Kalkine Media -

Highlights

- During the fourth quarter of 2022, Canada’s economy has grown by 1.6 per cent.

- Per Statistics Canada data, real industry GDP has increased by 3.8 per cent for the year.

- Loblaw Companies witnessed revenue growth of 8.3 per cent in Q3 2022.

The Bank of Canada's declaration of higher interest rates, which have increased by 425 basis points since last March, appeared to be the cause of this slow GDP growth.

Canadian GDP grew at a rate of 2.9 per cent in the third quarter, but it dropped to 1.6 per cent in the last quarter as measured by monthly increases for annualized growth.

Additionally, from April to June, Canada’s GDP improved by 3.2 per cent, and for the first three months of 2022, its growth rate was around 2.8 per cent, as stated by Statistics Canada. Canada’s real industry GDP increased by 0.4 per cent in the fourth quarter of 2022 and 3.8 per cent for the entire year.

Having said that, let’s talk about three TSX-listed retail and utility stocks and see how they have performed amid a slowing economy in the fourth quarter:

Loblaw Companies Limited (TSX: TSX:L) With brands like Loblaw, No Frills, and Maxi under its hood, Loblaw Companies Limited is a leading Canadian grocery, pharmacy, and merchandise retailer.

With a market capitalization of approximately C$ 38.61 billion, Loblaw has paid its shareholders a quarterly cash dividend of C$ 0.405 per common share, with an annualized dividend yield of 1.359 per cent.

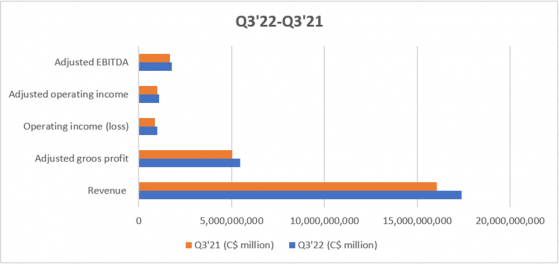

In its unaudited third quarter 2022 financial results, Loblaw revealed that it had grown its revenue by 8.3 per cent to C$ 17,388 million compared to the same period last year. E-commerce and retail sales increased in the third quarter by 3 per cent and 8.2 per cent, respectively. Apart from this, the company witnessed a 14.8 per cent increase in its operating income to C$ 991 million in Q3’22.

Loblaw’s other financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Fortis Inc . (TSX: TSX:FTS) Fortis Inc. operates as a regulated electric and gas utility company in the US and Canada. The company is also involved in electricity generation and transmission, catering to more than 3.4 million electricity and gas customers.

Fortis has a total market share of C$ 26.2 billion and delivered a cash dividend of C$ 0.565 per share on a quarterly term, up 6 per cent from the prior quarter. With this quarter’s dividend increase, Fortis has marked delivering dividend increases for 49 consecutive years.

The third quarter of 2022 saw an increase in net earnings for this well-diversified utilities company from C$ 295 million to C$ 326 million. In addition, Fortis unveiled its new C$ 22.3 billion capital plan for the years 2023 to 2027, which is C$ 2.3 billion more than its previous five-year plan and the largest in the company's history.

Aritzia Inc . (TSX: TSX:ATZ) Aritzia Inc., a vertically integrated clothing company of premium fashion brands, has its mall stores in the US and Canada. Aritzia designs clothing and accessories for its assortment of high-end brands. Following retail, the company's eCommerce division is its secondary source of revenue.

Aritzia has an estimated market share of C$ 5.29 billion, with earnings per share (EPS) of C$ 1.67.

Aritzia grew its net revenue for the third quarter of 2022 by 37.8 per cent, up from C$ 453.3 million in Q3’21 to C$ 624.6 million. While net revenue in the United States increased to C$ 313.5 million, retail and e-commerce net revenue improved to C$ 423.2 million and C$ 201.4 million in Q3’22.

Bottom Line One should exercise caution before investing since the stock market has yet to recover from recessionary and inflationary pressures. Therefore, you should always be very analytical while putting your money in equities.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.