Kalkine Media -

Companies that offer wired, wireless, satellite, cable, and other communication infrastructure to enterprises and consumers are called communication or telecom stocks.Highlights

- Rogers’ fourth quarter total service revenue witnessed a 6 per cent increase from the prior comparable period.

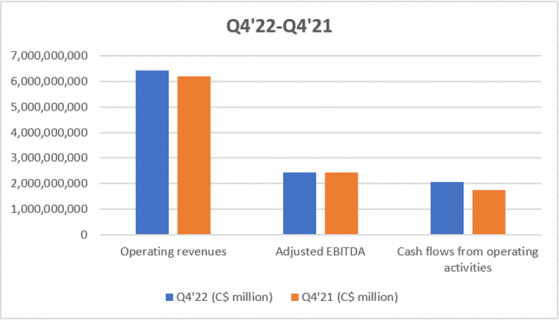

- BCE (TSX:BCE) improved its Q4’22 revenue by 3.7 per cent, up from C$ 6.2 billion in Q4’21 to C$ 6.4 billion.

- BCE mentioned growing its revenue by 3.7 per cent in the fourth quarter of 2022.

Recent trends have revealed that the telecom sector needs faster internet, driving up the number of devices linked to the internet. According to the Statistics of Canada, a smartphone was held by 84.4 per cent of Canadians in 2020, up 4.1 percentage points from 2018.

Investing in communication stocks allows you to participate in developing cutting-edge technologies. However, one should know the risks of a stock market before entering.

With that said, let’s flick through the financial performances of these two Toronto Stock Exchange (TSX)-listed communication companies:

BCE Inc. (TSX: BCE) As Canada’s leading wireless, broadband, television, and landline phone services provider, BCE Inc. has a wide network of over 10 million customers. Besides being a wireless carrier, BCE is also a media segment that makes television, radio, and other digital media available to Canadians.

The company has a total market cap of C$ 54.9 billion, with earnings per share of C$ 2.98 and a quarterly cash dividend of C$ 0.968 per share.

BCE mentioned growing its revenue by 3.7 per cent in the fourth quarter of 2022, with positive adjusted EBITDA growth for the quarter. Net earnings for Bell in Q4’22 were equivalent to C$ 567 million. Moreover, the company increased its cash flows from operating activities by 18 per cent compared to the same period last year.

Bell’s financials are showcased in the chart below:

© 2023 Krish Capital Pty. Ltd.

Rogers Communications Inc (TSX:RCIa). (TSX: RCI.B) As an owner of Canada’s one-third telecom market, Rogers Communications offers services like wireless, home internet, landline phone, and television. The company also holds ownership of a media segment that handles the Toronto Blue Jays alongside several television and radio stations.

Rogers’ total market capitalization is approximately C$ 25.48 billion, and it has paid its shareholders a quarterly dividend of C$ 0.50 per share.

In the fourth quarter of 2022, the total service revenue increased by six per cent for Rogers alongside an adjusted EBITDA increase of 10 per cent compared to Q4’21. This revenue increase was driven by wireless service revenue growing by 7 per cent and media revenue by 17 per cent.

Net income and adjusted net income also grew by 25 per cent and 14 per cent, respectively, in Q4’22.

Bottom Line The stock market is volatile, which makes it unpredictable. Therefore, investors are advised to exercise caution before investing in the equity market.