By Hideyuki Sano and David Henry

TOKYO/NEW YORK (Reuters) - Asian stocks hit a record high on Wednesday as upbeat earnings, hopes of a large U.S. fiscal stimulus and a prolonged period of low interest rates fanned optimism about a global recovery from the pandemic.

European stocks are expected to open sharply higher, with Euro Stoxx future up 0.47% and Britain's FTSE futures trading 0.56% higher.

MSCI's ex-Japan Asian shares index rose 0.86%, breaking above its January peak to reach its highest level ever.

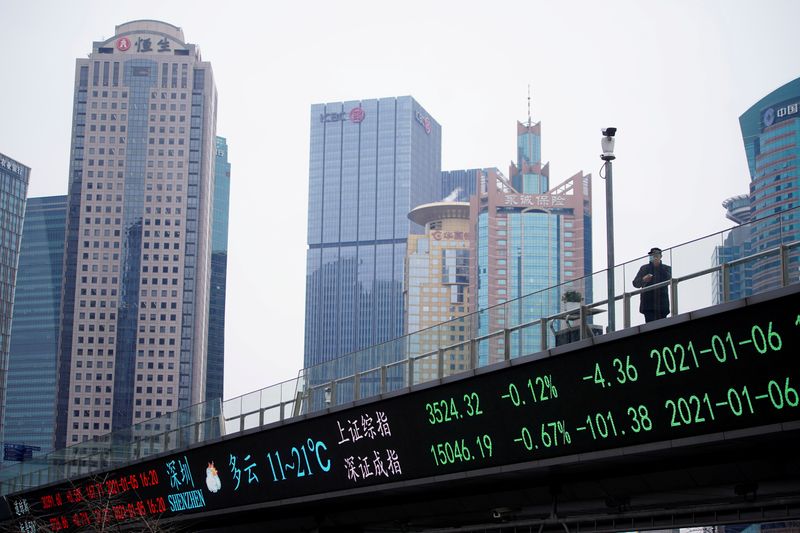

In mainland China's CSI300 rose 2.1% to a 13-year high and the Shanghai Composite hit a five-year high on the last trading day before the week-long lunar new year holidays.

Japan's Nikkei eked out gains of 0.19% while e-mini futures for the U.S. S&P 500 rose 0.35% after a mixed day on Wall Street as corporate earnings have been beating expectations in many places including the United States and Japan.

In the latest example, shares of Lyft Inc rose as much as 11.8% while Twitter Inc (NYSE:TWTR) climbed 3.5% in aftermarket trading on their latest quarterly results.

"Globally investors are raising weightings on stocks as the Biden administration looks set to spend pretty much close $1.9 trillion on its stimulus," said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley (NYSE:MS) Securities.

Although U.S. President Joe Biden's stimulus package faces opposition from Republicans, his fellow Democrats last week approved a budget outline that will allow them to muscle the stimulus through in the coming weeks without Republican support.

The prospects of the large U.S. relief package drove U.S. bond yields higher, with the yield on the benchmark U.S. 10-year Treasury notes last at 1.16%, not far off Monday's 10 1/2-month high of 1.20%.

Higher bond yields also reflect rising inflation expectations, with break-even inflation calculated from inflation-protected Treasuries rising to 2.20%, the highest since 2014.

The Fed has said it would tolerate inflation rising beyond 2% temporarily, leaving investors to believe low interest rates will stay at least until 2023.

U.S. inflation data, due later on Wednesday, is expected to show an annual rise of 1.5% in core CPI.

In the currency market, the dollar traded near two-week lows against a basket of currencies after a sizable fall in the previous trade.

"Players who focus on economic fundamentals still expect a weaker dollar, as a flip-side of rising risk sentiment," said Masanari Takada, cross-asset strategist at Nomura Securities.

The dollar traded at 104.57 yen after 0.64% fall on Tuesday, its biggest in three months, while the euro changed hands at $1.2124, extending its rebound from a two-month low of $1.1952 touched on Friday.

The British pound held firm at $1.3822, hitting its highest level since April 2018.

The offshore Chinese yuan held firm at 6.4262 to the dollar, within sight of its 2 1/2-year high of 6.4119 set on Jan. 5.

A weaker dollar fed renewed strength in cryptocurrencies.

Bitcoin, which gained 19.5% on Monday, stood little changed at $46,562, not far off its record high of $48,216 set on Tuesday. Ethereum, the second-most-popular cryptocurrency, hit a record high of $1,826.

"I fully get that many savers are looking for an alternative to stocks and bonds, which seem terribly over-valued," wrote Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

But he added: "Bitcoins and cryptocurrencies are only currencies because they say they are. They do not fulfill the economists' definition of money: a means of exchange, a store of value, and a unit of account. The rapid appreciation says nothing about its moneyness or store of value."

Brent oil held firm at $61.03 per barrel, near 13-month highs after a seven-day winning streak as investors are betting that fuel demand will rise while OPEC and allied producers keep a lid on supply.