For do-it-yourself investors managing their diversified portfolios, finding the right balance of income and growth is key.

I believe Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) offers a unique opportunity for income and growth over the long haul with below-average risk.

A growth opportunity Brookfield Infrastructure invests, owns, and operates a diverse set of infrastructure assets that are critical to the economies it serves. Its portfolio consists of regulated utilities, rail, toll roads, energy transmission and storage, and more.

There are huge funding gaps for infrastructure in the markets Brookfield Infrastructure operates in. There’s an estimated gap of US$3.6 trillion in the United States by 2020, $200 billion in Canada by 2025, and €1 trillion in Europe.

Governments around the world simply don’t have the capital to invest in all the infrastructure that’s needed. That’s where Brookfield Infrastructure can scoop in as a global leader with lots of fire power.

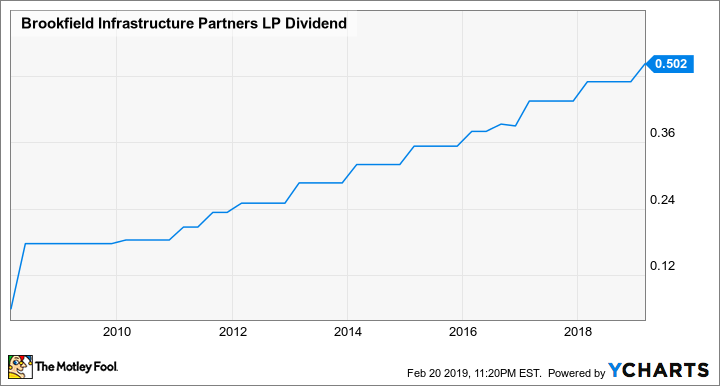

BIP Dividend data by YCharts. BIP’s cash distribution per unit growth history.

An income opportunity Brookfield Infrastructure has infrastructure assets that tend to generate sustainable cash flows. In fact, about 95% of its cash flow generation is either regulated or contracted.

Additionally, there’s organic growth with roughly 75% of its cash flow indexed to inflation. Its assets also have low maintenance capital with overall high EBITDA margins of more than 50%.

Brookfield Infrastructure has proven itself with a decade’s long cash distribution growth of 11% per year. Right now, the limited partnership still offers a very competitive yield of about 4.9%.

Shareholders should be satisfied with the cash distribution growth of 5-9% per year that the company has guided. Just this quarter, it increased its cash distribution by 6.9%. To receive the cash distribution coming up, make sure you own the stock before the record date of February 28.

Valuation Thomson Reuters has a 12-month mean target of US$45.80 per share on the stock, which represents nearly 11% near-term upside potential. So, Brookfield Infrastructure is fairly valued.

Investors who don’t own the stock might consider starting a position at current levels and buying more on meaningful dips, for example, in dips such as the one in December when the stock retreated up to 19% from a market correction.

Investor takeaway Globally, in developed or developing markets alike, capital is needed for investing in infrastructure. So, Brookfield Infrastructure has a long runway. It makes a great stock for TFSAs because of its stable nature and quality profile. As well, it offers a good balance of income and growth.

Conservatively speaking, the stock should deliver long-term returns of at least 10%. A $10,000 investment today with a contribution of $1,000 per year will result in more than $206,000 in 25 years based on a 10% rate of return.

Fool contributor Kay Ng owns shares of Brookfield Infrastructure Partners. Brookfield is a recommendation of Stock Advisor Canada.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019