Highlights:

- Fortis Inc (TSX:FTS) pays a quarterly dividend of C$ 0.535.

- Enbridge Inc. (TSX:ENB) has a market cap of C$ 111.93 billion.

- Canadian National Railway (TSX:CNR) Company posted revenue of C$ 11,475 million in Q2 2022.

Canadian investors looking for some regular passive income can explore stocks like Fortis Inc. (TSX: FTS), Enbridge Inc. (TSX: ENB), Canadian National Railway Company (TSX: CNR), Royal Bank of Canada (TSX:RY), and Canadian Natural Resources Limited (TSX:CNQ).

Dividend-paying stocks can be explored amid rising inflation to try and get extra income to tackle the rising cost of goods and services.

The above stocks pay dividends regularly, which could be a reason to explore. Let's explore these stocks, curated by Kalkine Media® that distributes dividends:

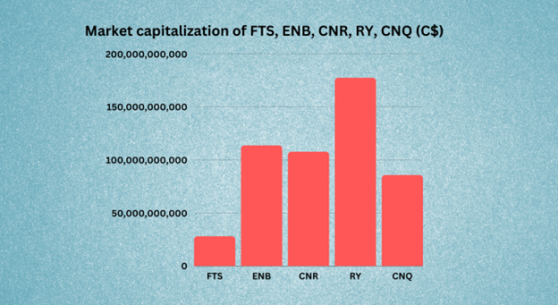

Fortis Inc. (TSX: FTS) Fortis is a global diversified electric utility holding company headquartered in St. John's, Canada. The C$ 27.9 billion market cap company distributed a quarterly dividend of C$ 0.535.

The company posted second-quarter 2022 net earnings of C$ 284 million or C$ 0.59 per common share. Compared to the second quarter of 2021, its adjusted net earnings for Q2 2022 of C$ 0.57 per common share, up from C$ 0.55.

The company said its C$ 4 billion annual capital plan is in place, of which approximately C$ 1.9 billion was already invested during the first half of 2022.

The net earnings of Fortis on a year-to-date (YTD) basis were C$ 634 million or C$ 1.33 per common share, relative to C$ 0.03 in the same quarter a year ago. It was a growth of C$ 26 million from the previous year.

Enbridge Inc. (TSX: ENB) The C$ 111.93 billion market cap company, Enbridge Inc., is a global pipeline company based in Calgary, Alberta. For the quarter that ended June 30, 2022, Enbridge earned C$ 486 million in total operating revenues, compared to C$ 423 million in the same quarter in 2021.

Its earnings of C$ 169 million in the second quarter of 2022 grew by over 4.3 per cent from C$ 162 million in the year-ago quarter.

Enbridge maintained a balance of C$ 6,976 million at the end of the second quarter of fiscal 2022, noting an increase of 5.4 per cent from the balance in the previous year's corresponding quarter of C$ 6,618 million.

Enbridge, Canada's largest natural gas distribution company, distributed a dividend of C$ 0.86 per share quarterly.

Canadian National Railway Company (TSX: CNR)

A formidable freight railway, the Canadian National Railway Company operates in Canada and the US in its midwestern and southern states. The Montreal, Quebec-based company has a market valuation of C$ 108.23 billion.

Canadian National Railway Company pays a quarterly dividend of C$ 0.733, next payable on September 29, 2022.

The company reported a revenue of C$ 4344 million in the second quarter of fiscal 2022, relatively 17.15 per cent higher than C$ 3,598 million in Q2 2021.

In Q2 2022, the company's operating revenue of C$ 4,195 million by 16.27 per cent from C$ 3,452 million in the year-ago period.

The CNR stock also saw a surge of close to 10 per cent on a quarter-to-date (QTD) basis. Its Relative Strength Index of 51.34, as per Refinitiv on September 14, 2022, indicates a moderate stock condition.

Royal Bank of Canada (TSX: RY) Royal Bank of Canada is the largest bank in Canada by market capitalization at C$ 176.6 billion. It has a client base of over 17 million, with more than 89,000 employees worldwide.

The Toronto-based company distributes a quarterly dividend of C$ 1.28 per share. The next slated payable date for the dividend is November 24, 2022.

The Royal Bank of Canada, in its third quarter of fiscal 2022, earned a net income of C$ 3.6 billion, which is a slump of 17 per cent YoY hit by unfavourable macroeconomic conditions that are plaguing the world right now.

Its diluted EPS of C$ 2.51 was also a drop of 15 per cent over the same period in 2021.

The company said its net income of C$ 186 million in the insurance segment also plunged 21 per cent YoY. Compared to the preceding quarter, its insurance net income shrank by C$ 20 million, triggered by a less favourable claims experience.

However, the RY stock can be said to have a moderate condition at the moment, as indicated by an RSI value of 54.16 shown on Refinitiv for September 14, 2022.

Canadian Natural Resources Limited (TSX: CNQ) Canadian Natural Resources Limited (CNRL), which primarily operates in the Western provinces of Canada in British Columbia, is a renowned and old Canadian oil and natural gas company.

CNRL is an C$ 83.3 billion company headquartered in Calgary. The company distributes a quarterly dividend of C$ 0.75. CNRL has regularly paid quarterly dividends since 2001 and is next payable on October 5, 2022.

Canadian Natural posted revenue of C$ 11,475 million in the second quarter of 2022, which is over a 75 per cent jump, compared to C$ 6,525 million in the same period in 2021. Its diluted net earnings for the reported second quarter of the current fiscal was C$ 3, relative to C$ 1 in 2021.

The CNQ stock also saw an increase of 37.86 per cent YTD while jumping 6.5 per cent in the latest quarter.

Bottom line: The above dividend-paying stocks can be a good option for investors as they have projected steady growth over the period. However, markets are unstable at the moment and looking at the volatility since the start of this year, and only a long-term strategy can provide a safety net to traders.