By Shariq Khan and Maiya Keidan

(Reuters) - Low interest rates, and strong debt and equity markets that propelled Canadian mergers and acquisitions (M&A) to an all-time high in 2021 would underpin robust dealmaking this year too, M&A bankers said, though another record was unlikely.

Pent-up demand for dealmaking from 2020, when the coronavirus pandemic roiled global markets, helped last year's record activity. But with inflation and supply chain bottlenecks threatening to derail economic recovery, dealmaking could slow down this year, they said.

Global M&A also hit a record last year, comfortably erasing the high-water mark that was set nearly 15 years ago, as an abundance of capital and sky-high valuations fuelled frenetic levels of dealmaking.

In Canada, over $349 billion worth of M&A deals were announced in 2021, making it the busiest year on record, compared with $148.2 billion in 2020, data from Refinitiv showed.

"Looking ahead to 2022, I expect the M&A market to continue to be strong as the fundamental drivers remain in place – low interest rates, and strong debt and equity markets that are rewarding growth," said Mike Boyd, head of Global M&A at CIBC.

Boyd expects the resurgence in activity seen in the commodities sectors to continue.

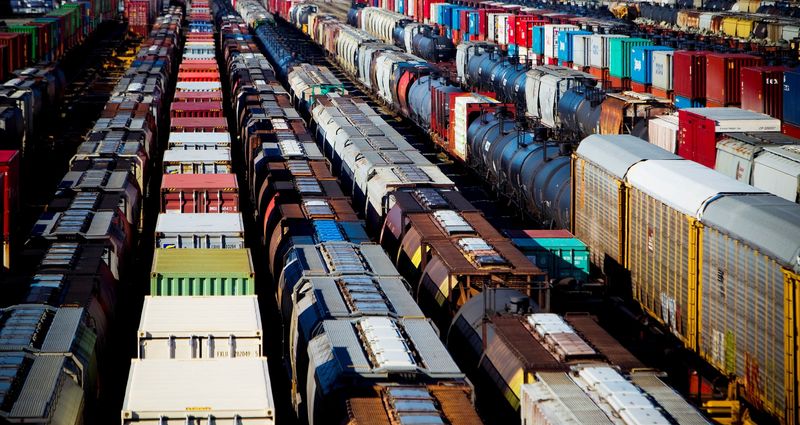

Railroad operator Canadian Pacific's (TSX:CP) contentious $27 billion takeover of U.S. railway Kansas City Southern (NYSE:KSU) topped the charts for last year's biggest deals.

Transportation and industrials led the way last year, with energy sector making a strong rebound, helped by recovery in oil and gas prices.

With central banks globally focused on taming runaway inflation, interest rates are widely expected to rise this year from record lows that could spook equity markets.

"Inflation may be a drag on the M&A market to the extent that it drives up interest rates and/or negatively impacts equity markets," said Bill Quinn, a director at TD (TSX:TD) Securities.

The fast-spreading Omicron coronavirus variant may also cause some economic uncertainty early in the year, but that should be temporary, Quinn said.

Canadian corporations raised $52.4 billion by share sales, the highest since 2016, with Shopify (TSX:SHOP), Canada's most valued company, leading the equity issuance chart.

BofA Securities Inc, BMO Capital Markets and Morgan Stanley (NYSE:MS) were the top three financial advisors on announced M&A, according to the Refinitiv data.