- August has usually turned out to be a dull month for the markets

- But we can still make it interesting by trying to find stocks that look poised to rally over the next year

- So, let's take a look at 4 such stocks using InvestingPro

August has a history of being a somewhat quiet month in the financial world.

When it comes to the S&P 500's performance in August from 1950 to 2021, it has shown an average return of -0.03%. This places it as the third worst month, surpassing only February and September in terms of poor performance.

As for the Dow Jones Industrial Average, in the last 20 years, August has seen a modest return of +0.07%. However, if we zoom out to the last 50 years, the return drops to -0.20%, but over the last 100 years, it bounces back to a positive +0.97%.

Right now, it's clear that 2023 is shaping up to be a promising year for equities overall. In the United States, both the S&P 500 and the Nasdaq are leading the way.

Meanwhile in Asia, the Japanese Nikkei is the only one keeping pace with the U.S. stock market. In Europe, most stock markets are performing well except for the British FTSE 100

The German DAX hit record highs this week, and the Italian FTSE MIB has shown impressive strength.

With many stocks experiencing attractive gains in this environment, it's worth exploring those with good 12-month potential and solid support from the market.

So, let's dive into some of these promising stocks using the InvestingPro tool for our analysis.

1. Enphase Energy

Enphase Energy (NASDAQ:ENPH), with its headquarters in Fremont, California, specializes in designing and manufacturing software-driven home solutions that encompass solar generation and home energy storage.

On July 27, the company released earnings, and the news was impressive. Enphase Energy far surpassed market expectations, particularly in terms of earnings per share.

Source: InvestingPro

Source: InvestingPro

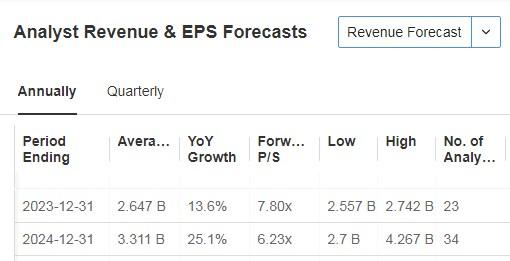

Enphase Energy is gearing up to present its next earnings on October 24. The company is anticipated to showcase a notable increase in profit, with expectations of a +13% growth this year, followed by an even more substantial +25% growth projected for the year 2024.

As the push for sustainable and eco-friendly energy solutions continues, the company's focus on software-driven home solutions in solar generation and energy storage positions it well to capitalize on the growing interest in solar technology for residential use.

Source: InvestingPro

Source: InvestingPro

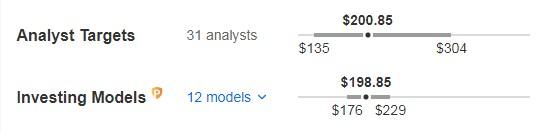

Enphase Energy currently holds 35 ratings, with 23 being classified as "buy," 11 as "hold," and only 1 as "sell." This indicates a generally positive sentiment among analysts and investors.

Over the last 3 months, the stock has declined by -5.50%. However, the market remains optimistic about its future performance, estimating a 12-month potential of $200.85.

On the other hand, InvestingPro's models offer a slightly more conservative estimate, pegging the stock value at around $198.85 for the same 12-month period.

Source: InvestingPro

Source: InvestingPro

As of now, Enphase Energy's stock is heading towards a critical support level, which lies within the $119-133 range. This support zone has historically acted as a level where the stock has found buying interest and experienced a rebound in the past.

As of now, Enphase Energy's stock is heading towards a critical support level, which lies within the $119-133 range. This support zone has historically acted as a level where the stock has found buying interest and experienced a rebound in the past.

2. Halliburton

Based in Houston, Texas, Halliburton Company (NYSE:HAL) is primarily focused on providing oilfield services and operates in over seventy countries worldwide.

Investors in Halliburton receive an annual dividend of $0.64 per share, distributed across four quarterly payments of $0.16 each. With a yield of +1.64%, the company offers a modest return to its shareholders.

On July 19, the company released its latest earnings report, and the results were positive across the board. Particularly noteworthy was its earnings per share, which exceeded market forecasts, indicating strong financial performance during that period.

Source: InvestingPro

Source: InvestingPro

Halliburton's next earnings report is scheduled for October 17. The market expects the results to be favorable, building on the company's positive overall performance in the previous earnings release.

Source: InvestingPro

Source: InvestingPro

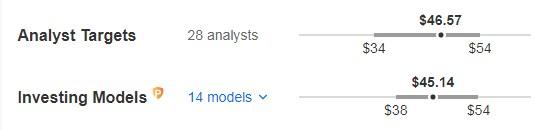

Halliburton's stock has surged by +20% in the last 3 months. The market projects a 12-month potential of $46.57, while InvestingPro's models estimate it to be at $45.14.

Source: InvestingPro

Source: InvestingPro

The stock is currently experiencing a bullish uptrend and appears to be moving toward its resistance level at $43. This resistance level is a price point where the stock has historically faced selling pressure.

The stock is currently experiencing a bullish uptrend and appears to be moving toward its resistance level at $43. This resistance level is a price point where the stock has historically faced selling pressure.

3. Etsy

Etsy (NASDAQ:ETSY) is an e-commerce company that operates an online marketplace specializing in the buying and selling of handicrafts, vintage items, and decorative products. It was founded in June 2005.

On May 3, the company released the previous financial results, which were highly impressive. Both its revenue and earnings per share surpassed all market expectations.

Source: InvestingPro

Source: InvestingPro

Etsy presented the latest financial results recently, which included revenue forecasts for the company. According to the projections, the revenue is expected to increase by +7.1% for the current year, demonstrating steady growth.

Looking ahead to the following year, the company's revenue is expected to rise once again with a forecast of +10.4%.

Source: InvestingPro

Source: InvestingPro

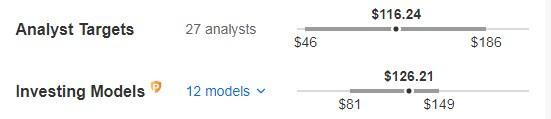

Over the last 3 months, Etsy's shares have surged, rising by +5.60%. Market analysts project a 12-month potential value of $116.24 for Etsy's shares.

On the other hand, InvestingPro models provide a slightly more optimistic estimate, pegging the stock's 12-month potential at $126.21. Etsy currently has 28 ratings, with 16 of them being "buy," 11 "hold," and only 1 "sell."

Source: InvestingPro

In June, the stock marked a support level, acting as a floor, from which it has started to rebound in an upward direction. Additionally, it has already surpassed the 50-day moving average, indicating a positive trend.

In June, the stock marked a support level, acting as a floor, from which it has started to rebound in an upward direction. Additionally, it has already surpassed the 50-day moving average, indicating a positive trend.

The next target for the stock is to break above the 200-day moving average, which could further validate the upward momentum.

4. SolarEdge Technologies

SolarEdge Technologies (NASDAQ:SEDG) is a leading provider of energy optimizers and PV plant monitoring solutions. Established in 2006, the company operates offices in the United States, Germany, Japan, and Israel.

The company's previous quarterly earnings, reported on May 3, surpassed all expectations. Both earnings per share and overall earnings outperformed, indicating a strong performance during that period.

Source: InvestingPro

Source: InvestingPro

And, the latest results were presented on August 1, which surpassed initial expectations, with EPS coming in better than expected.

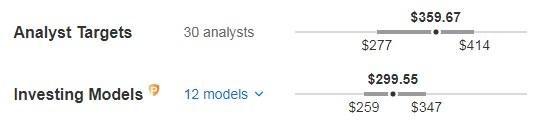

Despite being down by 30% over the past 12 months, SolarEdge Technologies still holds potential in the eyes of the market. Analysts project a 12-month potential value of $359.67 for its shares, suggesting a positive outlook.

However, InvestingPro models are slightly more conservative, estimating the shares to be valued at almost $300 in the same timeframe.

Source: InvestingPro

Source: InvestingPro

The stock has been consistently trading within a rectangular range. Whenever it reaches either end of the range, it rebounds strongly in the opposite direction.

The stock has been consistently trading within a rectangular range. Whenever it reaches either end of the range, it rebounds strongly in the opposite direction.

***

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.