GuruFocus - On August 6, 2024, Pauline Richards, a Director at Apollo Global Management Inc (NYSE:APO), purchased 2,351 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 85,854 shares of Apollo Global Management Inc.

Apollo Global Management Inc is a global alternative investment manager. It specializes in credit, private equity, and real assets. The company offers a range of financial solutions for investors and aims to generate attractive investment returns.

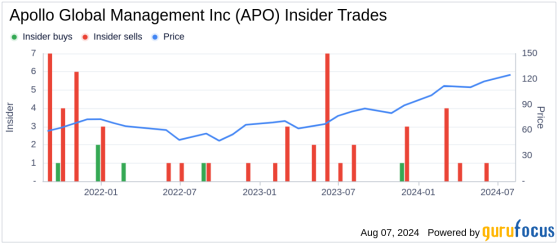

The shares were acquired at a price of $104.92, valuing the transaction at approximately $246,570.92. This purchase reflects a continued trend of insider buying activity at the company over the past year, with a total of 2 insider buys and 9 insider sells recorded.

The current market cap of Apollo Global Management Inc stands at approximately $58.68 billion. The stock's price-earnings ratio is 11.51, which is below both the industry median of 12.02 and the companys historical median.

According to the GF Value, the intrinsic value of the stock is estimated at $160.70, suggesting that the current price represents a Possible Value Trap, Think Twice scenario with a price-to-GF-Value ratio of 0.65.

This insider buying activity could be a signal to investors about the perceived value of the stock at current prices, considering the insider's increasing stake in the company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com