By Svea Herbst-Bayliss and Arunima Kumar

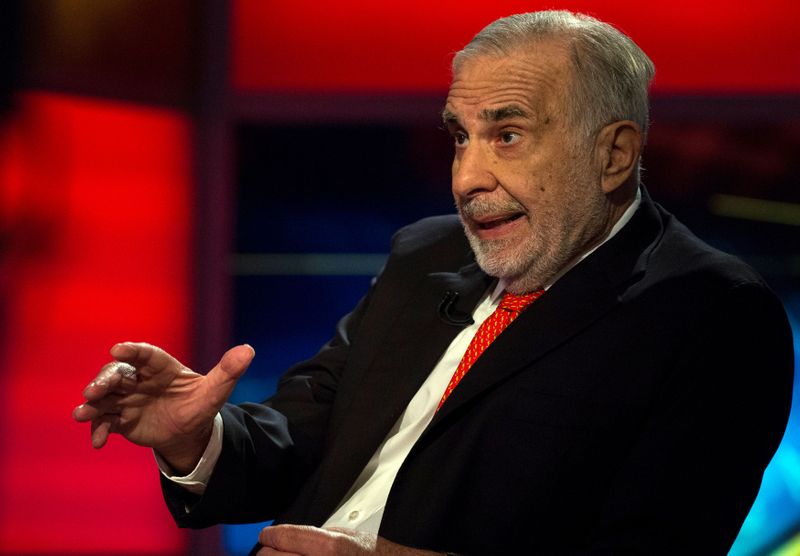

(Reuters) - Billionaire investor Carl Icahn, who was the largest shareholder in Hertz Global Holdings Inc, unloaded his entire stake in the rental car company at a "significant loss" days after it filed for bankruptcy protection.

According to a regulatory filing https:// made on Wednesday, Icahn, who held a nearly 39% stake in Hertz and had three representatives on the board, sold 55.34 million shares on Tuesday at 72 cents per share.

Hertz fell victim to coronavirus shutdowns that dramatically curtailed travel and created major financial hardships for the company, Icahn said in the filing, adding that he supported the board's decision to seek bankruptcy protection on Friday.

Even though he suffered heavy losses, which he did not quantify, Icahn said that he still believed in the company and thinks it can be a "great company" in the future. At the end of 2019, his stake in Hertz was worth close to $700 million.

"I intend to closely follow the Company’s reorganization and I look forward to assessing different opportunities to support Hertz in the future," he said in the filing. He could not be reached for comment on Wednesday evening.

Rumors had circulated for weeks about how Icahn might react as Hertz' troubles mounted and the company replaced its chief executive officer, laid off 10,000 people and warned that there was considerable doubt about its ability to continue operations. The company operates Hertz, Dollar and Thrifty car-rentals.

Icahn declined to comment because his representatives -- Vincent Intrieri, Daniel Ninivaggi and SungHwan Cho -- sit on the board.

Icahn obtained his shares in 2016 when the company was separated from Herc Holdings, where he also had representatives on the board.

Icahn, whose net worth is said to be $14.3 billion, had been fond of saying that investors should buy a stock when his representatives get on the board and not sell until they leave, promising that good things inevitably happen when he becomes involved.