(Reuters) - Canada's main stock index fell on Thursday as the energy sector dropped 4.5% with oil prices falling due to piling U.S. inventories, while a sobering economic outlook from the Federal Reserve dented risk appetite.

The U.S. Fed on Wednesday projected the U.S. economy would shrink 6.5% in 2020 and the unemployment rate would still be 9.3% at the year's end.

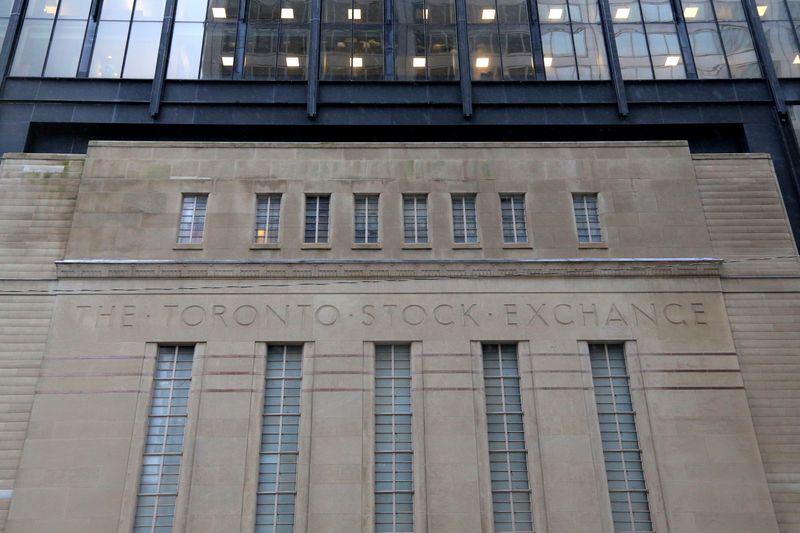

At 9:51 a.m. ET (13:51 GMT), the Toronto Stock Exchange's S&P/TSX composite index (GSPTSE) was down 339.55 points, or 2.16%, at 15,361.78.

The energy sector (SPTTEN) dropped 4.5% as U.S. crude (CLc1) prices were down 7.6% a barrel, while Brent crude (LCOc1) lost 6.5%, dragged down by another record build-up in U.S. crude inventories. [O/R]

The financials sector (SPTTFS) slipped 2.9%, while the industrials sector (GSPTTIN) fell 2.5%.

The materials sector (GSPTTMT), which includes precious and base metals miners and fertilizer companies, stayed flat, even though gold futures

On the TSX, 22 issues were higher, while 206 issues declined for a 9.36-to-1 ratio in favor of the losers, with 62.49 million shares traded.

The largest percentage gainers on the TSX was Hexo Corp (TO:HEXO), jumping 11.1% after the pot producer's third-quarter revenue soared 70% to C$22.1 mln.

Hexo was followed by Transcontinental Inc (TO:TCLa), which rose 2.7%.

Secure Energy Services Inc (TO:SES) fell 12.2%, the most on the TSX, followed by Shawcor Ltd (TO:SCL), down 11.3%.

The most heavily traded shares by volume were Hexo Corp, Canadian Natural Resources Ltd (TO:CNQ), down 3.1%, and Air Canada (TO:AC), down 6.2%.

The TSX posted no new 52-week high or low.

Across all Canadian issues there were six new 52-week highs and four new lows, with total volume of 103.58 million shares.