Kalkine Media -

Industrial stocks provide equipment, machinery, materials, and technology for various industries, including but not limited to manufacturing, construction, transportation, and defense.Highlights

- Industrial stocks are companies that engage in services such as manufacturing, construction, machinery, etc.

- According to Statistics Canada, Canadian manufacturers export goods worth more than C$ 354 billion annually.

- Ag Growth International achieved record sales for the third quarter of 2022.

One of the 11 stock market sectors on the Toronto Stock Exchange (TSX), the industrial sector is quite sizable and far-reaching. The S&P Capped Industrials Index has a total adjusted market share of around C$ 455.3 billion and had gained by 1.45 per cent month-to-date.

In addition, the Canadian manufacturing sector accounts for about C$ 174 billion, or 10 per cent of the country's overall GDP. According to Statistics Canada, the manufacturers in Canada export goods worth more than C$ 354 billion annually.

With all that said, let’s flick through these two TSX-listed industrial stocks priced under C$ 60 and their financial positions:

Ag Growth International Inc. (TSX: AFN) Ag Growth International Inc. designs and manufactures portable and stationary equipment for grain handling, storage, and conditioning with manufacturing facilities in Canada, the US, the UK, Italy, Brazil, France, and India.

AGI paid its shareholders a cash dividend of C$ 0.14 per share on a quarterly basis, with an annualized dividend yield of 1.205 per cent.

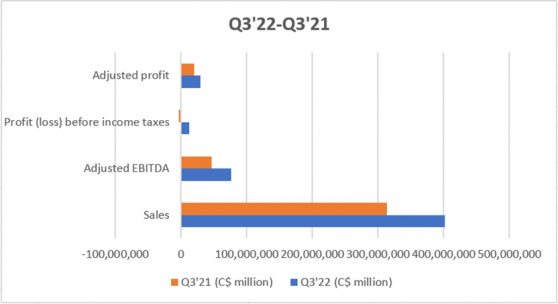

For the third quarter of 2022, this Canadian manufacturing company saw another record for sales and adjusted EBITDA, which climbed by 28 per cent and 65 per cent year over year (YoY), respectively.

At the same time, for the nine months that ended September 30, 2022, AGI improved its sales by 24 per cent from the same period last year and adjusted EBITDA by 40 per cent.

AGI’s financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Andlauer Healthcare Group Inc. (TSX: AND) Andlauer Healthcare Group functions under two different segments: specialized transportation and healthcare logistics. The company handles ground transportation, air freight forwarding, and last-mile delivery through its specialised transportation segment. Contract logistics services for customers are managed under its healthcare logistics segment.

AHG declared to pay a cash dividend of C$ 0.07 per share for the last quarter of 2022, and the company’s total market share is approximately C$ 1.9 billion.

The company mentioned improving its revenue for Q3’22 by 58.3 per cent to C$ 164.9 million, up from C$ 104.2 million. The operating and net income also increased in the third quarter by 65.9 per cent to C$ 27.9 million and 55.9 per cent to C$ 19 million, respectively.

Bottom Line The equity market gets influenced by several factors that drive it to rise or fall. It is also extremely unpredictable, and anything can happen any time. Therefore, it is advised to conduct thorough research before investing.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.