(Reuters) - Cisco Systems Inc (NASDAQ:CSCO) gave a lackluster forecast for third-quarter revenue and profit on Wednesday and said it continued to expect a pause in customer spending given the current macroeconomic environment, sending its shares down 4%.

The company forecast adjusted profit of 79 cents to 81 cents per share, the midpoint of which was in line with analysts' estimate.

Revenue in the current quarter is expected to drop 1.5% to 3.5%, which translates to $12.51 billion to $12.77 billion, according to Reuters' calculations. Analysts are expecting revenue of $12.62 billion.

"We are seeing longer decision-making cycles across our customer segments for a variety of reasons, including macro uncertainty as well as unique geographical issues," Chief Executive Officer Chuck Robbins said on a post-earnings call.

"(Customers) are just a little cautious and trying to see what's going on."

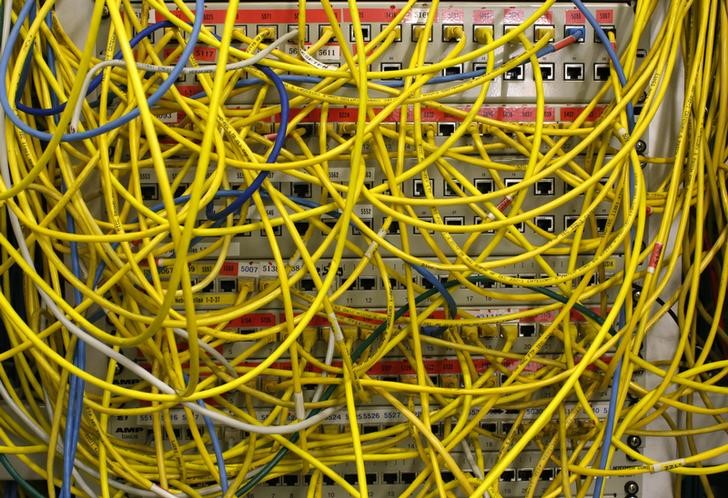

Cisco's infrastructure unit, which includes its traditional business of supplying switches and routers, posted an 8% drop in revenue to $6.53 billion.

The business has struggled as customers increasingly prefer using cloud-based services offered by companies such as Amazon.com Inc (NASDAQ:AMZN) and Microsoft Corp (NASDAQ:MSFT) instead of upgrading their networks and servers.

Cisco also reported revenue declines across all its geographies, including a 5% drop in Americas, its biggest market that accounts for about 58% of its revenue.

Broad weakness in orders will likely be a multi-quarter problem, Needham analyst Alex Henderson said.

Sales in its application software unit fell 8% to $1.35 billion, while its fast-growing security business - which offers firewall protection and breach detection systems - rose 9% to $748 million.

Revenue fell 3.5% to $12 billion in the second quarter ended Jan. 25, but still beat analysts' estimate of $11.98 billion.

Excluding items, Cisco earned 77 cents per share, edging past estimates by 1 cent.