By Allison Martell and Alastair Sharp

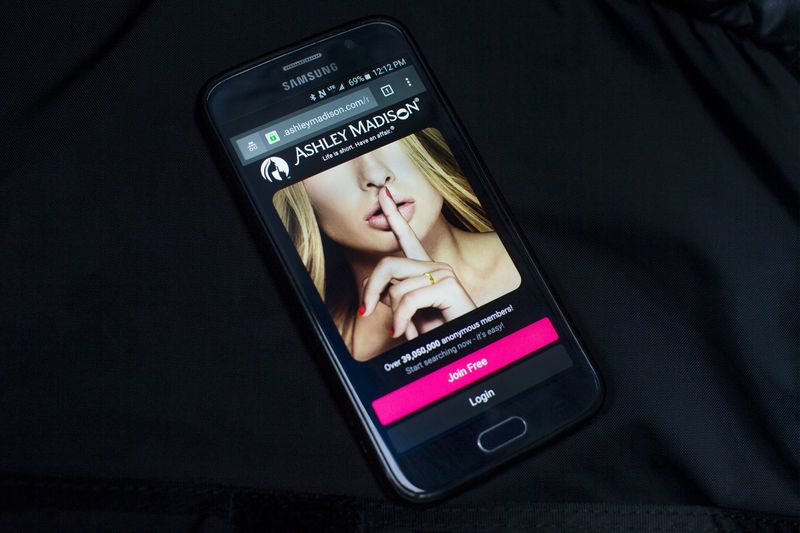

TORONTO, Aug 28 (Reuters) - The owner of adultery website

Ashley Madison had already been struggling to sell itself or

raise funds for at least three years before the publication of

details about its members, according to internal documents and

emails also released by hackers as part of their assault on the

company in recent weeks.

Some unnamed investors wanted out, multiple attempts to

close a deal or raise funds failed, and a public market debut

looked increasingly unlikely, the documents show.

Avid Life Media announced on Friday that CEO Noel Biderman,

who founded the website in 2001, had left the company with

immediate effect, the latest sign of the wrenching impact on the

company of the attack that led to the disclosure of sensitive

data about millions of clients.

In an April 2015 letter addressed to all its investors,

closely-held Avid Life acknowledged that some investors had

pressed it to improve liquidity so they could sell shares. The

company said it would buy back up to $10 million worth of

shares.

"Over the last couple of years, we have not been successful

in exploring various alternatives including a sale of the

business and seeking debt from third parties," said the letter

signed by the board of directors.

Reuters could not independently verify the authenticity of

the email messages and internal documents.

Avid Life did not respond to repeated requests for comment.

Members of the company's board also could not be reached for

comment. Biderman was not reachable by phone.

DILLER HOPES DASHED

The attack has likely sharply lowered the price Avid Life

could muster in any sale of assets, assuming it could find a

buyer willing to take on a company facing several multi-million

dollars lawsuits and the challenge of rebuilding a computer

network that has been so badly infiltrated.

Bankers told Reuters last month - before the massive

disclosure of its customers' information - that a full data dump

would create a 'doomsday scenario' for the company, and kill any

IPO plan.

Several messages show that Biderman was trying to secure a

meeting with executives at media mogul Barry Diller's

IAC/InterActive Corp, whose biggest online dating assets,

including Match.com and Tinder, are being prepared for a public

market spinoff. Biderman's goal was to start acquisition talks

with the much larger rival.

"They would be CRAZY not to speak with us," wrote Biderman

in February this year. And in May: "If there was ever a moment

to have a 'private' meeting with Diller, it is now."

But in an email message later forwarded to Biderman by an

intermediary, one IAC director, Bryan Lourd, was blunt about the

chances IAC might buy Ashley Madison: "They don't want it."

IAC declined to comment "on rumors and speculation about

transactions."

Avid Life in April said it was considering an initial public

offering in London, at a $1 billion valuation, with company

executives expressing hope in media interviews that European

investors would prove more understanding of the controversial

business than those in North America.

The emails show that Biderman received an informal approach

in May from Cliff Lerner, the CEO of Snap Interactive Inc

STVI.PK , which owns the online dating site AYI.com. Lerner

suggested a reverse takeover and a Nasdaq listing.

A spokesman for Snap said Lerner had a short back and forth

email conversation with Avid Life representatives, but

ultimately decided a deal wouldn't work.

By June, Biderman called the IPO a "long shot" in one email.

He told an acquaintance, who helped put other companies'

financing deals together, that he was looking to raise between

$50 million and $75 million in debt.

Similar efforts had fallen through before. Avid Life had a

letter of intent from Fortress Credit Corp, part of Fortress

Investment Group LLC FIG.N , to borrow $43 million in September

2013, the documents the hackers released show, but the deal

never went through.

"I can confirm that the proposed loan you referenced did not

close," Gordon Runté, head of investor and media relations at

Fortress, said in response to queries, declining to comment

further on the reasons.

Avid Life had intended to use some of that cash to pay a

dividend to its shareholders, the proposal, dated September 6,

2013, showed.

It also received a term sheet for a $40 million three-year

loan from GMP Securities, a Canadian investment bank, in 2012.

GMP said the deal was not completed and it has never loaned

Avid Life any money. It declined to specify why.

The emails also show that Avid Life came close to selling

itself at least three times in 2012.

In one instance, a deal with Canadian billionaire Alex

Shnaider and frozen yogurt mogul Michael Serruya fell apart

because of CEO Biderman's "difficult and very demanding"

personality, according to an email from the potential buyers.

Two other attempted deals, with a boutique investment bank and a

private equity firm, also fell apart.

Shnaider confirmed that he and Serruya wanted to strike a

deal to acquire Avid Life and had agreement in principle to buy

it. "We didn't feel comfortable, at the end of the day, going

through with the deal," he said.

A spokesperson for Serruya did not immediately return calls.

(Editing by Amran Abocar and Martin Howell)