- The S&P 500 has hit a new record high after 512 trading days - one of the largest negative streaks in history

- Meanwhile, hedge funds hold the highest level of Nasdaq 100 purchases in almost seven years

- Other factors also point toward a bullish follow-through, such as the US elections and a strong healthcare sector

- Creating a market-beating portfolio has never been as easy as with ProPicks. Join now and access the six strategies that outperformed the S&P 500 by triple digits over the last decade!

As we all know, the S&P 500 index achieved a new intraday record high last Friday. It is the most recent of the three major U.S. indexes to attain such a milestone since the bear market of 2022, joining the Nasdaq 100 index and the Dow Jones Industrial Average.

Having peaked nearly two years ago, the S&P 500 experienced a decline of as much as a quarter of its value, reaching a closing low of 3,577 on Oct. 12, 2022. This means the index went 512 trading days without a record until Friday, placing it as the sixth-longest streak since 1928, according to Ned Davis Research.

Despite the seemingly negative milestone, it is worth noting that historical data indicates that one year after reaching new highs, the index has risen 13 out of 14 times, with an average increase of +13%.

Moreover, except for the off year in 2022, the index has recorded a double-digit annual return for four of the last five years.

Nasdaq Buying Fever

Tech stocks posted a solid rally on Thursday and Friday, driven by an optimistic 2024 outlook from chipmaker Taiwan Semiconductor Manufacturing (NYSE:TSM). This contributed to an outperformance of mega-cap tech stocks, resulting in the S&P 500 and Nasdaq erasing their 2024 losses and turning positive year-to-date.

As per data from Societe Generale, hedge funds currently maintain the highest level of Nasdaq 100 futures buying in nearly seven years.

Meanwhile, a global survey of fund managers conducted by Bank of America showed that the most crowded trades by investors are in the so-called Magnificent Seven stocks, namely Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA), Nvidia (NASDAQ:NVDA), Meta (NASDAQ:META) and Microsoft (NASDAQ:MSFT).

Yes, the Magnificent Seven had an extraordinary year in 2023, but one that will be very difficult to repeat. They each returned +49% or more in 2023 and were responsible for the lion's share of the S&P 500's gains last year.

This is the first time the seven largest stocks have posted such returns since at least 1999. But heading into 2024 on Wall Street they already have their new Magnificent 7 list for the fiscal year.

It includes most of the 2023 Magnificent Seven (Alphabet, Amazon, Microsoft and Nvidia), while Apple, Meta and Tesla are left out and in their place come Berkshire Hathaway (NYSE:BRKa), UnitedHealth Group (NYSE:UNH) and Visa (NYSE:V).

The Election Pattern

The typical stock market seasonal pattern or pattern in presidential election years (as is the current 2024 White House election) is weakness in the first half of the year and strength in the second half.

The average return for the Dow Jones in the first half of the year is -4.3%. The second half of presidential election years is a different story, with the stock market stronger than in non-election years. The Dow Jones performance in the second half of election years has an average return of +8.6%.

One explanation for this pattern is that the market performs poorly at first in reaction to the economic uncertainty created by the candidates' policies and as the year progresses the candidates are explaining their proposals and running campaigns that excite.

Golden Cross in the Healthcare Sector

Healthcare stocks are off to a strong start this year, actually leading the pack as the best-performing sector in the S&P 500 for 2024. This success is attributed to their attractive valuations relative to earnings and a compelling growth story.

Eli Lilly (NYSE:LLY) continues to shine as the top-performing stock in the sector, having surged by +78.1% in 2023. This impressive performance has landed the drugmaker among the S&P 500's top 10 most valuable companies.

Other players in the healthcare sector are also making strategic moves, with involvement from health insurers like UnitedHealth Group (NYSE:UNH), pharmaceutical giants such as AbbVie (NYSE:ABBV), Viatris (NASDAQ:VTRS), and medical device makers like Dexcom (NASDAQ:DXCM).

A noteworthy development is the recent occurrence of the "golden cross" pattern in several of these stocks, where the 50-day moving average crosses above the 200-day moving average. Interestingly, the entire sector witnessed a golden cross during the first week of January.

It's worth noting that the golden cross pattern is generally seen as a bullish indicator.

The Health Care Select Sector ETF (NYSE:XLV) looks poised to move higher and could soon surpass its record high of April 8, 2022, when the ETF closed at $142.83. But it has reached its resistance and so far has been unable to break through it, hence the latest cuts.

Investor sentiment (AAII)

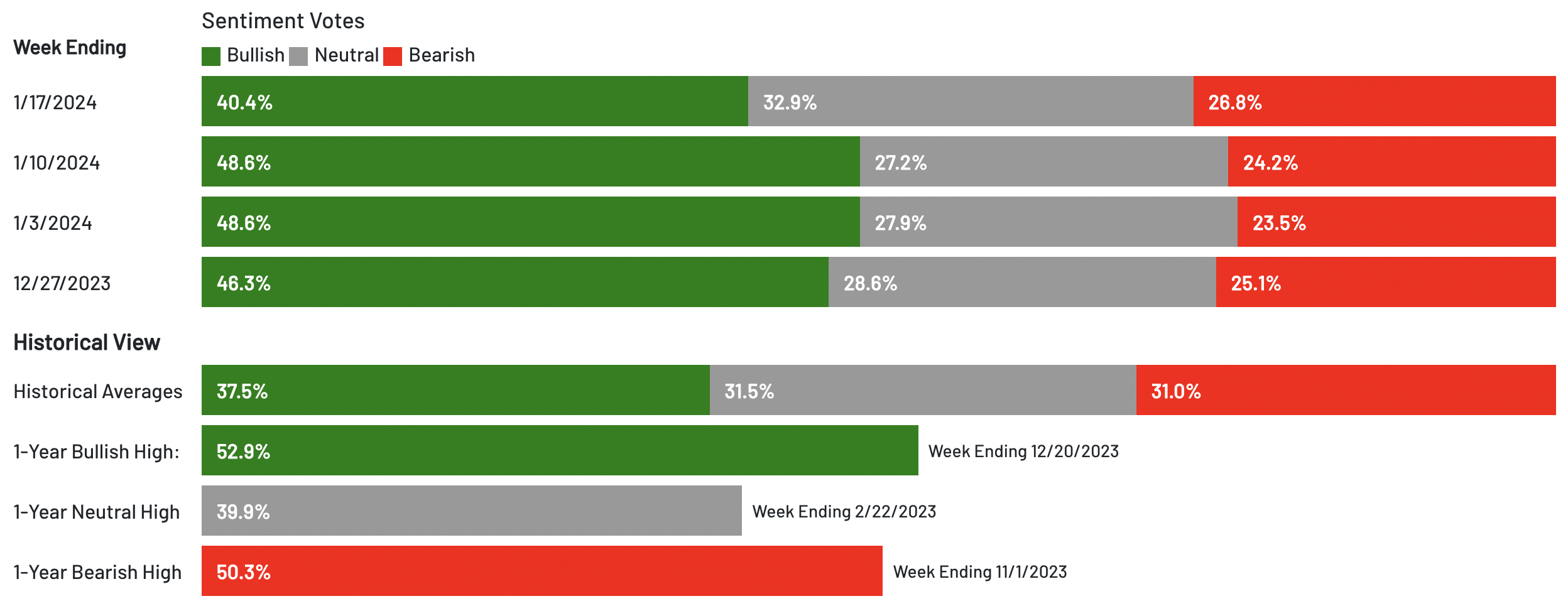

Bullish sentiment, i.e. expectations that stock prices will rise over the next six months, up to 40.40% but remains above its historical average of 37.5.

Bearish sentiment, i.e. expectations that stock prices will fall over the next six months, rose to 26.8% and remains below its historical average of 31%. Source: AAII

Source: AAII

Global Stock Market Ranking in 2024

- Nikkei +7.47%

- Nasdaq +2%

- S&P 500 +1.47% +0.46%

- Dow Jones +0,46%

- FTSE MIB Italian -0.22%

- Dax -1,17%

- Euro Stoxx 50 -1,61%

- Cac 40 -2,27%

- Ibex 35 Spanish -2.41%

- FTSE 100 British -3.51%

- CSI -4.70%

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

_____________________________________________________

Investing Pro Subscribers are the first to receive breaking news, analyst upgrades, and best buy ProPick recommendations. For an extra 10% discount, use Coupon: Canada2024. Don’t miss the New Year’s sale, for up to 60% off. Only until Jan 31st.