BeInCrypto - Galaxy Digital will shift more operations offshore due to increasing US hostility towards the crypto industry. It is far from the only entity in the crypto space to reach this conclusion in recent months.

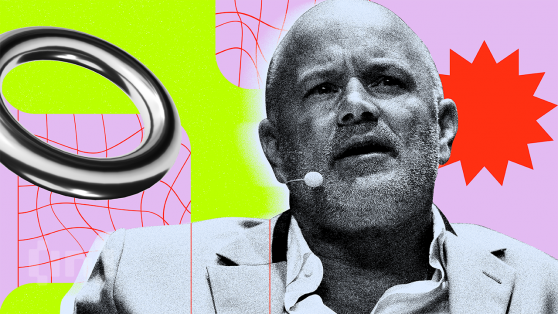

Yet another crypto firm has said it will relocate outside the United States, at least partially. Galaxy Digital, founded in 2017 by Michael Novogratz, will move more of its operations offshore in the midst of a regulatory crackdown.

Galaxy’s Headache

Galaxy Digital is a crypto-focused investment firm. It offers trading, asset management, investment banking, and mining services, acting as a bridge between TradFi and the digital assets industry.

Its founder is blunt about the frustrations Galaxy faces operating in these areas in an age of regulatory overreach.

“When I look at the short term, we still have a regulatory headache in the United States,” Novogratz, who is also the company’s CEO, said on a May 9 conference call after the group published its first-quarter earnings. “I don’t see that breaking anytime soon.”

The collapse in trust between regulators and the industry can be attributed, in part, to certain individuals in the industry, such as Do Kwon of Terraform Labs and Sam Bankman-Fried of FTX, according to Novogratz. Both individuals lead companies that spectacularly crashed in 2022. Both are currently in custody awaiting trial for the role they played in those respective fiascos.

Their involvement contributed to a cooling-off of relations between the cryptocurrency industry and the SEC, in particular.

Novogratz added: “We still have a hangover, as well, from the denting of trust that FTX and other bad actors in the space created.”

Galaxy Announces $134 Million in Profits

As a response to the collapse of FTX and Terraform Labs, regulators in the United States have intensified their crackdown on the industry. Novogratz believes the United States has entered a period of “stasis.” In part, he says, because the Securities and Exchange Commission (SEC) will continue to “regulate with lawsuits.”

In theory, the US economy runs on entrepreneurship and innovation. But the actions of the SEC are notorious within the industry for eroding America’s position as a crypto leader.

But for all the trouble and frustration, Galaxy Digital has posted strong results.

On Tuesday, the company reported a net income of $134 million for the first quarter. A remarkable turnaround from the net loss of $288 million recorded at the end of last year.