By Medha Singh

(Reuters) -U.S.-listed shares of Chinese companies slumped on Monday after President Xi Jinping's new leadership team sparked investor concerns that ideology-driven policies would be prioritized at the cost of private sector growth.

Ecommerce giants Alibaba (NYSE:BABA), JD.com as well as internet behemoth Baidu (NASDAQ:BIDU) crashed between 14% and 17%, even as the benchmark S&P 500 edged higher.

The iShares MSCI China ETF tanked 10%, tracking its steepest one-day drop ever.

"The concern is that the Chinese government is continuing to move to a more socialist economic model under Xi which may require Chinese companies to place ever more focus on social goals rather than profitability," said Rick Meckler, a partner at Cherry Lane Investments in New Vernon.

"By consolidating power, Xi is likely to face little opposition to this form of nationalization of corporate interests."

Earlier in the day, Hong Kong stocks slumped 6.4% to 13-year lows and China's blue-chip shares slid 2.9% as investor worries over the direction of the world's second largest economy overshadowed upbeat third-quarter growth data.

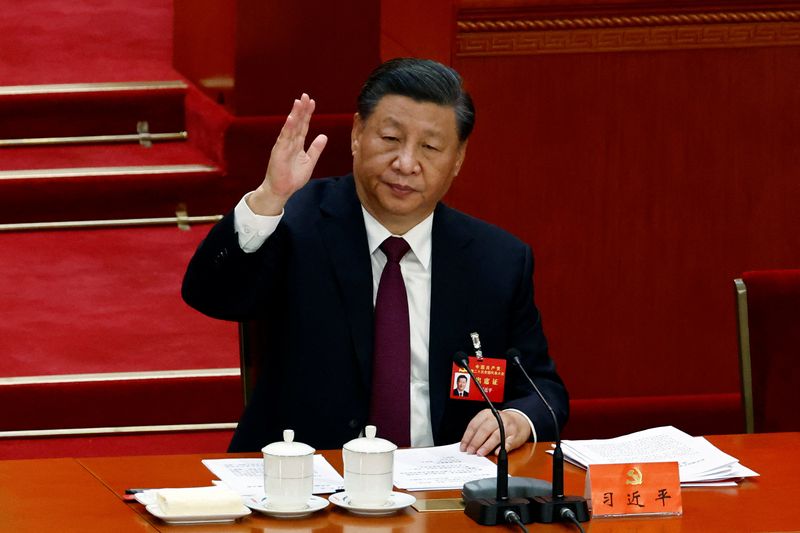

Xi secured a precedent-breaking third leadership term on Sunday and introduced the new Politburo Standing Committee stacked with loyalists.

"While there were no new announcements on the policy front, the departure of perceived pro-stimulus officials and reformers ... and replacement with allies of Xi, suggest that 'Common Prosperity' will be the overriding push of officials," strategists at TD (TSX:TD) Securities said.

Music streaming provider Tencent Music, e-commerce platform Pinduoduo and mobile game publisher Bilibili shed between 16% and 33%.

Electric vehicle firms Nio Inc, Xpeng (NYSE:XPEV) and Li Auto fell between 23% and 30%.

The EV makers were also weighed down by Tesla (NASDAQ:TSLA) cutting starter prices for its Model 3 and Model Y cars in China for the first time this year, indicating signs of softening demand in the world's largest auto market.