By Jamie McGeever

ORLANDO, Florida (Reuters) -It is that time of year when lists of quirky, semi-serious market forecasts of unpredictable "Black Swan" events and surprises are compiled, but perhaps the biggest tail risk for investors is reality itself.

Who would have said at the end of 2019 that a once-in-a-century global pandemic would hit the world the following year, kill millions of people, shut down the global economy and yet stocks would end the year 15% higher?

And who would have said oil prices would turn negative for the first time in history, with a barrel of Brent crude for a brief moment in April 2020 'costing' minus $37.00?

These are extreme events, but they happened. Are they any more outlandish than the surprises and outrageous predictions suggested by Saxo Bank, Standard Chartered (LON:STAN) and others?

Before COVID and pre-2008, during the 'Great Moderation' years of low inflation and macro volatility, investors might have looked at these wildcard scenarios more closely to get a better sense of the potential tail risks in the year ahead.

But reality has proven to be stranger than fiction, which blunts the shock value of these scenarios. The far-fetched calls are now no more extreme than what has actually happened, and the surprises that were at the more realistic end of the spectrum to begin with are even less surprising.

That said, many key consensus macro and market forecasts since the pandemic have turned out to be way off beam - in no particular order: the U.S. economy, the Federal Reserve, 'year of the bond', inflation, China, 'higher for longer' interest rates and most markets' and economies' ability to withstand them.

So surprises do happen.

And since the pandemic, links between economics, policy and markets that have for decades established the models and rules of thumb that investors rely on are now being questioned. Familiar anchors are maybe a little less secure than they once were, leaving investors more open to being sideswiped by events.

PUSHING THE BOUNDARIES

Analysts at Saxo Bank have been publishing their annual 'Outrageous Predictions' for many years, "a series of unlikely but underappreciated events which, if they were to occur, would send shockwaves across the financial markets."

Of their eight Outrageous Predictions for next year, their Japan call is perhaps the least far-fetched - the extraordinary stimulus finally sparks a growth boom, the Bank of Japan abandons yield curve control, huge repatriation flows suck the life out of world bond markets, and dollar/yen slides below 130.

Analysts at Standard Chartered go further and speculate the dollar could go below 120 yen. Even then, would a dollar decline of around 18%, in a world where the BOJ is raising rates and the Fed is easing, really be that outlandish?

Another of Standard Chartered's more plausible surprises next year is the Fed being forced into a 25 basis point rate hike because inflation accelerates. Inflation is still above the Fed's 2% target, so why wouldn't policymakers act if it picked up again?

Morgan Stanley (NYSE:MS)'s emerging markets team, meanwhile, posit that Argentina could be the best-performing emerging market in the world if the domestic and international stars align for newly-elected hard-right, libertarian President Javier Milei.

Could the country's battered bonds return 100%?

The scenarios below are not official forecasts, and it may be that not one pans out.

But as Saxo says, at the very least they are a reminder for investors "to consider all potential outcomes, including those that seem far-fetched ... a deliberate effort to push the boundaries of market participants' imaginations and prepare them for any eventuality."

SAXO:

- With oil at $150, Saudis buy Champions League franchise

- World hit by major health crisis as obesity drugs make people stop exercising

- US heralds the end of capitalism with tax-free government bonds

- Generative AI deepfake triggers a national security crisis

- Deficit countries form 'Rome Club' to negotiate trade terms

- Robert F. Kennedy Jr. wins the 2024 U.S. presidential election

- Japan's 'lucky 7%' GDP growth rate forces BOJ to abandon yield curve control

- Luxury plunges as EU goes Robin Hood, introducing wealth tax

STANDARD CHARTERED:

- Brent crude oil falls to $40/bbl on recession fears

- USD/JPY falls below 120 on Bank of Japan rate hikes and repatriation flows

- The Fed hikes rates by 25 bps in Q1 on resurgent inflation

- S&P 500 falls 20% on a string of profit warnings from large cap tech

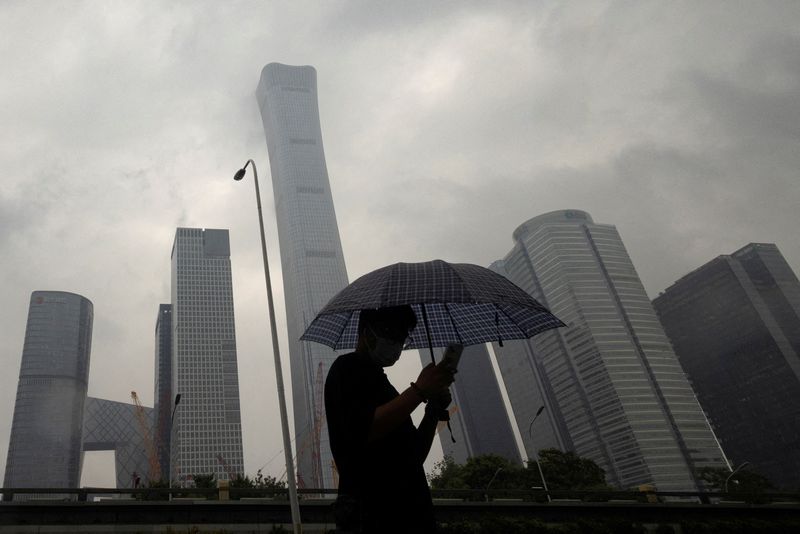

- USD/CNH falls to 6.50 on a big-bang stimulus program from China

- Emerging markets stage the best rally in over 10 years

- Gold falls 20% as the Fed shocks markets with an additional rate hike

- Joe Biden steps down as U.S. president before the election; Donald Trump wins

MORGAN STANLEY (EMERGING MARKETS TEAM)

- EM sovereign credit returns 0% in 2024

- The year of local over sovereign debt

- EM inflows return in size

- Egypt restructures its debt

- Copper production in Panama

- Argentina bonds return 100%

- Saudi Arabia reverses all oil supply cuts

- Colombian peso outperforms EM FX peers again

- China's policy pivot

(The opinions expressed here are those of the author, a columnist for Reuters.)

(By Jamie McGeever; Editing by Richard Chang)