(Corrects quote in third paragraph to read "the quarterly point-in-time full-year earnings", instead of "the poorly point-in-time full-year earnings")

* Does not provide EBITDA forecast, shares reverse course

* Sees global consumption growth for aluminum between 3-4 pct

* Expects global aluminum deficit to continue

*

By Sanjana Shivdas

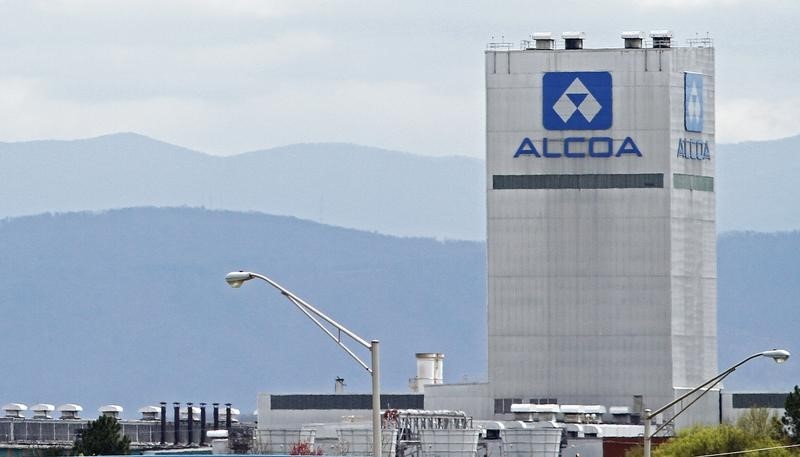

Jan 16 (Reuters) - Top U.S. aluminum producer Alcoa (NYSE:AA) Corp AA.N beat Wall Street estimates for quarterly profit on Wednesday, buoyed by strength in its alumina segment, but shares slipped after the company did not provide a closely watched profit measure for the full year.

The company's shares were down 1.6 percent in extended trading, reversing course after rising as much as 3.5 percent to $30.

Alcoa Chief Financial Officer William Oplinger said on a post-earnings call that the company was eliminating "the quarterly point-in-time full-year earnings before interest, tax, depreciation and amortization outlook" given the unprecedented market volatility.

Alcoa said it expected the global aluminum deficit to extend into 2019 and estimated that its aluminum shipments would decline 500,000 to 600,000 tons year over year.

"Demand growth for primary aluminum in 2019 is expected to be robust, with global consumption growth in the range of 3 percent to 4 percent, driven by continued strong growth in China," Chief Executive Officer Roy Harvey said on the call.

The company said it expected an alumina surplus in China in 2019, driven by refinery expansions and lower-than-expected smelting production.

Strong sales of alumina to third-party smelters, which jumped 20.8 percent to $1.13 billion, helped the company counter a fall in aluminum prices.

Pittsburgh-based Alcoa has reaped mixed benefits from President Donald Trump's decision to impose tariffs on aluminum and steel imports into the United States. The company has been hit by imports from its smelter in Canada.

Alcoa, which is shuttering two of its aluminum plants in Spain, said it expected an annual net income improvement of $70 million to $80 million beginning in the third quarter of 2019 from the closures.

Benchmark three-month aluminum prices on the London Metal Exchange fell 5.7 percent in December, the steepest monthly drop since June, as the United States said it would withdraw its sanctions on Russian aluminum giant Rusal 0486.HK .

Net income attributable to Alcoa was $43 million, or 23 cents per share, in the quarter ended Dec. 31, compared with a loss of $196 million, or $1.06 per share, a year earlier. rose 5.4 percent to $3.34 billion.

On an adjusted basis, the company earned 66 cents per share.

Analysts on average had expected a profit of 50 cents per share, according to I/B/E/S data from Refinitiv.