The Federal Reserve meets in a month. We all can appreciate that one of the most important elements is expectations. How should investors measure expectations?

We can take a page from the Fed's playbook itself. It has identified two ways to measure inflation expectations. There are market measures, like the spread between inflation-linked bonds and conventional bonds, or break-evens. In addition, there are surveys, like the University of Michigan's survey that ask respondents specifically the rate of inflation they expected in both the short- and long-terms.

The Federal Reserve has placed more emphasis on surveys, which show inflation expectations remain anchored. The market-based measures have softened.

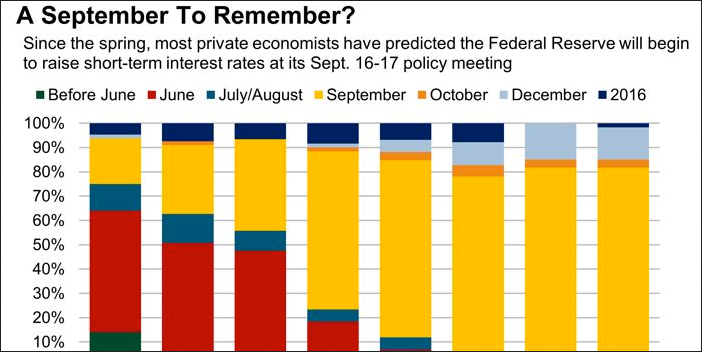

Similarly, there are survey- and market-based measures of expectations for Fed policy. This Great Graphic is the result of the Wall Street Journal's monthly survey. The survey for the most recent bar was conducted following last week's employment report. There are also market-based measures such as the Fed funds futures and the Overnight Index Swaps (OIS).

There is a similar discrepancy between the measures of Fed expectations and inflation expectations. The WSJ survey shows high expectations for a hike next month while market-based measures show less conviction.

The Wall Street Journal survey of 60 business and academic economists found 82% expect a hike next month. This is unchanged from July's survey and up 10 percentage points from June. A December hike is thought more likely by 13% of the respondents, down from 15% in the July survey. Only one economist thought the Fed would wait until next year to hike rates.

Interestingly, the survey found that 69% of economists believe that the Fed will wait too long to raise rates. The others -- 31% -- think the Fed will move too soon. The split last month was 71% to 29%.

Market-based measures are considerably less convinced. The September Fed funds futures contract is pricing in a little less than a 60% chance of a hike. Some assumptions have to be made and the different assessments reflect these different assumptions. The contract settles at the average effective Fed funds rate for the month. Unlike in the past, the current policy targets not a fixed level of Fed funds, but a range. Currently, that range is 0-25 bp and the effective Fed funds rate has averaged 13 bp over the past 100 days. Note that the Fed funds effective rate on Friday also count for Saturday and Sunday. This month the effective Fed funds rate has averaged 14 bp and this week it ticked up to 15 bp, which incidentally is the highest since Q1 13.

Under the assumption that the effective Fed funds rate average 14 bp in September prior to the FOMC meeting, and then average 38 bp after the hike, the effective average for the month would be 24.4 bp. September contract is currently implying an effective average of 19 bp. The higher we assume the effective Fed funds rate average, the smaller the percentage that a hike has been discounted.

If we assume that the effective Fed funds averages 15 bp in the first 17 days in September -- before the Fed decision and then 38 bp for the remaining 13 days of the month -- then the effective average for the month is 25 bp. There would be a six bp gap between the current implied yield and the "fair value" under the conditions of a rate hike.

In trying to decipher what the Fed funds futures market is discounting, some try to incorporate implied option volatility, but we do not find this particularly helpful. The options are not always actively traded and there is often a relatively large spread between bids and offers. In any event, one can see through this exercise that assumptions are critical and that the Federal Reserve's new target range for Fed funds increases the degrees of freedom.

That said, the OIS market appears to line up well with the Fed funds futures. This offers another market-based measure that indicates investors/traders are not as convinced as economists that the Fed will raise rates next month.

Many who push against a hike next month cite the IMF's recommendation that the Fed should hold off until next year, the volatility of the stock market and China's currency move. In some ways, these developments may well boost the risk of a Fed hike in September on the assumption that Fed officials may feel the need to show that it keeps its own counsel. Fed policy is not set by the IMF, Beijing or institutional traders that dominate the U.S. equity market.

Part of the logic of the timing of the PBOC's move this week may signal that it's trying to get ahead of a Fed move. We saw such a move earlier this year from the Swiss National Bank, which may have been timed to get ahead of the ECB's asset-purchases plan.

Moreover, decision makers like to maximize their options. A failure to hike rates next month would mean that there can only be, within reason, one hike in 2015. In June, a slight majority of Fed officials still saw two hikes as being appropriate.