 million and C$ 32.9 million, respectively.

Neighbourly Pharmacy Inc. (TSX: NBLY) Neighbourly Pharmacy Inc., with over 284 active properties, represents itself as a Canadian community pharmacies network wherein the pharmacies act as the center of care within their communities. The patient-first Neighbourly pharmacies deliver affordable healthcare in their neighbourhoods.

The company recently informed the investors of signing two separate agreements to buy six community pharmacies in New Brunswick and Nova Scotia alongside two in British Columbia. Neighbourly expects to create a total annualized adjusted EBITDA of approximately C$ 2.7 million through these acquisitions.

Apart from this, Neighbourly informed of achieving 97.3 per cent higher revenue of C$ 178.9 million in the second quarter of 2023 than in the previous comparable quarter. Same store sales, net income, and comprehensive income, all witnessed improvement in Q2'23.

Bottom Line Before making a final decision on investing, one should conduct thorough market research, given how volatile the stock market has been since 2022.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.