Are you looking for valuable monthly income and powerful growth potential in your investments? If so, you should add Northland Power (TSX:NPI), which is endorsed by strong insider ownership of about 34%, to your watch list.

A business overview Northland Power began trading publicly in 1997, but was actually founded in 1987. It develops, owns, and operates clean-energy facilities powered by natural gas, wind, solar, hydro, or biomass.

Northland Power has a net generating capacity of 2,014 MW across 26 power generation facilities, totaling $8 billion of assets. It has about 40% in thermal generation, 30% and 10%, respectively, in offshore and onshore wind generation, and 5% in solar. It has a growing presence in Canada, the United States, Mexico, Latin America, Europe, and Taiwan.

The utility aims to participate in projects that offer contracted revenue, thereby generating predictable cash flow.

Recent results Northland Power just reported a bonanza year with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $891 million, an increase of 17% from 2017.

More important, its free cash flow rose 30% on a per-share basis to $1.90. This implies a payout ratio of less than 64% of free cash flow.

Some things to watch Northland Power is pretty aggressive with its growth. And it has been funding growth with a combination of debt and equity. It has relatively high debt levels and has been increasing its share count significantly. At the end of 2018, it had $8 billion of long-term debt compared to $1.1 billion of operating cash flow.

In December 2018, the company redeemed its 5.0% Series B convertible debentures, but not before about 70% or $54.1 million of the debentures was converted to common shares. This added 2,504,670 shares to Northland Power’s outstanding shares.

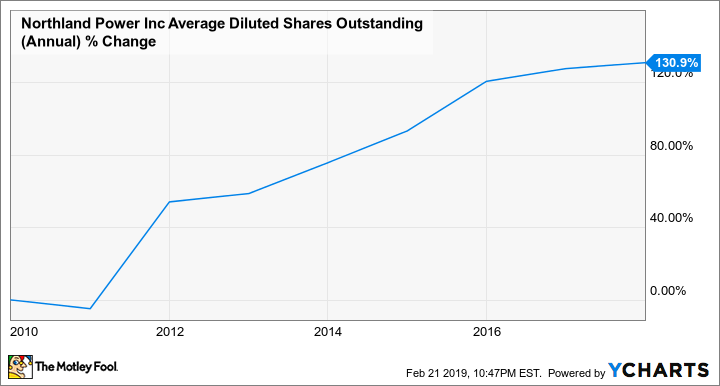

NPI Average Diluted Shares Outstanding (Annual) data by YCharts. Northland Power’s outstanding share growth in the last 10 years.

At the end of 2018, the company’s debt-to-equity ratio was 5.7, and it has more than doubled its share count in the last decade. So, shareholders should keep Northland Power’s per-share growth rates in check and ensure that it can continue servicing its debt with no problem.

Final takeaways Northland Power seems to generate sufficient free cash flow to pay dividends, service its debt, and to grow the company. At $24.32 per share as of writing, it offers a yield of 4.93%.

New projects will increase the utility’s cash flow generation and help with debt reduction. Northland Power’s near-term growth spurt will come from the Deutsche Bucht offshore wind project that’s expected to complete by the end of the year. Deutsche Bucht will add 269 MW of wind power generation to its portfolio.

Thomson Reuters has a mean 12-month target of $26 per share on the stock, which represents nearly 7% of near-term upside potential. That implies there’s little margin of safety in the high-yield stock currently. So, investors should look for a meaningful dip of at least 10% in the stock before considering the shares.

Stay hungry. Stay Foolish.

Fool contributor Kay Ng has no position in any of the stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019