Kalkine Media -

natural gascrude oilHighlights

- Energy stocks are companies developing, maintaining, and selling energy products.

- In 2017, Canadian energy sector contributed approximately 9.2 per cent to Canada’s GDP.

- Canadian Natural declared to pay a quarterly dividend of C$ 0.85 per share, a 13 per cent increase from Q3’22.

In the second half of 2022, the Canadian energy industry went through a rough patch. However, rising commodity prices and forecasts for an increase in crude oil prices in 2023 have given investors cause for optimism. But nothing can be predicted as the stock market is still experiencing volatility.

With all that said, let’s glance at three TSX-listed energy companies and track their financial performances:

Canadian Natural Resources Limited (TSX: TSX:CNQ) As one of Canada’s leading oil and natural gas producers, Canadian Natural Resources has a vast portfolio of light and medium oil, natural gas liquids, synthetic oil, heavy oil, bitumen, and natural gas.

For the fourth quarter of 2022, Canadian Natural declared a 13 per cent higher cash dividend for its shareholders of C$ 0.85 per common share. The company claims that, including this quarter’s dividend increase, it has delivered dividend increases for 23 consecutive years alongside a compound annual growth rate (CAGR) of about 21 per cent.

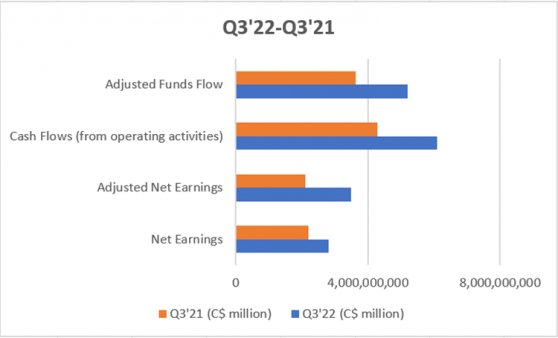

The company informed the shareholders of generating about C$ 5.2 billion and C$ 1.7 billion in adjusted funds flow and free cash flow in Q3’22.

Canadian Natural’s other financials are listed below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Enbridge Inc. (TSX: TSX:ENB) Enbridge provides natural gas, oil, and renewable energy to millions of consumers across the US and Canada. The company houses a wide pipeline network of oil sands and natural gas alongside several offshore and onshore wind projects and natural gas distribution facilities.

The company announced to pay a 3.2 per cent higher common share cash dividend of C$ 0.8875 per quarter or C$ 3.55 on an annual term to its shareholders, due March 1, 2023. Enbridge has increased dividends for 28 consecutive years, including this quarter’s increase.

Besides this, the company is set to extend its normal course issuer bid (NCIB) through 2023, allowing it to repurchase up to C$ 1.5 billion of its outstanding common shares.

Enbridge mentioned growing its adjusted EBITDA in the third quarter of 2022 to C$ 3.8 billion, up from C$ 3.3 billion in the same period last year. Adjusted and GAAP earnings also grew in Q3’22 to C$ 1.4 billion (C$ 1.2 billion in Q3’21) and C$ 1.3 billion (C$ 0.7 billion in Q3’21), respectively.

The company reaffirmed its full-year 2022 guidance range for EBITDA and distributable cash flow (DCF) of C$ 15- C$ 15.6 billion and C$ 5.20- C$ 5.50 per share.

Suncor Energy Inc. (TSX: TSX:SU) Suncor Energy Inc. operates as an integrated energy company and engages in oil sand development and petroleum refining in the US and Canada. Apart from this, the company is focused on advancing its renewable energy strategy to curb carbon emissions.

Suncor Energy's board recently approved a quarterly dividend increase of 11 per cent to C$ 0.52 per common share compared to the previous corresponding period.

In the third quarter of 2022, Suncor mentioned increasing its adjusted operating earnings and adjusted funds from operations to C$ 2.565 billion (C$ 1.043 billion in Q3’21) and C$ 4.473 (C$ 2.641 in Q3’21).

Bottom Line Looking at the continued volatility in the stock market, investors should act more vigilant and conduct thorough market research before buying stocks.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.