GuruFocus - On August 5, 2024, Paul Salem, a Director at MGM Resorts International (NYSE:MGM), purchased 147,500 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 1,702,500 shares of MGM Resorts International.

MGM Resorts International operates as a global hospitality and entertainment company. It owns and operates a portfolio of destination resort brands around the world.

The transaction occurred with shares priced at $33.8 each, valuing the purchase at approximately $4,984,500. This acquisition has increased the insider's stake significantly, reflecting a strong commitment to the company's future.

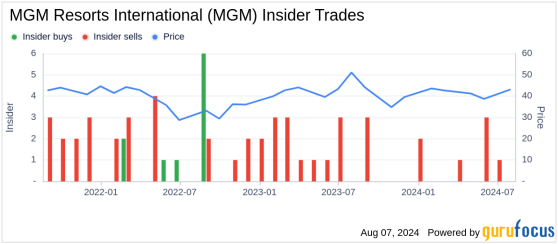

Over the past year, there have been three insider buys and ten insider sells at MGM Resorts International. The insider transaction history shows a mixed activity of buys and sells within the company.

The current market cap of MGM Resorts International stands at $10.75 billion. The stock's price-earnings ratio is 13.41, which is lower than the industry median of 18.83 and also below the companys historical median.

According to the GF Value, the intrinsic value estimate for MGM Resorts International is $66.59 per share, suggesting that the stock might be undervalued. The price-to-GF-Value ratio stands at 0.51, indicating the stock is categorized as a Possible Value Trap, Think Twice.

This insider purchase could signal a belief in the company's value or potential for recovery, despite the current valuation metrics suggesting caution. Investors might want to keep an eye on further insider transactions at MGM Resorts International for clues about the company's direction.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com