Kalkine Media -

Large-cap stocks, commonly referred to as blue-chip stocks, are companies with a market cap of at least $10 billion or more. Large-cap equities, also known as big-cap stocks, are frequently regarded as blue-chip stocks because they are larger than small-cap and mid-cap stocks and often represent established businesses with promising long-term growth potential.Highlights

- Businesses that have a market share of $10 billion or higher are known as large-cap stocks.

- The Royal Bank of Canada (TSX:RY) improved its earnings in the third quarter of 2022 by 9 per cent compared to Q3’21.

- During Black Friday Cyber Monday weekend, Shopify (TSX:SHOP) merchants set a record by generating US$ 7.5 in sales.

Large-cap stocks can be very lucrative prospects for investors because these industry-leading businesses tend to be less volatile than small or mid-cap companies, despite the fact that many investors believe smaller, rapidly growing companies to be more profitable.

Big-cap stocks can provide good long-term share price growth and assist in your portfolio diversification.

However, despite their size, profitability, and reliability, blue-chip stocks are still subject to market turbulence, and investors should stay cautious before investing, as nothing is guaranteed in the stock market.

Royal Bank of Canada (TSX: RY)

With a market capitalization of over C$ 191 billion, the Royal Bank of Canada (RBC) poses itself as one of the leading banks in Canada. RBC functions as a diversified financial services company with operations in 29 nations, including Canada and the US.

With earnings per share (EPS) of C$ 11.08 and a dividend yield of 3.822 per cent, RBC has paid its shareholders a quarterly dividend of C$ 1.32 per common share.

In the fourth quarter of 2022, RBC mentioned growing its earnings by 9 per cent from the prior comparable period, coupled with pre-provision, pre-tax earnings of C$ 5.2 billion. This was 10 per cent higher than the last quarter, primarily driven by significant volume growth and greater spreads in Canadian banking and wealth management.

Meanwhile, for the full year 2022, RBC’s personal and commercial banking increased earnings by 7 per cent, wealth management by 20 per cent, and investor and treasury services by 17 per cent compared to 2021.

Shopify Inc. (TSX: SHOP)

With operations in more than 175 countries, Shopify offers reliable tools and essential internet infrastructure for commerce to many retail companies in order to improve the shopping experience for millions of customers. Shopify was established in Ottawa and is home to a number of well-known international brands, such as Netflix (NASDAQ:NFLX), Heinz, Tupperware, Allbirds, FIGS, and others.The company achieved record Black Friday Cyber Monday weekend sales from its independent merchants of US$ 7.5 billion in 2022, a 19 per cent (or 21 per cent on constant currency) increase from the previous corresponding period.

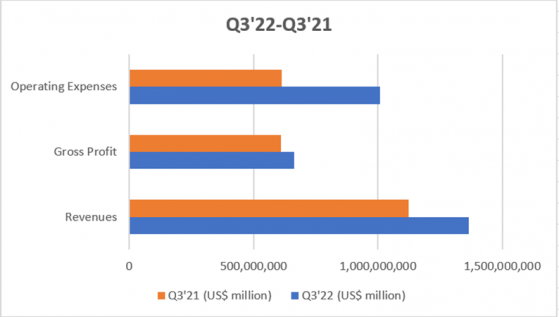

In the third quarter of 2022, Shopify grew its total revenue by 22 per cent to US$ 1.4 billion compared to last year's period. On the other hand, subscription solutions and merchant solutions revenues increased by 12 per cent (US$ 376.3 million) and 26 per cent (US$ 989.9 million), respectively, in Q3’22.

Shopify’s other financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Fortis Inc . (TSX: TSX:FTS)

Operating as a North American regulated utility company, Fortis Inc. provides electricity and gas to more than 3.4 million Canadians and Americans. The company owns ten utility transmission and distribution assets in the US and Canada, with a total market share of over C$ 26.5 billion.

Fortis has paid its shareholders a cash dividend of C$ 0.565 per share on a quarterly term alongside a 3-year dividend growth rate of 5.12 per cent.

The company mentioned generating C$ 326 million in net earnings for the third quarter of 2022, up from C$ 295 million in the same period last year. Net earnings on a year-to-date (YTD) basis also grew from C$ 903 million for the nine-month period of 2021 to C$ 960 million in 2022.

Besides, Fortis had launched a new and largest 5-year (2023-2027) capital plan of C$ 22.3 billion alongside an annualized dividend growth forecast of 4-6 per cent.

Bottom Line Even though large-cap companies are known for their stability, long-term growth, and profitability, it’s always better to stay cautious and conduct extensive market research before putting your money in the stock market.

Please note the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.