(Bloomberg Opinion) -- Stock investors, who seem to be looking to the Federal Reserve to bolster the market, shouldn’t hold out too much hope.

That’s not just because the U.S. central bank, for a number of reasons that include the still strong labor market and President Donald Trump’s attempts undermine the Fed’s independence, is expected to raise interest rates on Wednesday. Even if the Fed were to pause, or announce that it was slowing future rate increases, stocks still have more room to fall.

That logic is based on the so-called Fed model, a method for valuing stocks based on bond yields. By that metric, unlike others, there’s not much of an incentive for a market rally.

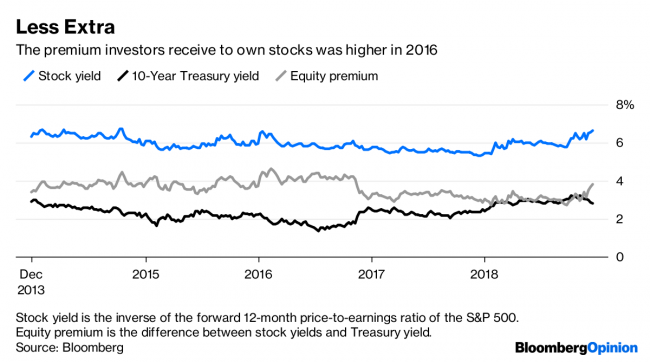

The Fed model, which was reportedly used by former Fed Chairman Alan Greenspan but never officially endorsed by the central bank, compares the average earnings yield of the companies in the S&P 500, which is the inverse of the price-to-earnings ratio, to the yield on 10-year U.S. Treasury bonds. When stocks are yielding more than bonds, it’s time to buy. When they are yielding less, sell.

The problem with the Fed model is that stocks, because they are generally riskier investments than bonds, have consistently yielded more than Treasuries since the early 2000s. So if investors were were relying on it as a sell indicator, they would have missed the 2008 plunge associated with the financial crisis as well as the most recent market correction. Even at the market high in late September, S&P 500 stocks still yielded a hefty 2.7 percent more than U.S. Treasury bonds.

But what the Fed model can tell investors is how much extra they are getting paid for the risk of owning stocks. Some call the spread between stock and bond yields the equity risk premium. And right now the list of risks, from a trade war with China to an earnings slowdown to Trump’s intensifying legal troubles, seems to be pretty long. Yet investors are not getting paid all that much extra to own stocks.

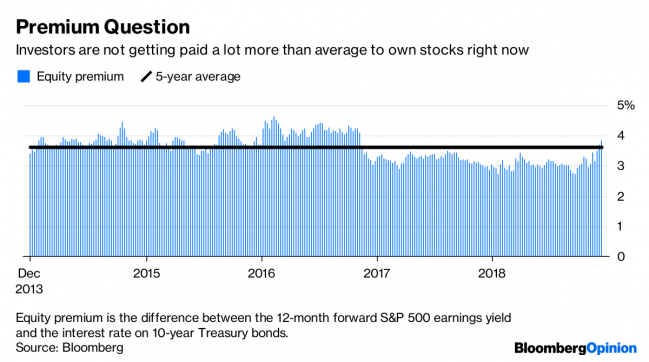

While the forward P/E ratio, which is another way investors determine whether stocks are cheap, fell on Monday to a four-year low of 14.9, based on the next four quarters of expected earnings, the Fed model is far from its most bullish. During the past five years, stocks in the S&P 500 have traded at an average earnings yield premium of 3.6 percent, compared with the current 3.8 percent. What’s more, stocks, according to the Fed model, have been a better value than they are now a number of times during the past five years, including pretty much all of 2016.

Of course, if the Fed does decide to raise rates, that could be a cause for concern. A quarter-point increase in interest rates, if 10-year bonds were to follow, would shrink the equity premium to 3.6 percent. But even if the Fed were to pause, suggesting that Chairman Jerome Powell and company share concerns that the economy may soon slow, stock investors would still only be getting paid slightly above average when the risk seems well above that.