by Noreen Burke

Neither the European Central Bank (ECB) nor the Bank of Japan (BOJ) are expected to make any major changes when they hold their monetary policy meetings tomorrow, amid speculation over how soon they will begin to scale back quantitative easing measures.

The issues of sluggish inflation and strong currencies look likely to dominate policy discussions. Markets will be watching for any indication that the banks are looking at shifting away from their easing bias, a pledge that asset purchases can be increased if necessary.

Some analysts expect the ECB to discuss dropping its easing bias when it holds its second meeting of the year on Thursday, but a revision of forward guidance is not seen as likely until later this year. Analysts at Barclays are not anticipating any changes to policy guidance, despite the minutes of the ECB’s January meeting showing growing confidence among policymakers about the strength of the economic expansion in the euro area.

The weakening of headline inflation, political risk in the aftermath of this week's Italian election and the threat of a potential trade war sparked by US President Donald Trump's protectionist stance mean that the ECB will wait until April to adjust forward guidance, Barclays said.

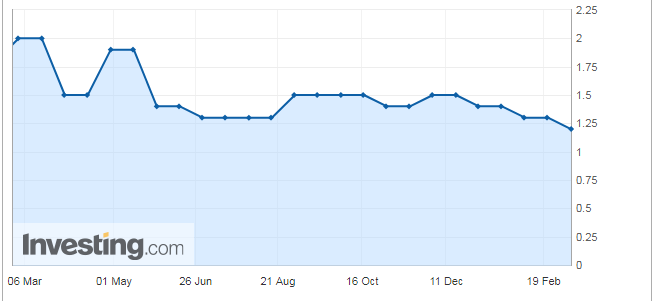

Inflation in the euro zone slowed to 1.2% in February, the lowest level in more than a year, remaining well below the ECB’s 2% target. The ECB will also release updated macroeconomic projections, but significant changes to the outlook for both growth and inflation are not expected by economists.

Analysts at ING are not expecting any change to the inflation forecast but do see an upward revision for 2018 GDP to 2.4%, with the GDP forecast for 2019 and 2020 remaining unchanged. ING is not expecting any hints regarding when QE could end, but is looking for a subtle change in the language signaling that the ECB is already en route to the exit.

“The ECB’s readiness to increase QE ‘in size and/or the duration’ may be dropped and replaced by the readiness ‘to use all tools available’, which would be a very mild form of dropping the QE easing bias,” ING said.

ING analysts see the EUR/USD pair moving higher, with the cross likely to break above the 1.25 level if the ECB revises up the GDP forecasts, signals that it is a step closer to the end of QE and makes no clear attempt to talk down the euro.

The Bank of Japan will likely seek to avoid fueling speculation about any future exit from ultra-easy monetary policy after its meeting on Friday, while Japan's parliament is considering nominations to its Policy Board.

BoJ Governor Haruhiko Kuroda surprised markets last week when he told lawmakers that the central bank could consider exiting easy policy if its 2% inflation target was met by March 2020 as projected.

The remarks sent the yen and bond yields higher.

Japan’s improving economic outlook and hints of rising inflation have fueled speculation that the BoJ could start to scale back its massive stimulus program.

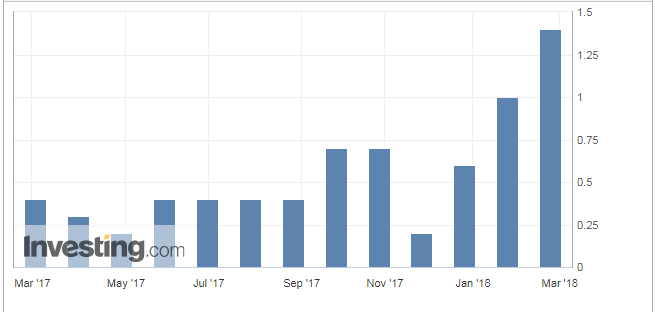

The BoJ has pledged to buy government bonds at an annual pace of 80 trillion yen. But actual purchases have slowed to roughly 50 trillion yen per year, which some analysts have described as “stealth easing”.

Speaking in parliament on Tuesday, Kuroda sounded a cautious note about withdrawing stimulus too quickly, in comments analysts described as a bid to temper expectations for a near term easy policy exit.

“When the BOJ exits, it will be a very gradual process ... so as not to trigger a spike in long-term interest rates or a disruption in financial markets,” Kuroda said.

“Kuroda sounded confident about an exit probably out of need to reassure market the BOJ can engineer a smooth exit when the appropriate time comes,” noted Masaki Kuwahara, senior economist at Nomura Securities. “I think the BOJ will stand pat at least until fiscal 2020 given tepid inflation.”