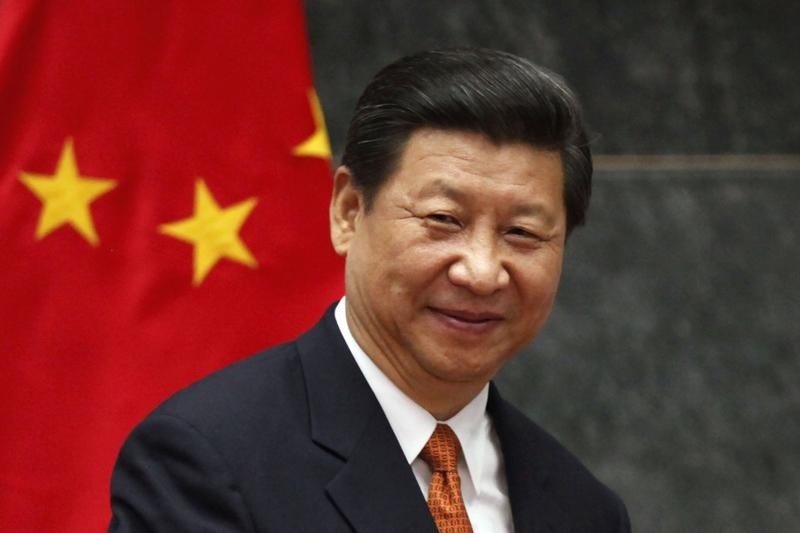

(Bloomberg) -- President Xi Jinping is signaling his long-term vision for the Chinese economy likely requires it to expand at a average pace of less than 5% a year, well below the historical trend over the past 30 years.

Xi told the Communist Party’s Central Committee last week the economy could double in size by 2035, according to state media. That would imply an annual average growth rate of 4.7%-5%, according to a range of forecasts from economists.

Read more: Xi Says Economy Can Double as China Lays Out Ambitious Plans

The Chinese leader was addressing the party’s top decision makers at a closed-door meeting in which they laid out plans for the economy over the next five and 15 years. Officials didn’t disclose a numerical growth goal, although the economic planning agency has said it’s working on five-year targets. Reuters reported that officials are considering a goal of around 5% growth a year.

“Keeping growth above 4.5% for another 15 years is more ambitious for China than many assume,” Capital Economics Ltd. economists, led by Julian Evans-Pritchard, wrote in a note. With the external environment likely to be even more challenging in the coming decade, and returns to capital accumulation diminishing, China would need faster productivity gains, they said.

China is likely to announce more specific targets when the plan is officially adopted by the national parliament, expected in March next year.

Growth Estimates

When the last five-year plan was released in 2015, Xi’s speech to the Central Committee disclosed a growth goal of at least 6.5% over the period. This year, the only hints economists have are his broad ambition of doubling gross domestic product in 15 years and the plan’s mention of raising GDP per capita to the level of a “medium developed country.”

Read more: China Pledges Quality Growth, Tech Powerhouse in 5-Year Plan

Haibin Zhu, chief China economist at JPMorgan Chase (NYSE:JPM) & Co. in Hong Kong, says the Communist Party’s commentary so far suggests an annual average growth of 4.73% over the next 15 years, which he breaks down as follows: an 8.7% surge next year from a low base in 2020; an average expansion of 5.3% in 2022-2025, 4.5% in 2026-2030 and 3.7% in 2031-2035.

With China’s potential growth gradually slowing as the economy matures, growth of 4.7%-5% may still be too ambitious. The government’s current aim is to double the size of GDP and income by 2020 from the level in 2010, but doubling it again from a bigger base may be harder to achieve.

U.S. Tensions

The nation also faces an aging population, rising wages and a rapid increase in debt, all of which could hurt its growth potential. That’s not even counting a more hostile global environment as rivals like the U.S. seek to curb China’s trade and technology ambitions.

“It is extremely difficult to project growth 15 years out and, although we view growth of 5%-6% over 2021-2025 as likely, growth above 5% over 2026-2035 appears quite challenging,” Nomura Holdings (NYSE:NMR) Inc. economists, led by Ting Lu, wrote in a note.

To overcome some of those challenges, the Communist Party is promising to build the nation into a technological powerhouse and focus on quality growth over speed. Key to that objective is developing a robust domestic market and becoming self-reliant in technology -- especially in chips, the building blocks for innovations from artificial intelligence to fifth-generation networking and autonomous vehicles.

What Bloomberg Economics Says...

The five-year plan “outlined a range of areas that need to be tackled to achieve higher-quality development, from strengthening the economic structure with a higher-end industrial base to raising household incomes, environmental standards, education levels and the quality of public services.”

“These would move China’s economy in the right direction. The key, as always, will be effective execution and enforcement.”

-- David Qu, China economist

For the full report, click here.

©2020 Bloomberg L.P.